October 9, 2025

Corn & Soybean Basis Outpace Historical Averages across the Eastern Corn Belt

by Josh Strine

As corn and soybean harvest progress across the country, recent basis movements have pushed nearby basis levels above their historical averages in much of the Eastern Corn Belt. Typically, basis weakens through harvest, with nearby basis levels often bottoming out between mid-October and November. This marketing year, however, corn and soybean basis began below the two- and three-year averages, respectively, and recent movement has flipped the relationship in many USDA crop reporting districts.

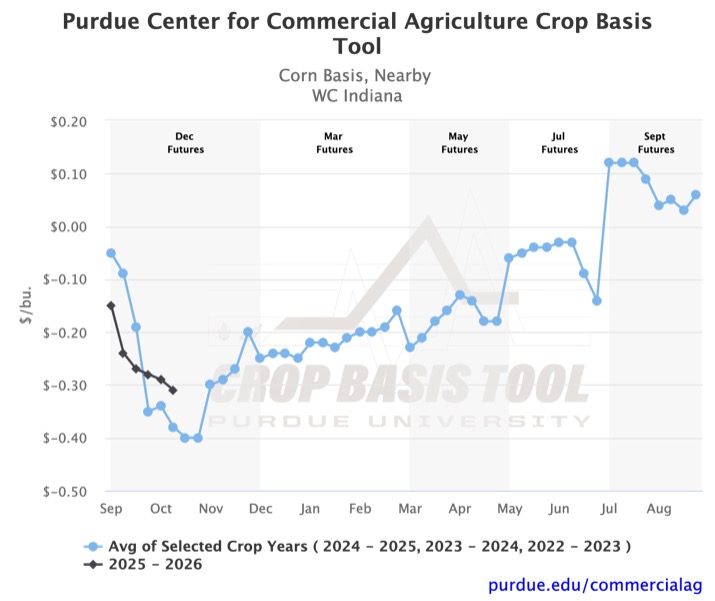

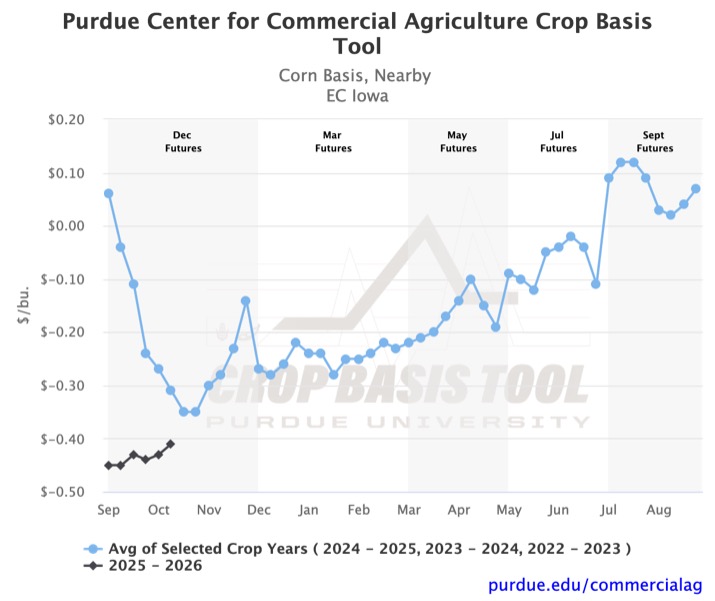

Figure 1 depicts West-Central Indiana’s nearby corn basis through the second week of October. Although the 2025 – 2026 marketing year started with a weaker basis than the three-year average, the typical seasonal decline has been more gradual. As a result, the $0.10/bu deficit to the trend line in early September has turned into a $0.07/bu surplus over the trend line by mid-October. While many markets in Illinois, Indiana, Ohio, and Michigan have seen basis surpass the historical average, the change is less prevalent in Iowa. East-Central Iowa may be the most extreme case where nearby corn basis has remained at a five-year low for the past six weeks (Figure 2).

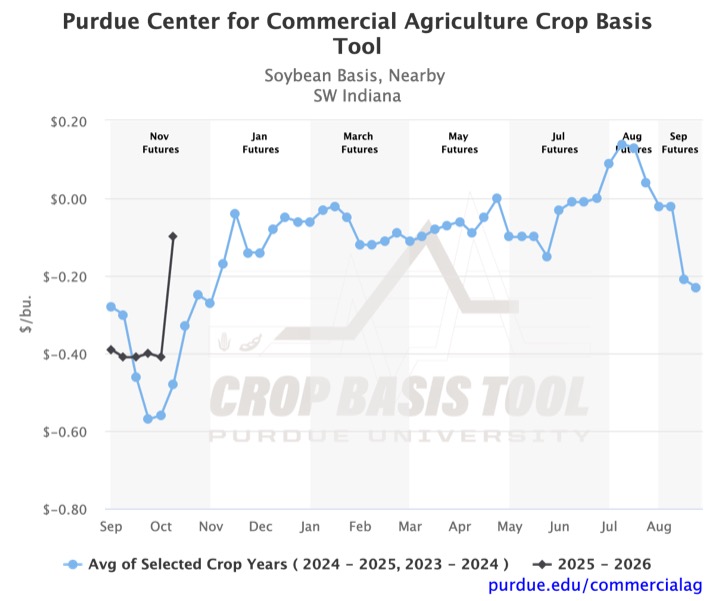

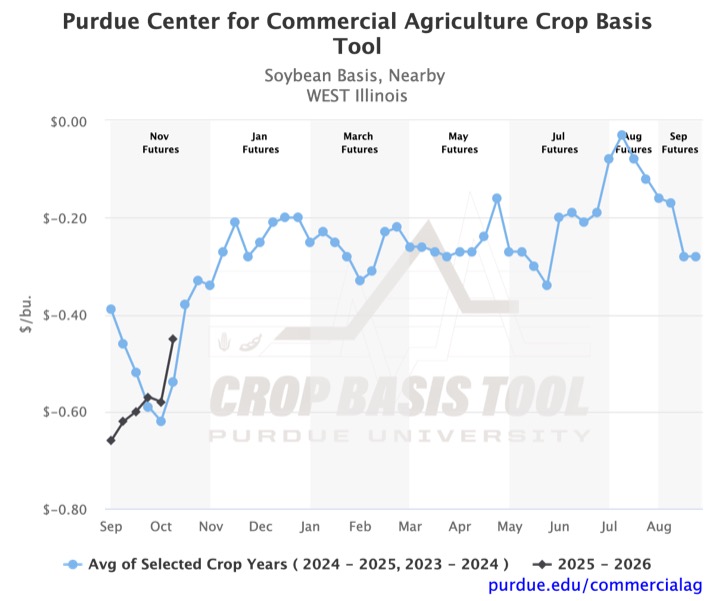

Soybean basis strengthening has been even more pronounced across portions of the Eastern Corn Belt. Figures 3 and 4 show the nearby soybean basis in Southwest Indiana and Western Illinois, respectively. In Southwest Indiana, basis increased by $0.31/bu between the first and second week of October. In West Illinois, basis increased by $0.13/bu between the first and second week of October. Similar but milder trends can be seen across the region.

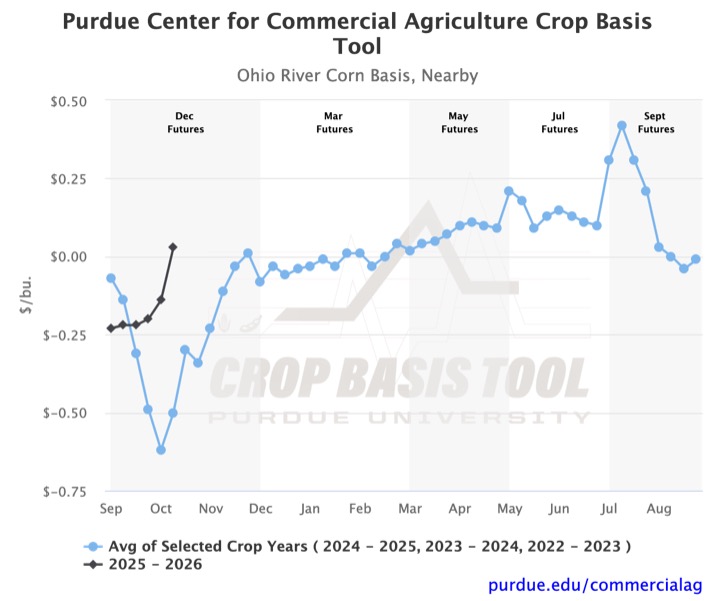

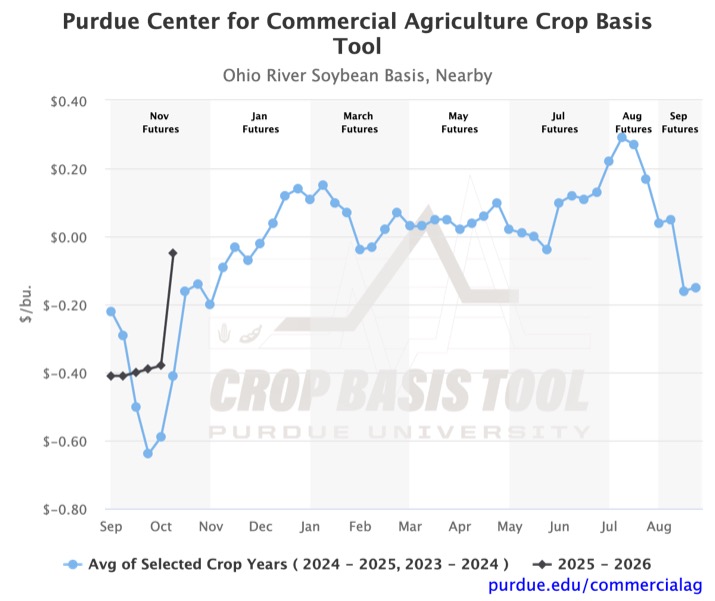

Many different factors may be driving the basis strengthening across the region. Both corn and soybean harvests are lagging behind the 2024 harvest. Additionally, basis along the Ohio River is well above the historical average for both crops (Figures 5 and 6). Strong river basis may signal increased export demand, as grain moved on barges is often destined for the Gulf for export. While the Crop Basis Tool does not include Mississippi River basis, basis strengthening in Eastern Iowa and Western Illinois may be further evidence of increased export demand.

As harvest continues into November, historical trends would suggest that basis across the region should continue to increase. However, if this year’s early upturn is tied to a slow harvest, further gains may be limited. Expectations may also be reduced in the short run in areas where the 2025 – 2026 basis level has surpassed the historical average. To see where your local basis sits, you can visit the Purdue Center for Commercial Agriculture’s Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.