Farms showing financial stress, producers express concern about future conditions

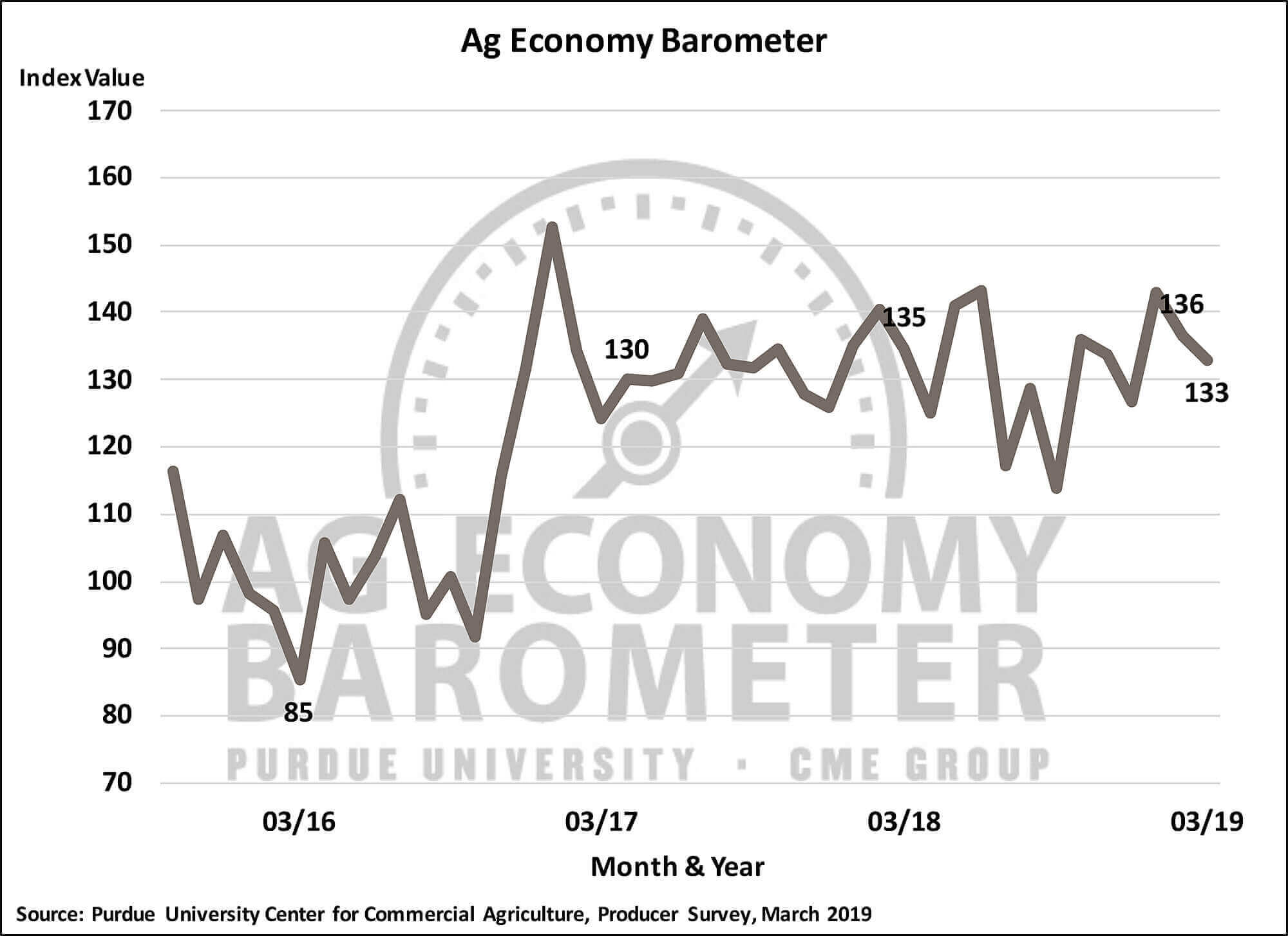

Producer sentiment weakened slightly in late winter, according to the March Purdue University/CME Group Ag Economy Barometer reading. The barometer, which is based on a survey of 400 U.S. agricultural producers, declined 3 points to a reading of 133, down from 136 in February.

“This month’s drop is largely due to producers’ weaker outlook regarding future economic conditions in agriculture and, in some cases, stress regarding their farm’s future financial performance,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Index of Future Expectations dropped 6 points, down from a reading of 145 to 139, while the Index of Current Conditions remained relatively unchanged at 120.

Financial stress continues to be a concern in the production agriculture sector. When asked about their financial performance expectations for 2019 compared to the previous year, 59 percent of producers expect their farm’s performance to be “about the same,” and 21 percent actually expect “better,” financial performance; however, 20 percent of producers said they expect their farm’s performance to be “worse than” in 2018. Responding to a separate question, just over half (52 percent) of respondents indicated they are less optimistic about their farm’s financial future compared to a year earlier.

To learn more about financial conditions on U.S. farms, Purdue researchers asked producers about their operating debt, both in the January and March 2019 surveys. Results suggest that 5 to as much as 7 percent of U.S. farms are suffering from some financial stress, using the need to carryover unpaid operating debt as a financial stress indicator. In March, of the 22 percent of farms that expect to have a larger operating loan in 2019, just over one in five said it was the result of carrying over a previous year’s unpaid operating debt.

In contrast to the concerns expressed about financial performance in the March survey, producers seem more optimistic about the future of agriculture exports. Only 8 percent of producers in the March survey said they expect agriculture exports to decrease in the next 5 years. Meanwhile, 68 percent expect exports to increase, which was the most optimistic perspective on agricultural exports provided by farmers since the Purdue researchers began posing questions on exports in May 2017. With respect to the trade dispute with China, 77 percent of producers were confident that it will be resolved in a way that benefits U.S. agriculture; however, less than half expect the trade situation with China to be resolved before July 1.

Read the full March Ag Economy Barometer report at http://purdue.edu/agbarometer. The report includes insights into producers’ attitudes toward farmland values and making large farm investments. The site also offers additional resources, such as past reports, charts and survey methodology, and a form to sign up for monthly barometer email updates and webinars. Each month Dr. Mintert also provides an in-depth analysis of the barometer. That video can be viewed at http://purdue.ag/barometervideo.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.