July 17, 2025

Soybean Basis Recovers from Sharp Decreases in June

by Josh Strine

At the time of our last basis update in the second week of June, the regional soybean basis was highly volatile. Several regions across the Eastern Corn Belt experienced a decline in the soybean basis of as much as $0.15/bu, while the basis rose by as much as $0.08/bu in other regions. This volatility was driven by sharp decreases in basis at soybean processors in Ohio, Illinois, and Indiana. As June continued, the sharp decrease in soybean basis continued and spread across the entire Eastern Corn Belt. However, as we have progressed through July, much of the basis decrease has been recovered.

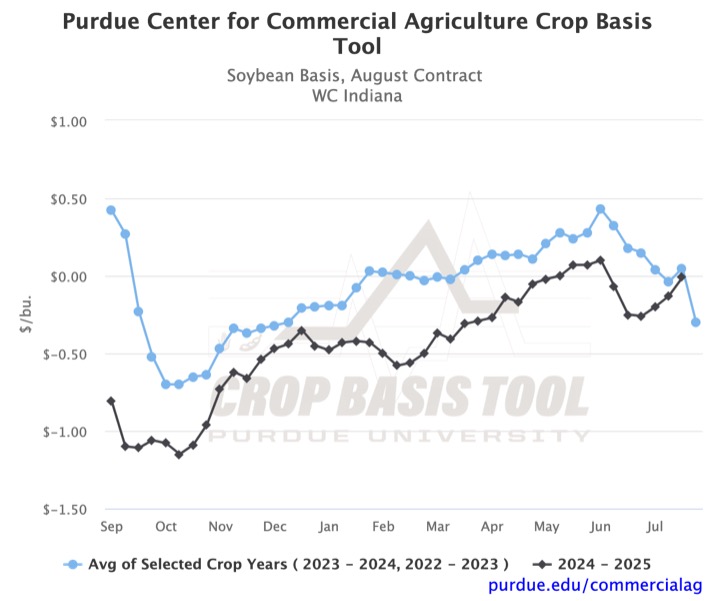

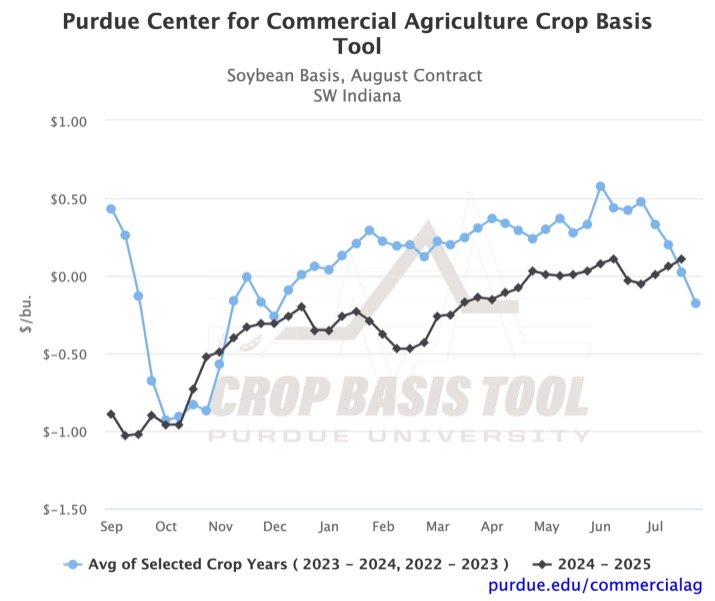

Figure 1 shows the soybean basis to August futures for West Central Indiana. During June, the basis fell by $0.27/bu in the region. Over the first three weeks of July, $0.25/bu of the loss was recovered. In other regions, such as SW Indiana, the weakening did not occur until later in the month (Figure 2). In SW Indiana, the basis did not decrease until the third week. Strengthening through July has set a new marketing year high at $0.11/bu in the region.

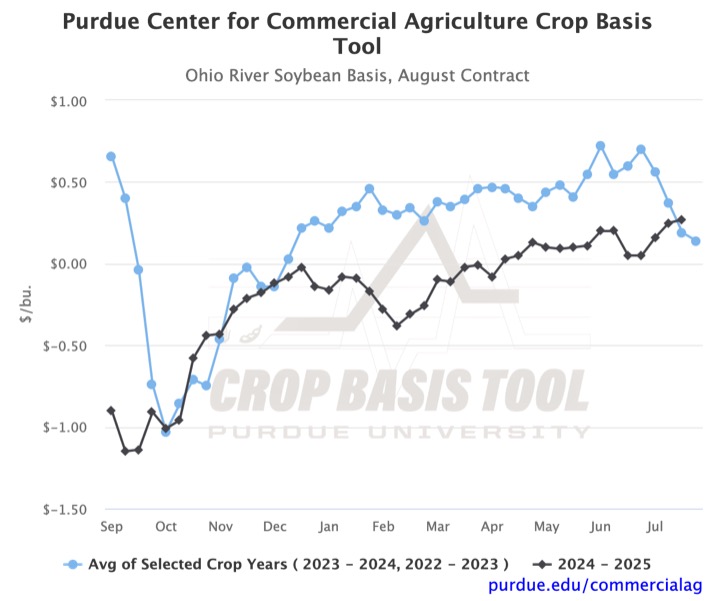

There is evidence that export demand may be helping drive the disparity in recent soybean basis movement. Soybean basis to August futures on the Ohio River only decreased by $0.03/bu through June before increasing by $0.22/bu over the past three weeks (Figure 3). The Ohio River basis is collected from river terminals in Southern Indiana and Ohio, where regional basis movement was lower.

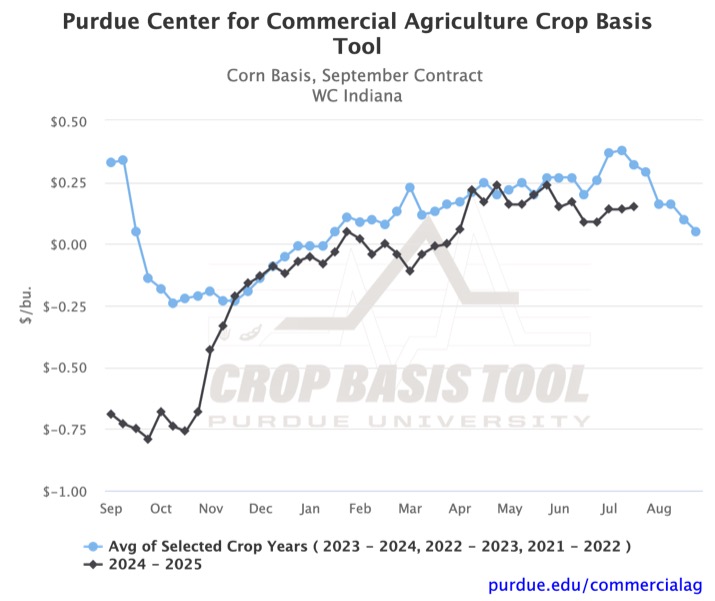

While there have been large swings in soybean basis, corn basis has been more stable over the past two months. Figure 4 shows the corn basis to September futures for West Central Indiana. Since the first week of June, the basis has held within a $0.08/bu range and currently sits at $0.15/bu. The greatest volatility in Indiana was in the South-Central region, where there was $0.20/bu swing over the past two months.

Looking forward, historical trends suggest that the corn and soybean basis will continue to weaken through the end of the marketing year. Projected sharp decreases in basis through September may be limited by the fact that many current basis levels are below the three-year average. In some cases, the current basis to September futures is already below the projected basis at the end of the year. Visit the Purdue Center for Commercial Agriculture’s Crop Basis Tool to check out your local crop basis and where it may be headed through the end of the year.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.