Survey tallies consumer attitudes toward lab-grown meat alternatives

Many consumers view conventional meats as both tastier and healthier than laboratory-grown alternatives, according to the March Consumer Food Insights Report.

The survey-based report out of Purdue University’s Center for Food Demand Analysis and Sustainability assesses food spending, consumer satisfaction and values, support of agricultural and food policies and trust in information sources. Purdue experts conducted and evaluated the survey, which included 1,200 consumers across the U.S.

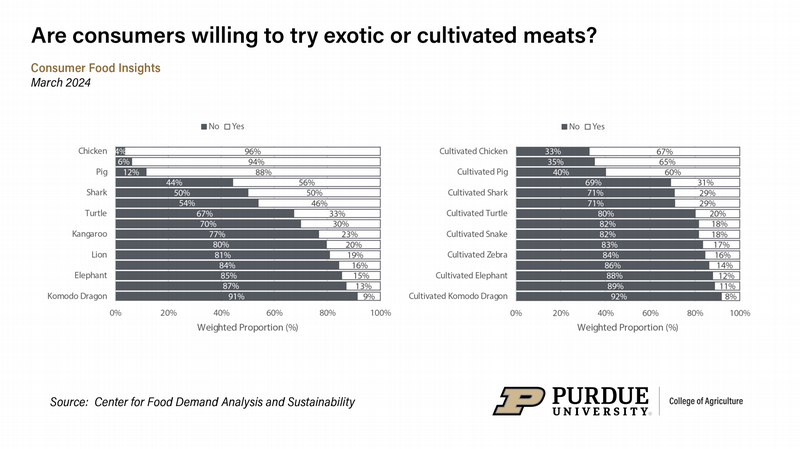

This month’s report explores consumer perceptions of and willingness to try exotic and cultivated meats. The report highlights differing responses to queries based on meat type: conventional (non-cultivated) or cultivated. The researchers use the term “conventional” meat to describe meat that is sourced conventionally — bred and raised or hunted, slaughtered and butchered. Cultivated meat is grown or cultivated in a laboratory from animal cells.

Focusing on familiar meats that Americans can find in any grocery store, such as beef and chicken, center researchers saw a big difference between the perceived taste and healthfulness of conventional versus cultivated versions of these meats. The conventional versions received a higher average rating in both aspects.

“We see similar results when evaluating consumers’ willingness to try conventional and cultivated meats in a restaurant setting,” said the report’s lead author, Joseph Balagtas, professor of agricultural economics at Purdue and director of CFDAS. For common meats, such as beef, chicken and pork, the researchers found that about 90% or more of consumers are willing to try conventional or noncultivated meats.

“The proportion of consumers willing to try the cultivated versions of these meats is around 30 percentage points lower, though it is still a majority, about 60%,” Balagtas said. “Given the fact that cell-cultured meat is not widely available, these results reflect consumer distrust of the unknown when it comes to food, which is a barrier for any novel food trying to break into the market.”

Share of Consumers Willing to Try Conventional Meats in a Restaurant Setting, Mar. 2024/Share of Consumers Willing to Try Cultivated Meats in a Restaurant Setting, Mar. 2024

Share of Consumers Willing to Try Conventional Meats in a Restaurant Setting, Mar. 2024/Share of Consumers Willing to Try Cultivated Meats in a Restaurant Setting, Mar. 2024 Among consumers unwilling to try conventional chicken, cow and pig, however, around 46%, 26% and 22%, said they are willing to try cultivated versions of these meats, respectively. “This shows that there may be market for cultivated meat among a sizeable portion — albeit small number — of consumers who do not eat meat along with a majority of consumers who already are willing to try conventional versions of these meats,” he said.

The questions about exotic and cultivated meats stemmed from a collaboration with Jacob Schmiess, a Purdue PhD student in agricultural economics, who co-authored this month’s report. The results showed that fewer consumers are willing to try exotic meats, though around 50% say they are willing to try professionally prepared octopus, shark and ostrich.

“Again, we see a willingness to try cultivated versions of these meats drop significantly,” Schmiess said.

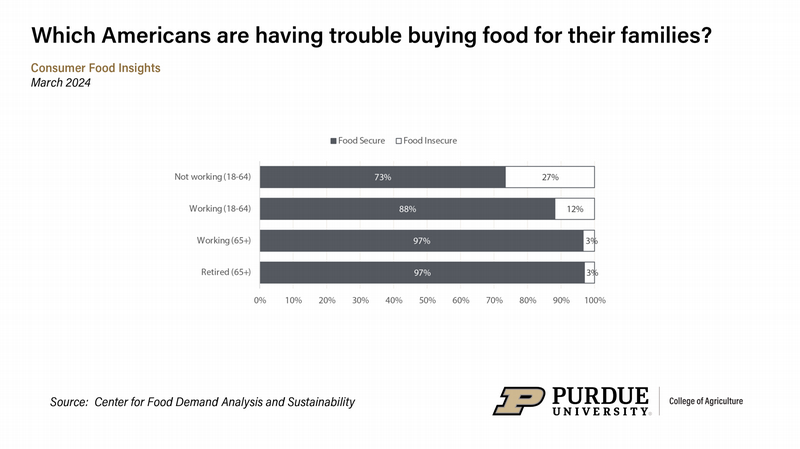

The CFDAS team broke down the results for these and other questions on the March survey by employment status. The researchers compared consumers of working age (ages 18-64) who are working and not, as well as seniors (ages 65-plus) who are working and not. The researchers combined the last 27 months of data (January 2022 to March 2024) for their analysis.

The team has been tracking a sustainable food purchasing (SFP) index every month since 2022, and quarterly since the start of 2024. The index is a self-reported measure of food purchasing designed to assess how well consumer shopping habits align with healthy diets from sustainable food systems based on components from the EAT-Lancet Commission.

The SFP index reveals that retirement-age consumers score higher overall than those of working age regardless of employment status. “This disparity is driven primarily by the differences in the ‘economic’ and ‘security’ sub-indicators, which measure consumers’ current ability or plans to buy a variety of nutritious and safe foods that fit their budgets,” Balagtas said. “Wealth tends to correlate with age, so finances may be less of a constraint for retirement-age individuals, resulting in higher scores.”

Consumers reported $190 in average weekly total food spending. This is 2.5% more than in March 2023 and 7.3% more than in March 2022. The consumer estimate of food inflation rose from 6.0 % in February to 6.5% in March.

“Similarly, expected food inflation rose to 4%,” said Elijah Bryant, a survey research analyst at CFDAS and co-author of the report. “We continue to see consumer inflation estimates diverge from the consumer price index measure of food inflation, which dropped to 2.2%.

“Recent media attention to food prices may be driving consumer pessimism about food inflation and future food costs, despite the CPI indicating that food inflation is on the decline,” Bryant said. “While prices do continue to rise, they are not quite rising at the high rate perceived by the average American.”

Retired consumers reported their household food spending as $168 per week in March, almost $40 less than younger working adults ($206 per week). “A substantially larger proportion of working-age adults share their households with more than two people,” Bryant said. “More mouths to feed mean more food must be bought to sustain all members of the household.”

Food security remained unchanged at 12.4% from February to March. “When aggregating all 27 months of data, we see that the food insecurity rate is much higher among working-age adults who are not currently employed (27%),” Bryant said.

Rate of Household Food Insecurity in the Last 30 Days by Employment Status, Jan.

2022 - Mar. 2024

Rate of Household Food Insecurity in the Last 30 Days by Employment Status, Jan.

2022 - Mar. 2024 People of retirement age are the most food secure, with only 3% of those who are 65-plus being food insecure. Participation in the U.S. Department of Agriculture’s Supplemental Food Nutrition Program (SNAP) showed a similar difference, with around one-third of those who are not working but are of working age reporting that they or someone in their household received SNAP benefits in March.

“The increased use of SNAP benefits among this cohort since January 2022 might be the result of high food inflation in 2022. While annual food inflation has cooled substantially since 2022, it remains positive, which means prices continue to rise. Higher prices can strain the food budgets of those who are out of work or maybe are unable to work, which might be why we are seeing an increase in food assistance use among this group over time. Bryant said.

In addition, survey results showed that consumer beliefs about food claims appear to vary more based on a respondent’s age rather than employment status, Bryant noted. “We see a smaller proportion of retirement-age individuals agreeing with statements about the healthfulness of plant-based milk over conventional dairy milk, or the taste of grass-fed beef over the taste of grain-fed beef relative to working-age adults,” he said.

The researchers further examined how trust in federal organizations and initiatives as information sources on healthy and sustainable foods has changed over time. “We observe an increase in the level of consumer trust in organizations such as the USDA and the U.S. Food and Drug Administration and in the Dietary Guidelines for Americans, a government program with a mission to support healthy diets.

“It will be interesting to see if this positive trend in trust continues or if consumer sentiment shifts as many Americans turn their attention to U.S. politics this year,” Bryant said.

The Center for Food Demand Analysis and Sustainability is part of Purdue’s Next Moves in agriculture and food systems and uses innovative data analysis shared through user-friendly platforms to improve the food system. In addition to the Consumer Food Insights Report, the center offers a portfolio of online dashboards.