September 26, 2023

Absorption Capacity and Producer Sentiment

by Margaret Lippsmeyer, Michael Langemeier, James Mintert, and Nathan Thompson

Introduction

Strategic risks threaten a farm’s ability to meet its long-term objectives and often cause a farm to rethink its long-run strategy. Strategic risk is the risk of being out of position when responding to shifts in the political and social environment, a growing or contracting macroeconomy, or a changing input and output price landscape. A previous article noted that agility and absorption capacity are two strategies that can be used to build resilience to strategic risk (Lippsmeyer and Langemeier, 2023). This article uses results of a survey of 403 U.S. producers to examine the relationship between absorption capacity and farm characteristics such as farm growth, producer sentiment, demographics, identification of major threats, management practices, and resilience to strategic risk. For a more general discussion of the survey see Lippsmeyer et al. (2023).

Absorption Capacity

Absorption capacity is related to a farm’s ability to withstand shocks from strategic risk (Sull, 2009). In production agriculture, absorption capacity is sustained by maintaining strong cash reserves, storing crops to market when extra cash is needed, diversifying cash flows, reducing fixed costs per unit of output, and any other strategy that buffers the business in times of uncertainty (Lippsmeyer and Langemeier, 2023). In addition to liquidity, balance sheet strength can also be related to solvency. Asking the following questions can be helpful. Does our farm have enough working capital to weather one or two years of relatively low net incomes? Does our farm have the capacity to borrow funds if the farm needs to make major repairs or replace a piece of equipment or building?

Our strategic risk survey included three questions pertaining to absorption capacity. The first question asked whether a respondent’s farm had low per unit fixed costs relative to their competitors. The second question asked whether the respondent’s farm had a more diversified enterprise mix today compared to 5 years ago. The third question asked whether a respondent’s farm had a strong balance sheet. On average, 72% of the respondents indicated that they had low per unit fixed costs. Approximately 55% of the respondents indicated that they had more diversified cash flows and 90% of the respondents indicated that they had a strong balance sheet.

Relationship between Absorption Capacity and Farm Characteristics

Table 1 : Correlation Coefficients for Absorption Capacity

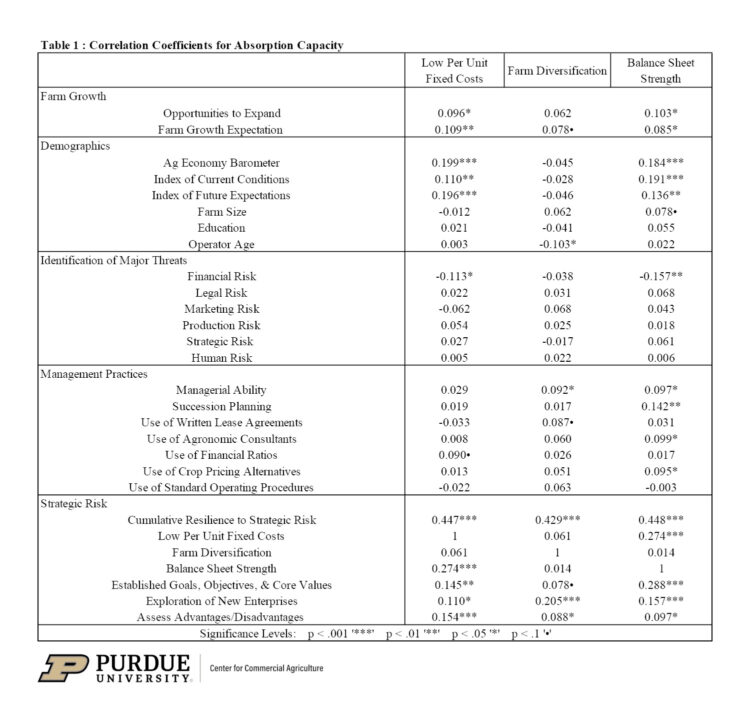

Table 1 presents correlation coefficients between each question pertaining to absorption capacity and farm characteristics such as farm growth, demographic variables, major sources of risk, management practices, and resilience to strategic risk. The discussion below will focus on the farm characteristics that were significantly correlated with one or more of the questions measuring absorption capacity.

The question on farm growth expectations asked whether the respondent’s farm expected to grow over the next five years. All three of the absorption capacity measures were positive and significantly correlated with farm growth. This tells us that farms with more absorption capacity have higher farm growth expectations.

The absorption capacity measures related to per unit fixed costs and balance sheet strength were positive and significantly correlated with producer sentiment as measured with the Ag Economy Barometer, the Index of Current Conditions, and the Index of Future Expectations. The producer sentiment questions replicated the questions used to create the monthly Ag Economy Barometer (https://purdue.edu/agbarometer). Results related to producer sentiment suggest that those with low per unit fixed costs and strong balance sheets were more optimistic.

In general, correlations between the absorption capacity measures and farm size, education, and operator age were relatively low. However, there was a negative and significant correlation between farm diversification and operator age (younger farm operators had more diversified cash flows), and a positive and significant correlation between farm size and balance sheet strength (larger farms had a stronger balance sheet).

Respondents were also asked to identify the most threatening source of risk on their farm. Choices included financial risk, legal risk, marketing risk, production risk, strategic risk, and human risk. With the exception of financial risk, sources of risk were not correlated with the absorption capacity measures. Financial risk was negative and significantly correlated with having low per unit fixed costs and a strong balance sheet. Given the importance of being a low-cost producer and having a strong balance sheet to financial position and performance, it is not surprising that producers concerned about financial risk were less likely to indicate they had low per unit costs and a strong balance sheet.

Management practice questions addressed whether farms had written succession plans, written crop lease agreements, used agronomic consultants, used financial ratios to make decisions, evaluated crop pricing performance, and documented standard operating procedures. We created a metric for managerial ability using the six management practice questions. This metric was positive and significantly correlated with diversification of cash flows and balance sheet strength. Interestingly, there was a strong positive correlation between having a strong balance sheet and succession planning. Farms with a strong balance sheet likely have more assets that need to be protected when a farm is transitioned to the next generation.

A strategic risk score or metric, represented by the cumulative resilience to strategic risk variable in Table 1, was created using the three absorption capacity measures and the three agility measures. Agility questions addressed whether a respondent’s farm had established goals, objectives, and core values; explored new enterprise opportunities; and assessed advantages and disadvantages. As expected, there was a positive and significant relationship between each absorption capacity measure and the strategic risk score. With the exception of the diversification of cash flows measure, having low per unit costs and a strong balance sheet were positive and significantly correlated with all of the absorption capacity and agility measures. Having a diversified cash flow was positive and significantly correlated with the three agility measures.

Summary and Conclusions

This article examined the relationship between absorption capacity and farm characteristics. Absorption capacity was measured by asking survey respondents whether they had low per unit fixed costs, a diversified enterprise mix, and a strong balance sheet. Producers with lower per unit fixed costs and a strong balance sheet were more optimistic and were less likely to indicate that financial risk was the most threatening source of risk on their farms. This article focused on the role of absorption capacity in building resilience to strategic risk. However, it’s important to note that absorption capacity is just one of the strategies to improve farm resilience. A future article will address agility, another strategy that can be used to build resilience to strategic risk.

References

Lippsmeyer, M. and M. Langemeier. “Agility and Absorption Capacity.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, April 20, 2023.

Lippsmeyer, M., M. Langemeier, J. Mintert, and N. Thompson. “Resilience to Strategic Risk.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, June 20, 2023.

Sull, D. (2009). How to Thrive in Turbulent Markets. Harvard Business Review, February 2009.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

January 27 or 28, 2026

Farm Shield is more than a conference, it’s a commitment to helping agricultural families build resilience and plan for a secure future. Don’t miss this opportunity to protect your legacy!

Read MoreJanuary 9, 2026

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture’s future and how you can position your farm to be successful in the years ahead.

Read More