Climb in consumer food spending signals continued inflationary pressure

Reported food spending has increased to its highest level since the Consumer Food Insights Report began surveying in January 2022, possibly leaving consumers feeling little relief from inflation.

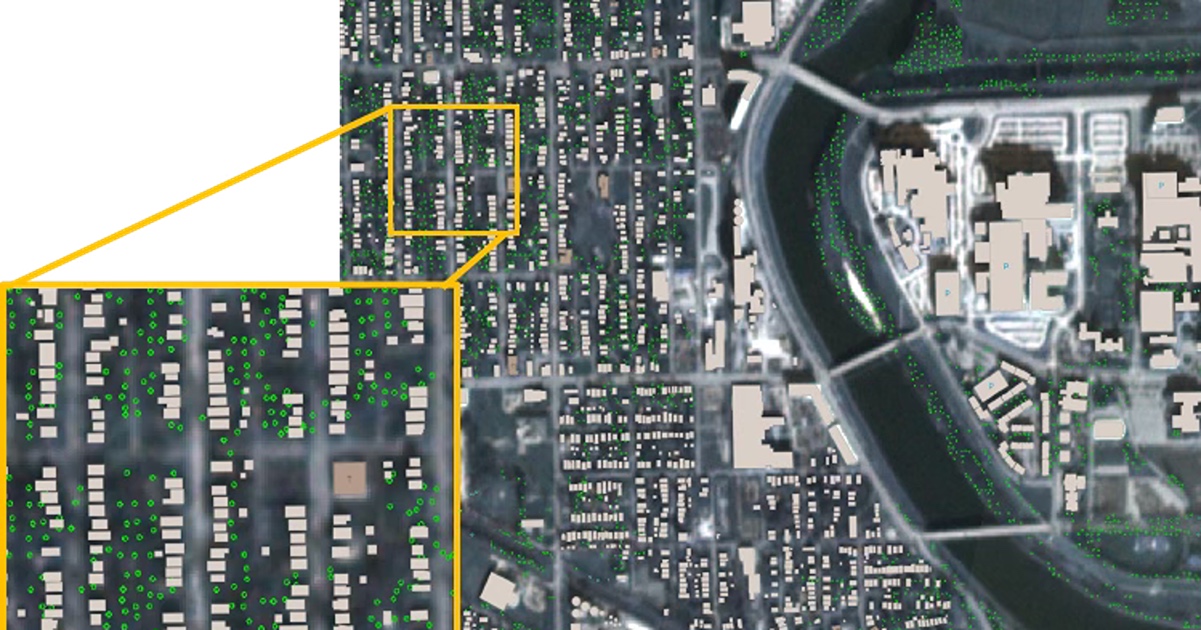

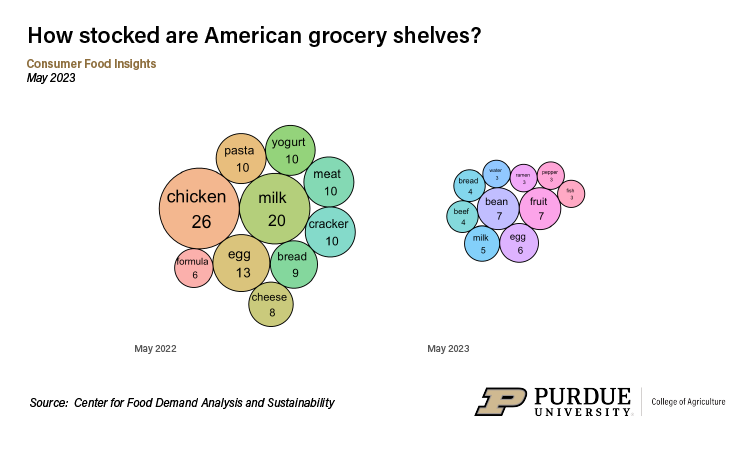

Reflecting this reality, consumers say they are spending 6.9% more on food, an uptick from last month, according to the May survey report. At the same time, the report shows that the rate of grocery stockouts has continued to decrease. This is a positive sign for consumer spending as it means less upward pressure on prices.

Top 10 Grocery Stockout Items, May 2022 vs. May 2023

Top 10 Grocery Stockout Items, May 2022 vs. May 2023 The survey-based report out of Purdue University’s Center for Food Demand Analysis and Sustainability assesses food spending, consumer satisfaction and values, support of agricultural and food policies, and trust in information sources. Purdue experts conducted and evaluated the survey, which included 1,200 consumers across the U.S.

“The key data point in food security is the decline in the average number of months that households are spending on the Supplemental Nutrition Assistance Program,” said Jayson Lusk, the head and Distinguished Professor of Agricultural Economics at Purdue, who leads the center.

“This trend suggests that people are leaving SNAP at a higher rate,” Lusk said. “After slowly climbing throughout 2022, this decline appears to correlate with the February end to pandemic-related SNAP expansions. But we will have to wait for more government data to get a better picture of whether SNAP participation is shifting.”

The latest survey also shows that a majority of shoppers with limited budgets are shopping at dollar stores, even for food items. And they are interested in shopping more if dollar stores expand their options. This coincides with a recent Reuters report suggesting that brand names are betting on dollar stores.

Share of Consumers who Shopped at a Dollar Store and Purchased Food in the Last 30 Days by Per Person Weekly Food Spending, Apr. 30 - May 2023

Share of Consumers who Shopped at a Dollar Store and Purchased Food in the Last 30 Days by Per Person Weekly Food Spending, Apr. 30 - May 2023 “Given this current investment from brands, we will definitely revisit this topic to see whether consumers come to further rely on dollar stores,” Lusk said.

Additional key results include:

- Food insecurity is up to 16% from 14% but remains within the same 3 percentage point range seen since January 2022.

- Grocery stockouts continue to trend downward, hitting their lowest point since January 2022, as few foods are hard to find.

- Thrifty food spenders are more likely to eat vegetarian, grow a food garden and compost food scraps.

The latest survey data also show that spending more on food does not necessarily mean people will be happier with their diets.

“We have discussed previously that a large majority of Americans are generally satisfied with their food options, which creates a sort of floor for food happiness,” said Sam Polzin, a food and agriculture survey scientist for the center and co-author of the report. “However, I might also speculate that Americans receive a lot of negative messages about their diets and that people often feel guilty about their diets. This could create a ceiling for food happiness.”

Lusk and Polzin expected to see differences between the food spending groups, which they classify as thrifty (less than $50 a week), moderate ($50-$85 a week) and liberal (more than $85 a week). This includes thrifty spenders more often choosing generic brand foods. But they also observed some unexpected similarities, such as thrifty and liberal spenders choosing organics or cage-free eggs at similar rates.

“These results run counter to some conventional wisdom that consumers with larger budgets are comparatively more likely to choose more expensive products like organics, which have a health and environmental halo,” Polzin said.

Lusk further discusses the report in his blog.

The Center for Food Demand Analysis and Sustainability is part of Purdue’s Next Moves in agriculture and food systems and uses innovative data analysis shared through user-friendly platforms to improve the food system. In addition to the Consumer Food Insights Report, the center offers a portfolio of online dashboards.