January 11, 2024

Corn & Soybean Basis Continue to Strengthen

by Nathanael Thompson

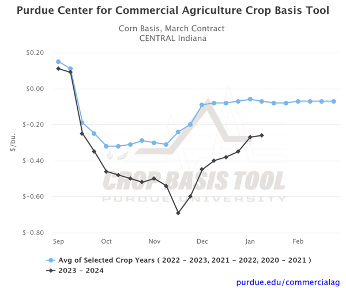

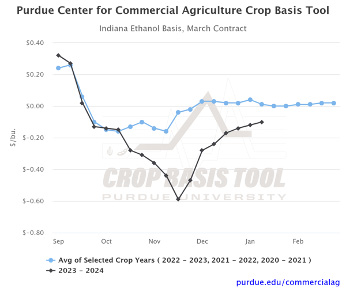

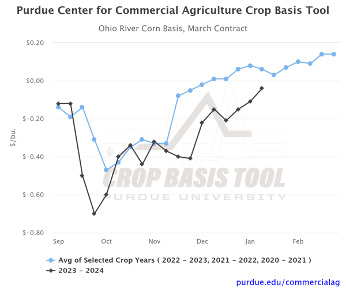

After starting the year with weaker than normal basis levels, corn and soybean basis are improving. The improvement in corn basis occurred much later than normal due to slow harvest progress from wet corn in many locations. For example, corn basis in Central Indiana did not reach its low until the third week of November. Since then, corn basis in Central Indiana has improved $0.43/bu. and is now $0.26/bu. under March ’24 corn futures (Figure 1). This is still about $0.19/bu. weaker than the 3-year historical average in Central Indiana. Corn basis at Indiana ethanol plants (Figure 2) and river terminals in southern Ohio, Indiana, and Illinois (Figure 3) have followed a similar pattern.

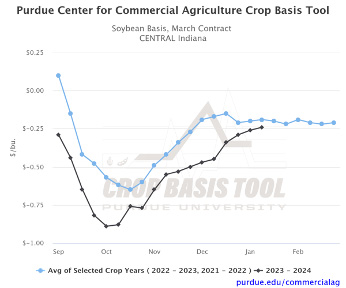

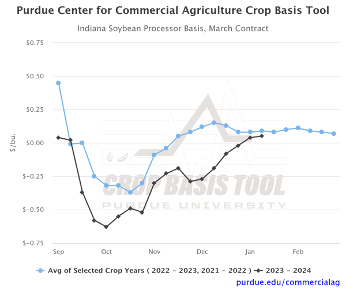

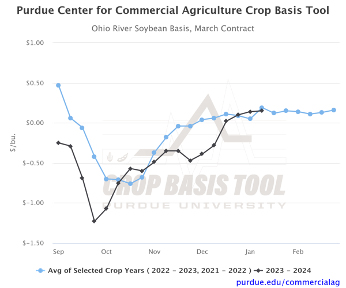

Soybean basis also started the year weaker than normal. However, strengthening of soybean basis happened earlier than corn given timelier harvest. For example, soybean basis in Central Indiana has been strengthening since early October and is currently $0.24/bu. under March ’24 soybean futures (Figure 4). This is just $0.05/bu. weaker than the 2-year historical average soybean basis in Central Indiana. Soybean basis at Indiana processors (Figure 5) and river terminals in southern Ohio, Indiana, and Illinois (Figure 6) have seen a similar recovery. As always, be sure to visit the Purdue Center for Commercial Agriculture Crop Basis Tool to check current corn and soybean basis levels and historical basis trends in your local area.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.