Farmer sentiment improves following USDA’s second MFP payment announcement and Farm Bill approval

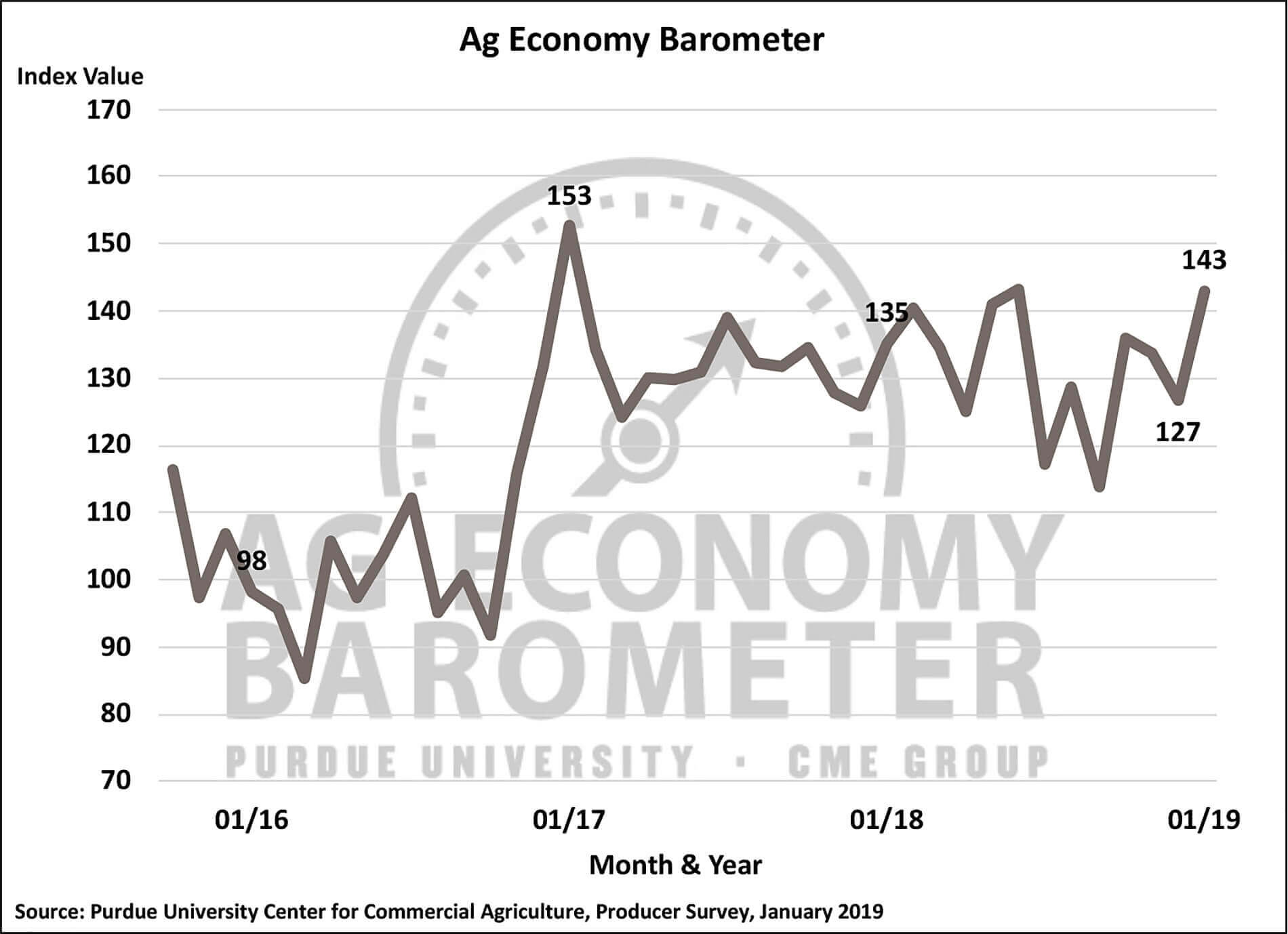

Agricultural producers were more optimistic about the agricultural economy in January, but they remain concerned about farmland values, according to results from the January Purdue University/CME Group Ag Economy Barometer. The barometer, which is based on 400 survey responses from agricultural producers across the country, rebounded to a reading of 143 in January, a 16 point improvement from December.

“This survey provided us with the first opportunity to measure farmers’ sentiment following the announcement of USDA’s second round of Market Facilitation Program (MFP) payments and the passage of the 2018 Farm Bill,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “It appears that these two announcements provided a significant boost to producer sentiment regarding both current and future economic conditions,” said Mintert.

In January, both of the barometer’s two sub-indices saw an uptick since December, with the Index of Current Conditions rising to 132 from 109 and the Index of Future Expectations rising to 148 from 135.

Increases were also seen in the Large Farm Investment Index, which measures whether producers feel this is a “good time” or a “bad time” to make large farm investments like machinery or buildings. Over the past few months, producers have been slowly expressing a more favorable view towards making large investments in their farming operations, with the index climbing 11 points from December and up 20 points from September, when the investment index bottomed out.

However, the same cannot be said for farmland values. According to the January survey, the percentage expecting higher farmland values over the next 12 months declined from 17 to 13 percent in December and, when asked to look ahead 5 years, producers expecting higher farmland values declined 2 points to 48 percent.

To better understand farmers’ planting intentions in 2019, the survey asked farmers who planted soybeans in 2018 what their plans are for 2019. Two-thirds of respondents said their soybean acreage will be the same as in 2018, but 25 percent of soybean producers said they intend to reduce their soybean acreage in 2019 compared to last year. Looking specifically at farmers who plan to reduce their soybean acreage in 2019, 58 percent of them said they will reduce acreage by more than 10 percent, while 42 percent said they would reduce acreage by 10 percent or less. This represented a shift in attitudes among soybean farmers from last fall. Back in November, among farmers that plan to reduce their soybean acreage, 69 percent of them said they planned to reduce their 2019 soybean acreage by more than 10 percent.

Lastly, when producers were asked about soybean futures, four out of ten respondents (43 percent) said they expect November 2019 soybean futures to fall below $8.50 sometime between mid-January and summer 2019. The negative perspective on soybean prices helps explain producers’ plans to reduce their 2019 soybean acreage.

Read the full January Ag Economy Barometer report at http://purdue.edu/agbarometer. This month’s report includes additional information about producer’s expectations for U.S. ag exports and their farm’s operating costs and whether their farm will have to carryover operating debt into 2019 from prior years. Each month Mintert also provides an in-depth analysis of the barometer. That video is also available at http://purdue.edu/agbarometer.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.