May 16, 2025

Corn and Soybean Basis Go Positive as Strengthening Continues

by Josh Strike

The corn and soybean basis across the Eastern Corn Belt have strengthened for three straight months. As a result of the increasing trend, multiple cash bids across the region are now higher than the July futures price (i.e., basis to July futures is positive). The consistent strengthening has also led to many local basis levels reaching their highest mark of the 2024 – 2025 marketing year. Even though the basis has climbed across the region, there is still a premium to be had at end users such as soybean processors and ethanol plants.

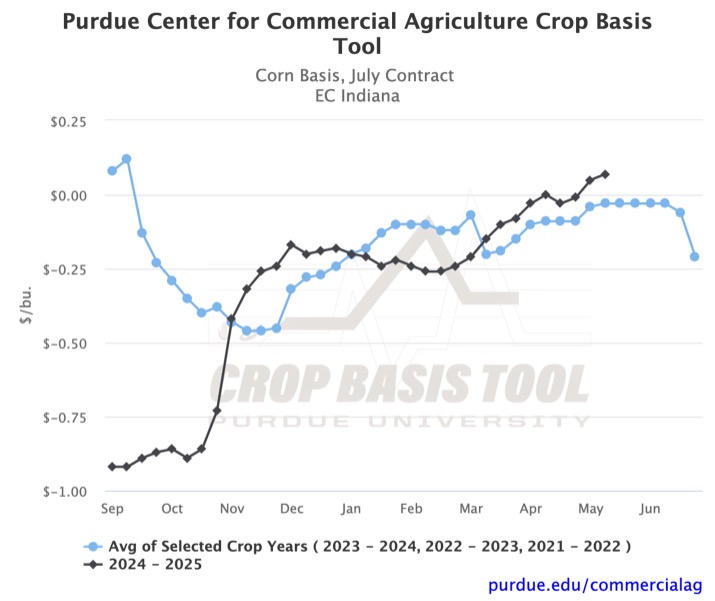

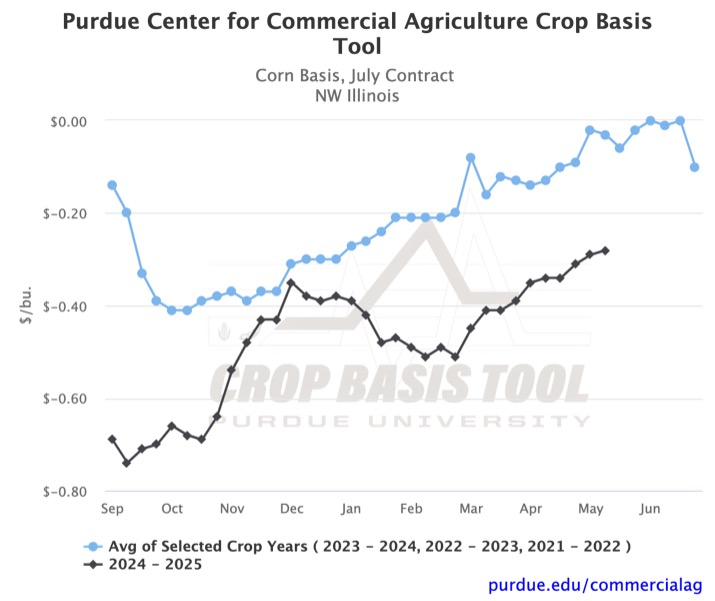

Over the past month, the corn basis to July futures in East Central Indiana has increased from $0.00/bu to $0.07/bu (Figure 1). This is the highest the district’s basis has been during the 2024 – 2025 marketing year and exceeds the maximum basis of the previous year. Similar patterns in Central, North-Central, and Southwest Indiana have seen basis move into positive territory over the past month. Additionally, many local basis levels have surpassed the historic average during the recent increases. While the increasing corn basis is consistent across the Eastern Corn Belt, current basis levels relative to the historic averages are much more variable. For example, corn basis in Northwest Illinois has increased by $0.06/bu over the past month but is $0.25/bu below the three-year average (Figure 2).

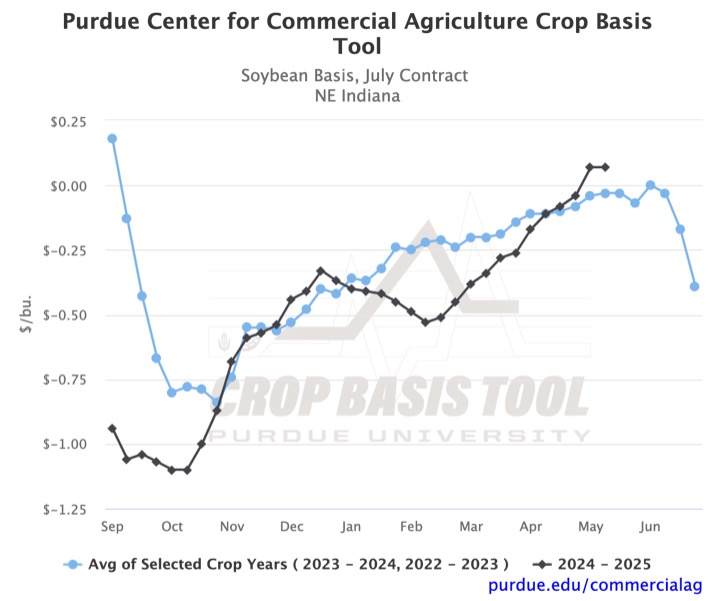

Similarly to corn, soybean basis across the region has increased since April. An $0.18/bu increase in Northeast Indiana soybean basis moved the local basis to $0.07/bu as of May 14th (Figure 3). This is the district’s highest basis of the year and exceeds any basis for the district in the previous year. During recent strengthening, soybean basis levels have converged to the district historical averages across Indiana. The widest disparity exists in Northeast Indiana, where the 2024 – 2025 basis was $0.10/bu greater than the two-year average on May 14th. The convergence to the historic average has not been consistent across other states where the basis is tracked.

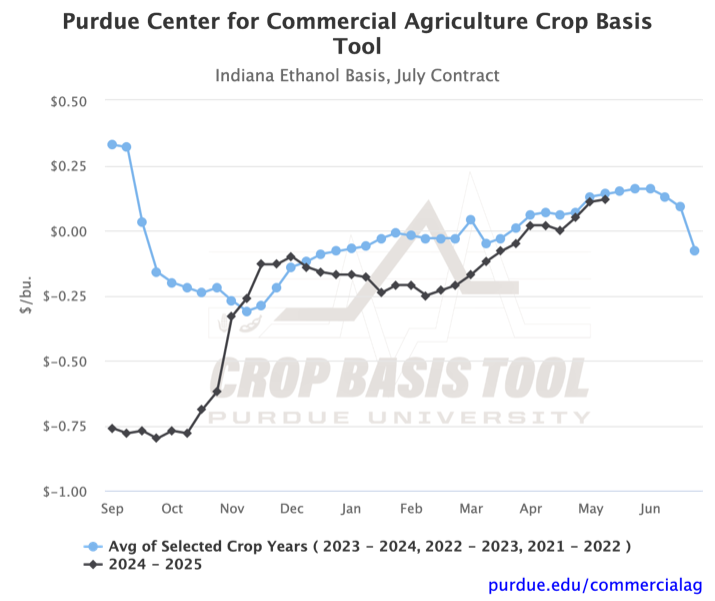

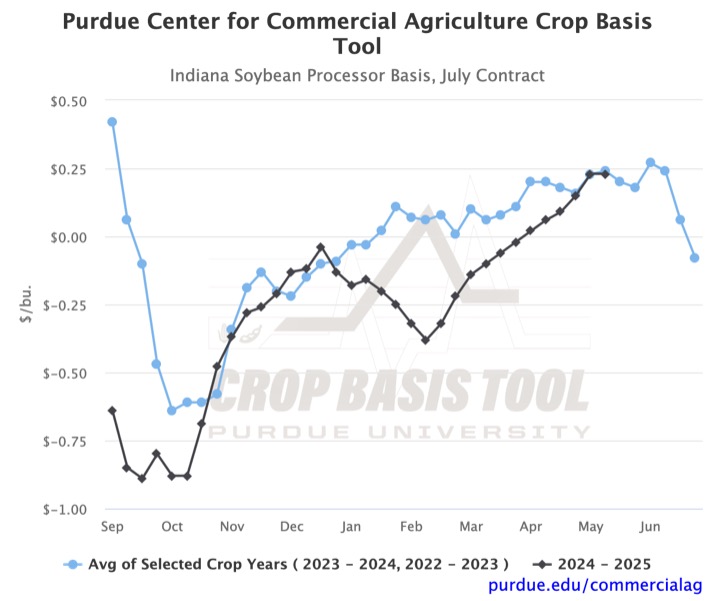

While local basis have increased across the region, a premium is still available at ethanol plants and soybean processors. Recent basis strengthening in Indiana has led to $0.12/bu corn basis and $0.23/bu soybean basis at the respective end users (Figures 4 and 5). These are both well above any local basis levels in the state. Price premiums also exist along the Ohio River, but the magnitude is much less than that at ethanol plants or soybean processors.

Looking forward, historical trends suggest that the pattern of basis strengthening is coming to an end. Based on the three-year average for corn and two-year average for soybeans, basis tends to level off through the latter part of May and into June before sharply declining as the expiration of July futures approaches. If the historical trends are to be believed, current basis levels may be the highest of the year; however, districts below the historic average may have an opportunity for further basis strengthening. To view your local crop basis, check out the Purdue Center for Commercial Agriculture Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.