How household composition influences food behaviors and spending

WEST LAFAYETTE, Ind. — New data sheds light on consumer perceptions of farms and firms in the food supply chain and provides an update on the sustainability of American diets, according to the September Consumer Food Insights Report (CFI).

The survey-based report from Purdue University’s Center for Food Demand Analysis and Sustainability (CFDAS) assesses food spending, consumer satisfaction and values, support of agricultural and food policies, and trust in information sources. Purdue experts conducted and evaluated the survey, which included 1,200 consumers across the U.S. The September CFI was co-authored with Lourival Monaco, research assistant professor of agricultural economics at Purdue.

“Consumers generally believe that groups within the food value chain act in their best interest,” said the report’s lead author, Joseph Balagtas, professor of agricultural economics at Purdue and director of CFDAS. “This belief is strongest for the agricultural production group — namely, farmers and ranchers.” This finding reflects positive sentiment toward farmers as expressed in the United Soybean Board’s 2021 consumer survey.

“Given that consumers may have limited knowledge of most actors within the food supply chain, we began by focusing on the food attributes they consistently say they care about most: taste, affordability and nutrition,” he said. “From there, we worked to identify which value-chain segments consumers believe have the greatest influence on each attribute and how they rate those groups’ performance in meeting their expectations.”

Forty percent of consumers believe that food manufacturers have the highest impact on how food tastes, followed by 22% who credit farmers and ranchers. Satisfaction with taste is relatively high, with consumers scoring food manufacturers 7.7 out of 10 for their work on keeping food “tasty.”

A similar pattern emerges for nutrition: 30% of consumers consider food manufacturers the most impactful segment in terms of the nutritional content of food, followed by 22% for farmers and ranchers, and 16% for agricultural input manufacturers, such as seed and fertilizer companies. However, food manufacturers receive a slightly lower score on their work to provide nutritious food — 6.3 out of 10.

“When it comes to affordability, food retailers are most often seen as the main drivers of food prices, followed by food manufacturers,” Monaco said. “Interestingly, agricultural producers appear as the third least impactful segment of the value chain in this context.” Consumer satisfaction with affordability is lower than for taste or nutrition, with food retailers receiving a score of 5.2 out of 10. Across all three attributes, about 8% of respondents selected “not sure,” indicating a potential opportunity for public outreach.

“A considerable portion of consumers are unfamiliar with the roles different groups play in the food value chain,” Monaco said. “Since every participant on the supply side contributes in some way to making food tasty, affordable and nutritious, helping consumers understand these contributions could be especially valuable for those involved in food production.”

The September CFI also provided a quarterly update on the center’s Sustainable Food Purchasing (SFP) Index. “The index scores how well American consumers’ food purchasing habits align with sustainability concepts from the EAT-Lancet Commission report,” said Elijah Bryant, a survey research analyst at CFDAS and a report co-author.

Results from the September update underscore that eating habits have changed little over time. “In our September SFP, much like our previous estimates, consumers score highest for the taste, economic and security components of sustainability. Meaning consumers are generally able to purchase foods they like at affordable prices,” Bryant said. Consumers score somewhat lower on the nutritional dimension of sustainability and the lowest on environmental and social sustainability. “These results are reflective of our work on food values, where consumers consistently tell us that nutrition and especially environmental and social responsibility are less important to them than taste and affordability.”

Meanwhile, Americans’ self-reported diet quality remains in the intermediate range, with an average Mini-EAT (a brief eating assessment questionnaire) score of 62.5. Despite more sustainable purchasing behaviors among households with children, there is no significant difference in diet quality between those with and without children in their household.

“This raises important questions about whether parents are prioritizing healthier food for their children over themselves — an area that may warrant further exploration,” he said.

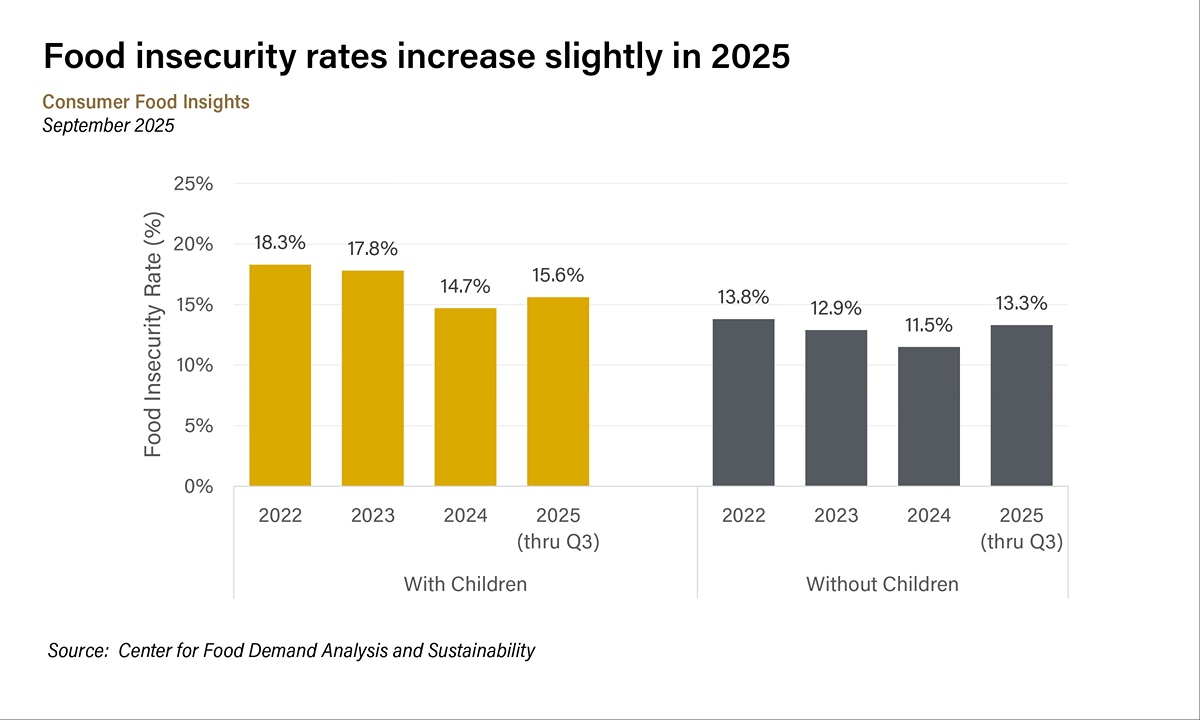

National food insecurity stands at 13% as of September, showing a slight improvement from August, according to recent survey data. However, households with children continue to face higher rates of food insecurity — 15.6% compared to 13.3% for those without children thus far in 2025.

“This disparity highlights the added challenges families face in maintaining consistent access to food, including greater financial strain and nutritional demands,” Bryant said. “These findings underscore the need for targeted interventions that consider household composition. Programs like school meal initiatives play a critical role in supporting families with children, who are more vulnerable to food insecurity.”

Consumer food spending continues to rise, with households reporting an average of $130 per week on groceries and $76 on dining out in September. While consumer estimates of food inflation have slightly declined, they remain higher than official consumer price index figures, suggesting a persistent perception gap. “Still, consumers appear to be tracking inflation trends more closely, with their expectations aligning directionally with Consumer Price Index changes,” he said.

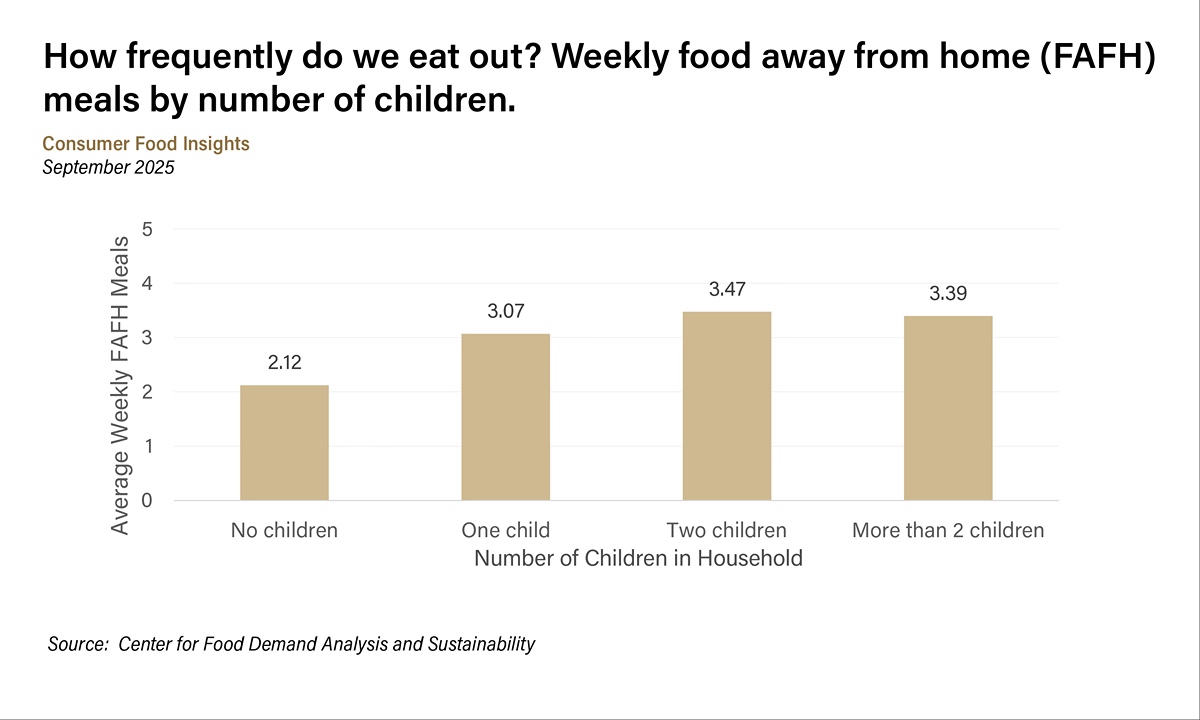

Households with children report eating out nearly one meal more per week than those without, though this trend tapers as family size increases. “Convenience plays a key role in food-away-from-home spending for families, with takeout and delivery making up a larger share of their budgets,” Bryant said. “In contrast, child-free households split their spending more evenly between dine-in and quick-service options.”

The Center for Food Demand Analysis and Sustainability is part of Purdue’s Next Moves in Plant Sciences 2.0and uses innovative data analysis shared through user-friendly platforms to improve the food system. In addition to the Consumer Food Insights Report, the center offers a portfolio of online dashboards.

About Purdue Agriculture

Purdue University’s College of Agriculture is one of the world’s leading colleges of agricultural, food, life and natural resource sciences. The college is committed to preparing students to make a difference in whatever careers they pursue; stretching the frontiers of science to discover solutions to some of our most pressing global, regional and local challenges; and, through Purdue Extension and other engagement programs, educating the people of Indiana, the nation and the world to improve their lives and livelihoods. To learn more about Purdue Agriculture, visit this site.

About Purdue University

Purdue University is a public research university leading with excellence at scale. Ranked among top 10 public universities in the United States, Purdue discovers, disseminates and deploys knowledge with a quality and at a scale second to none. More than 106,000 students study at Purdue across multiple campuses, locations and modalities, including more than 57,000 at our main campus locations in West Lafayette and Indianapolis. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 14 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its integrated, comprehensive Indianapolis urban expansion; the Mitch Daniels School of Business; Purdue Computes; and the One Health initiative — at https://www.purdue.edu/president/strategic-initiatives.

Writer: Steve Koppes

Media contact: Devyn Ashlea Raver, draver@purdue.edu

Sources: Joseph Balagtas, balagtas@purdue.edu; Elijah Bryant, ehbryant@purdue.edu; Lourival Monaco, lmonacon@purdue.edu

Agricultural Communications: Maureen Manier, mmanier@purdue.edu, 765-494-8415

Journalist Assets: Publication quality charts and images can be obtained at this, link