Farmer sentiment weakens amid increasing marketing risk concerns and continued uncertainty around tariffs

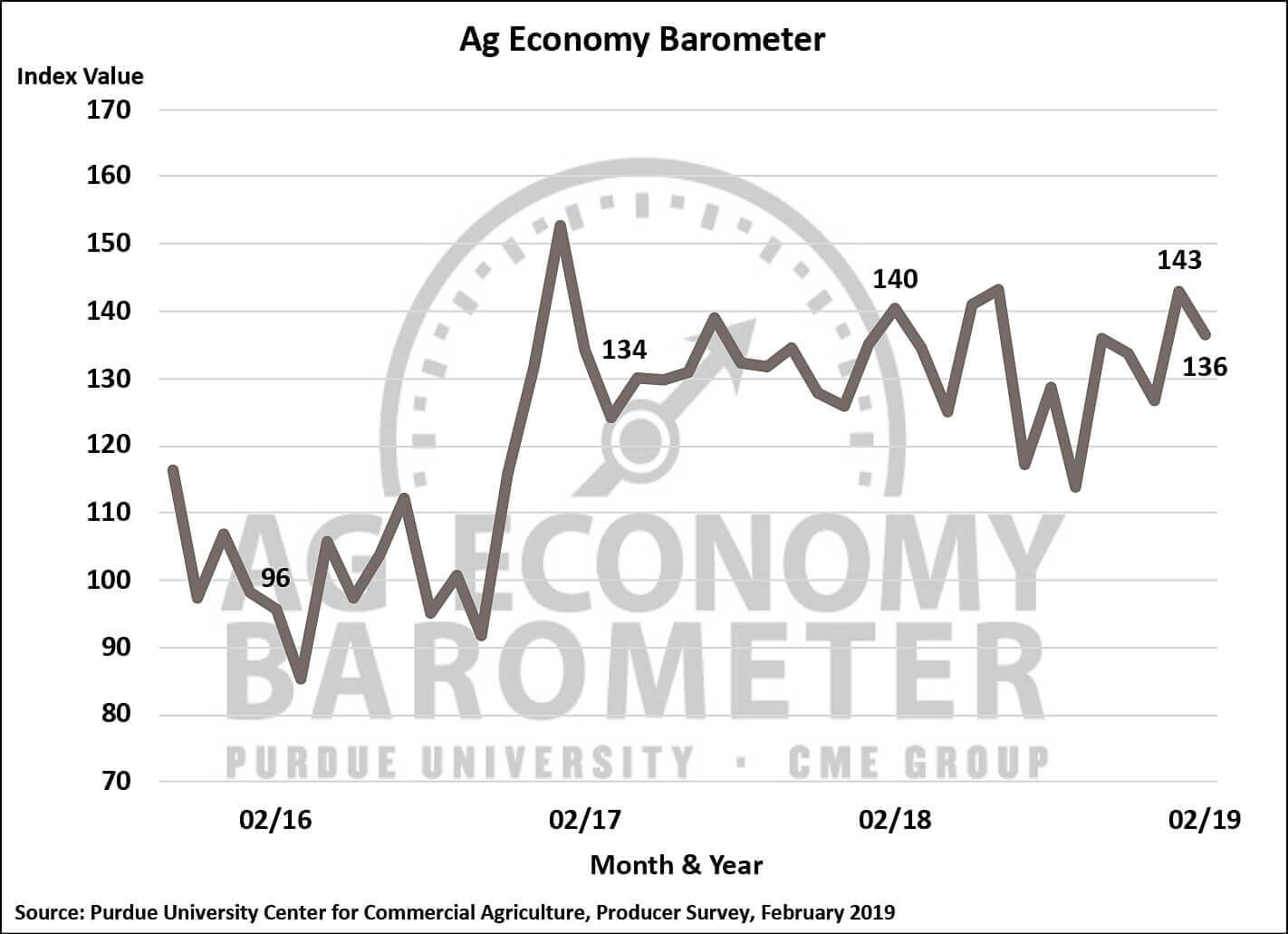

Uncertainty looms behind a weakened Purdue University/CME Group Ag Economy Barometer reading in February, with producers less optimistic about current conditions and the commodity price outlook. The barometer, which is based on a survey of 400 U.S. agricultural producers, declined 7 points to a reading of 136, down from 143 in January.

“Last month we saw a significant boost in optimism among agricultural producers after the announcement of the second round of MFP payments; however, it appears the positive impact eroded quickly,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Compared to responses from a year ago, fewer farms said they expect their operation to grow in the future, which could be a sign of increasing financial stress. We’re also seeing a growing number of farms concerned about marketing risk, ranking it as the biggest risk facing their operations.”

The monthly survey includes measures of producer sentiment toward current conditions and future expectations. In February, both indexes declined from their January reading. The Index of Current Conditions saw the biggest drop, down from 132 to 119, whereas the Index of Future Expectations weakened slightly, down from 148 to 145.

Last summer, the tariff battle disrupted commodity markets and, as a result, producers’ perspective on whether now is a “good” time or a “bad” time to make large farm investments has significantly fluctuated. From January 2018 through June 2018, before the trade disruptions emerged as a major market factor, the Large Farm Investment index averaged a reading of 65. However, since that time, the index has had an average reading of 53 points and, in February 2019 alone, the index fell to a reading of 50, down 12 points from January, as uncertainty about commodity prices continues to make farmers wary of large investments in their operations.

Additionally, when producers were asked whether they have plans to grow or increase the size of their current operation in 2019, 50 percent of respondents said that they either “have no plans to grow” or “plan to reduce in size,” compared to 39 percent in 2018. Last month, when 25 percent of farmers surveyed indicated they expected to take out a larger operating loan in 2018 versus 2019, a follow-up question found that 27 percent of those farms were taking out larger loans due to unpaid operating debt carryover, suggesting they were experiencing financial stress.

In February, producers were slightly more optimistic about evaluating farmland as a long-term investment and the future growth of agricultural exports; yet, they remain concerned about risk. When asked what type of risk was most critical to their farming operation, producers overwhelmingly chose marketing risk (56 percent) over both financial (27 percent) and production (17 percent) risk, which explains their uncertainty regarding the commodity price outlook.

Read the full February Ag Economy Barometer report at http://purdue.edu/agbarometer. In this month’s report, we continue to follow up with producers who planted soybeans in 2018 on their soybean acreage intentions for 2019 and ask producers, who planted corn in 2018, whether they plan to use one of the commodity support programs when sign-up becomes available. Each month Dr. Mintert also provides an in-depth analysis of the barometer. That video can be viewed at http://purdue.ag/barometervideo.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.