May 8, 2004

The Internal Analysis of Your Farm Business: What is Your Farm’s Competitive Advantage?

by Allan Gray, Michael Boehlje, Craig Dobbins, and Cole Ehmke

Assessing the strengths and weaknesses of your farm business will help you identify those activities conducted on the farm that can create a sustainable competitive advantage for the business. To accomplish this goal, it is necessary to identify those activities at which your farm business excels, not just activities that it does equally as well as its competitors.

Unfortunately, objectively identifying strengths and weaknesses for one’s own farm business is very difficult to do. This publication presents a method for identifying your farm’s competitive advantage. By clarifying for yourself the farm business’s capabilities, you can take better advantage of trends and opportunities in the business environment. The information and worksheets in this publication will help you identify the capabilities of your business.

Resources, Capabilities, and Core Competencies

The focus of an internal analysis of the farm business is to identify resources, capabilities, and core competencies. Resources are inputs into a production process, such as capital equipment, cash, skills of individual employees, and talents of management. Resources are of two types: tangible and intangible. For most farmers, it is fairly easy to recognize tangible resources because they can be seen and counted, and a dollar value can be assigned to them. Tangible farm business resources include things like land, storage facilities, barns, and machinery.

Intangible farm business resources are not so easy to identify. Intangible resources include technological or mechanical know-how, family commitment, organizational structure, reputation, etc. These resources can’t be touched or counted, and it would be difficult to assign a dollar value to them. Nonetheless, intangible resources are increasingly becoming the key to the long-term success of businesses both in and out of agriculture. However, just identifying the tangible and intangible farm business resources is not enough because resources, by themselves, do not create a competitive advantage. To develop a competitive advantage it is necessary to combine resources and capabilities.

A firm’s capabilities are a reflection of management’s capacity to use resources in a way that achieves goals and objectives. Capabilities relate to the way business decisions are made and implemented. Capabilities don’t necessarily reside in individuals, but more in the farm’s culture and decision-making procedures.

To be successful, a business uses resources and capabilities to create and maintain core competencies. Core competencies are simply resources and capabilities that serve as a source of competitive advantage. Core competencies are strengths that allow a business to achieve superior efficiency, quality, and innovation. For resources and capabilities to be core competencies, they need to be valuable, costly to imitate, and non-substitutable.

A valuable resource or capability creates value for the farm business by exploiting opportunities and/or neutralizing threats in the external environment. Valuable resources or capabilities enable the farm to develop and implement strategies that create value for customers. As an example, a flexible work schedule and the ownership of a semi- truck can allow a manager to create value for grain customers by delivering grain with only a few hours notice. In other words, to create value, the resource or capability must help solve a customer’s problem.

An important question that farm business managers need to consider when determining the value of a resource or capability is “How many other farms have this characteristic?” Resources and capabilities possessed by many rivals are unlikely to provide a source of competitive advantage. Planting the most popular hybrid or using the most popular brand of machinery will not provide a high value or a competitive advantage. Competitive advantage results only when the farm business manager can develop and exploit capabilities that differ from those possessed by competitors.

Costly-to-imitate resources or capabilities are those that competitors would have a difficult time developing because they require a large capital outlay or a long period of time to develop. One example would be an in-depth understanding of cropland that has been handed down through the family for a number of generations. Because of the years of experience in managing this land, the family members understand how to achieve the best crop performance. This particular capability (tangible resource of land and the capability to use it properly) would be difficult for many competitors, who either rent land or are new to the ownership of land, to quickly replicate.

Finally, the resource or capability must have no close substitutes that could be used to gain the same competitive advantage. One example is the trust-based working relationship that some farmers may have with their employees or in some cases with buyers or processors. Trust-based relationships take time to develop, are many times hard for competitors to recognize, and have very few, if any, close substitutes for gaining the same advantage.

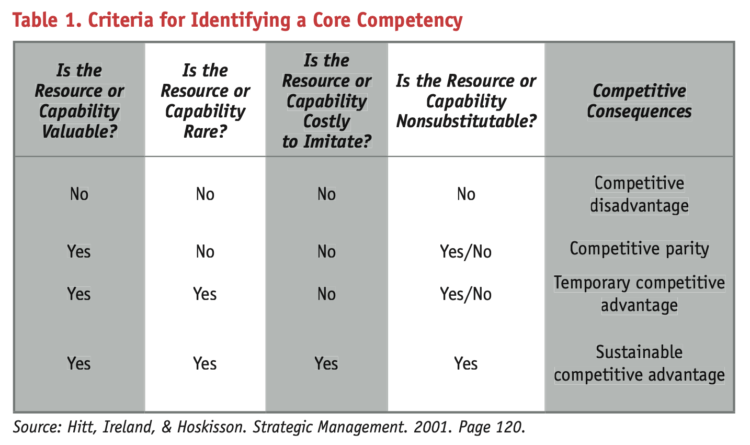

Core competencies are the key to developing a successful business strategy—a competitive advantage. However, relatively few resources and capabilities meet the stringent requirements of a core competency (Table 1). It is hard to develop and protect more than a few core competencies. In fact, most research conducted in this area suggests that firms should identify and concentrate on only three or four core competencies.

The Value Plate

So, how do farm business managers begin the process of identifying their business’s core competencies? One method that is useful for identifying the resources and capabilities of the farm business and contemplating their potential for providing a competitive advantage is the value plate.

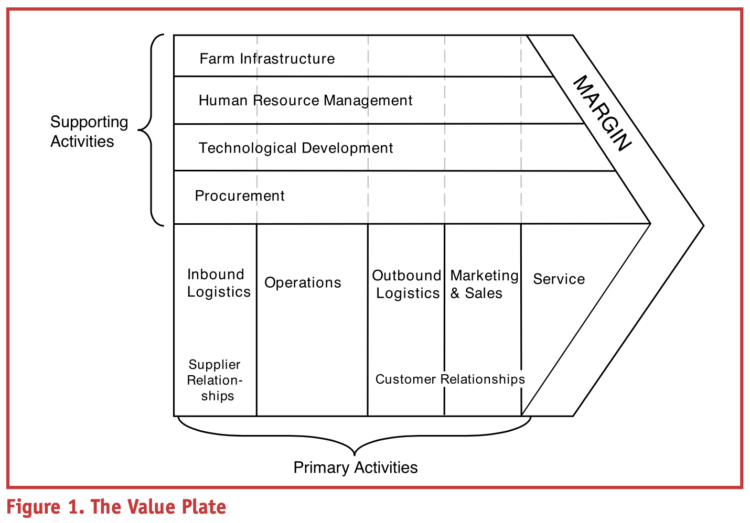

The value plate is a concept developed by Michael Porter to provide a framework for identifying the activities the firm conducts to create value. Figure 1 depicts the activities that a business might perform to development and deliver a product or service. This value plate reflects your business strategy and industry economics. The value your business creates is, generally, the amount that buyers are willing to pay for what you provide. The size of the external boundary of the plate represents the total value the farm creates for its customers. For your business, it is measured in total revenue. The individual boxes within the boundaries represent the activities performed and the cost of performing those activities. Your business is profitable only if the total revenue exceeds the costs required to create your product. The difference between the value activities (expenses) you perform and the value you create (total revenue) is the margin.

One wants the size of each individual activity box to be as small as possible, while having the overall value plate as large as possible. Those activities that the firm does at the lowest cost relative to the value created, vis-à-vis their competitors, give it a better chance of achieving a competitive advantage. Business activities are combined into two broad classes: primary activities and supporting activities. Primary activities, on the bottom half of Figure 1, physically create and service your product. Secondary activities, on the top half of Figure 1, support the primary activities by providing the business-wide functions. These are discussed in detail in the next sections.

Although not all farm businesses will include all of the activities depicted in the value plate, it is a useful way to think about and classify business activities. Differences in your value plate compared to your rivals’ can create competitive advantages. Just as United Airlines’ value plate differs from Southwest Airlines’ in significant ways, such as boarding procedures, crew policies, and aircraft and route configuration, so will your business differ from your competitors’ businesses.

Primary Activities

The bottom part of the value plate represents the general primary activities the farm undertakes to produce goods or services. These activities consist of supplier relation- ships (inbound logistics), operations, and customer relationships (outbound logistics, marketing and sales, and service).

Supplier Relationships

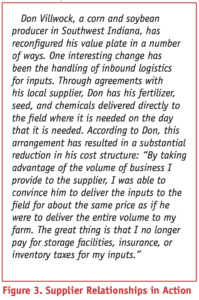

Moving from left to right on the value plate, the first primary activity normally includes a set of relationships with businesses that supply the inputs needed to create your product, referred to as “upstream activities.” These upstream activities can serve as a source of sustainable competitive advantage when special relationships are created with suppliers that either reduce the cost of providing value to the customer or reduce the costs of creating value.

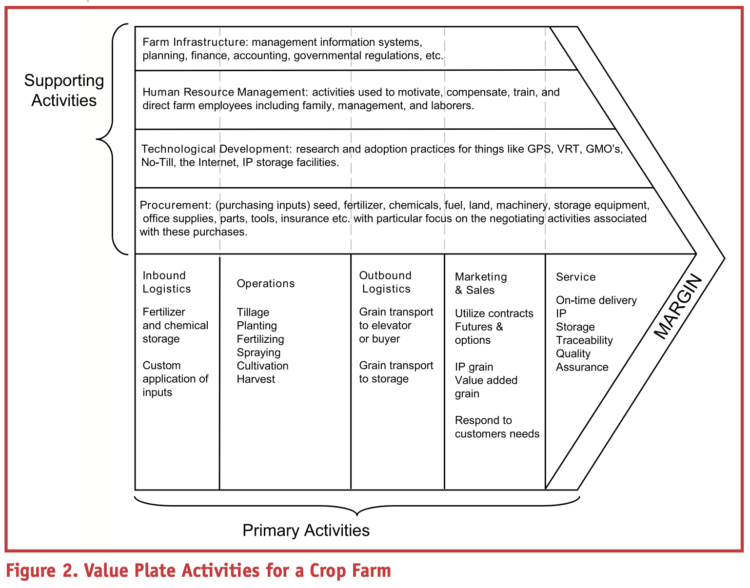

Inbound logistics are concerned with the way in which physical inputs are received and stored. The example crop farm in Figure 2 illustrates some examples of value plate activities. Inbound logistics activities include fertilizer delivery direct from the retailer, on-farm fuel storage, and custom application of inputs. These activities are important to the product or service processes that the farm business is trying to create. Figure 3 provides a unique example of innovative logistics management.

Operations

Operational activities are the physical activities carried out in the production of the product or service. These are the tillage, planting, fertilizing, spraying, harvesting, breeding, and feeding activities we normally think

of as farming. The way in which those operations are conducted and/or sequenced may prove to be the key to the farm’s competitive advantage. Organic crop production is one area where the types and timing of operations can provide a key strategic advantage in the quality of the final product. And even in commodity production, timely planting or harvesting implemented using two or three shifts may be an important source of yield or cost competitive advantage.

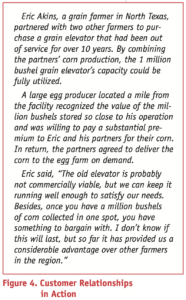

Customer Relationships

The next three primary activities include a set of relationships with customers known as “downstream value activities.” These activities can serve as a source of sustainable competitive advantage when used to create a special relationship with the customer that benefits the customer either through additional value in the product or reduction in the customer’s costs of using the product or service.

Outbound Logistics

Outbound logistics focus on the collection, handling, storage, and delivery of the completed product or service. The farm business may create value in this activity by undertaking activities that assure quality or purity of the finished product, helping customers manage inventories by storing the product until needed, or creating relationships with intermediaries such as wholesalers or retailers to store and deliver the product to the customer on a specified schedule. Figure 4 provides one such example.

Marketing and Sales

Marketing and sales activities build the relationship with the customer by increasing understanding of what the customer values and helping the customer understand the value that the farm creates. These activities can be a key source of competitive advantage for the farm and may consist of, for example, pooling production with others through a cooperative to provide both volume and quality needed by the buyer. Or for specialty products and services, it may be a set of integrated pricing, promotion, and delivery strategies that are unique and customized to each buyer. These activities might also include the set of pricing strategies the farm uses to reduce its risk in the product market.

Service

Service activities are often tightly linked with marketing and sales, and involve providing services the buyer would value along with the product. These services might include product characteristic explanations, product quality assurance, and product warranties. These additional services can, in some cases, be the only thing that differentiates your products from competitors’ products. In agriculture, a competitive advantage might

come from the adoption of a set of documented identity preservation practices that are provided to the customer, assuring them that exact procedures were followed to maintain the quality and safety of the specific product.

Supporting Activities

The top half of the value plate represents supporting activities undertaken so the primary activities can be done. These activities consist of the firm infrastructure, human resource management, technology development, and procurement. Each of these functions is necessary for successfully completing the primary activities depicted in the lower half of Figure 1 and Figure 2. The idea is to identify the support activities conducted by the firm and determine the cost of those activities relative to the value they create either directly or through the product or service that they support. Supporting activities can often be the true source of a competitive advantage, yet they are often ignored when management thinks about its resources and capabilities because much of the performance in these areas is associated with intangible assets.

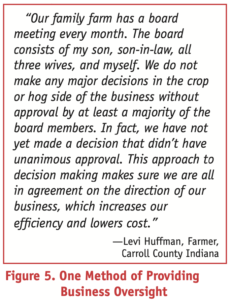

Firm Infrastructure

Firm infrastructure consists of the functions associated with general top management and includes the activities of strategic planning, systems integration, regulatory oversight, and other functions that cut across the farm business as a whole. This function is extremely important in making sure the business stays focused on its goals and objectives, and that activities, core to the success of the firm’s strategy, are carried out in a superior fashion. Figure 5 provides an example of this activity.

Human Resource Management

Human resource activities deal with recruiting, hiring, training, developing, and retaining the business’s employees. This support activity can be critical to the firm’s success, particularly when the primary activities require particular skills or incentive structures to achieve the desired product or service. For example, many farm businesses have grown to a size where herdsmen are employed to provide operations management to the livestock enterprise or maintenance and machine operations managers are employed for the grain enterprise.

Technology Development

Technology development activities are concerned with the way the farm manager develops, evaluates, and uses technology in the production process. For many, this may include investments in research and development, such as on-farm tests to improve production processes or product characteristics. For other farms, probably most farming operations, this activity will focus on the evaluation of technologies developed by others.

Procurement

Procurement activities focus on the processes used for purchasing inputs. This activity may involve bidding processes, Internet purchases, participation in purchasing groups, hiring buyers, negotiating contracts, etc. Ultimately, the firm uses a series of different procurement processes to assure a proper balance between cost and quality in the development of its primary products or services.

Margin

Margin is the desired result of performing the value-creating activities. The basic idea of the value plate is that the customer is willing to pay a certain amount for the value the farm creates. The value the customer is willing to pay is represented by the size of the overall value plate. The size of the individual activity boxes represents the cost of performing those particular activities. Thus, the smaller the size of the individual activity boxes relative to the value the customer is willing to pay, the greater the margin will be for the farm.

When using the value plate as a mechanism for identifying business strengths and weaknesses, it must be compared to competitors’ value plate. Those activities that are strengths for a farm business are those that it can perform in a manner that is superior to competitors’ or those that the competitors simply cannot perform.

Rating a farm’s and/or a competitor’s capacity to execute the primary and support activities of the value plate is challenging. This exercise requires judgment because there is no obviously correct model or rule available to help in the process. In addition, much of the data available for these evaluations is largely anecdotal and sometimes unreliable or difficult to interpret. Nonetheless, the concept of the value plate is a useful way to frame all of the various activities conducted by a farm business. In addition, the value plate forces farm business managers to think about these activities relative to their competition, as well as what value these activities create for customers.

Strategies for Improvement

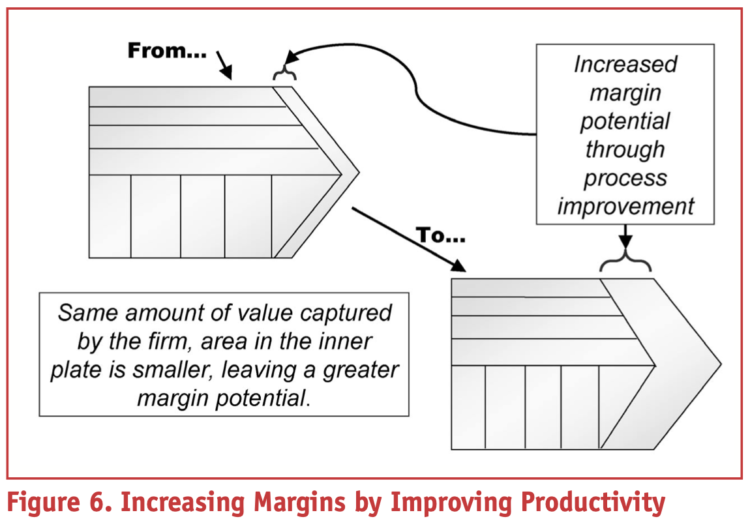

There are two traditional strategies for improving margins: improving productivity and creating more value. Figure 6 illustrates the concept of improving margin potential by improving productivity. The focus in this approach is on reducing the costs associated with performing the value-creating activities while maintaining the same overall value to the customer. The result of the improved productivity is a larger margin area.

Margins can be increased even if additional costs are incurred in some activities as long as benefits are obtained in others. For example, acquiring a more skilled work force may increase human resource costs. But more skilled workers may reduce downtime and managerial oversight and thus the cost of production activities. The size of the human resource box in the value plate would increase, but the size of the inbound logistics, operations, outbound logistics, marketing, and service would decrease. As long as overall cost savings is larger than the increase in the human resources box, the result will be an increase in potential margin.

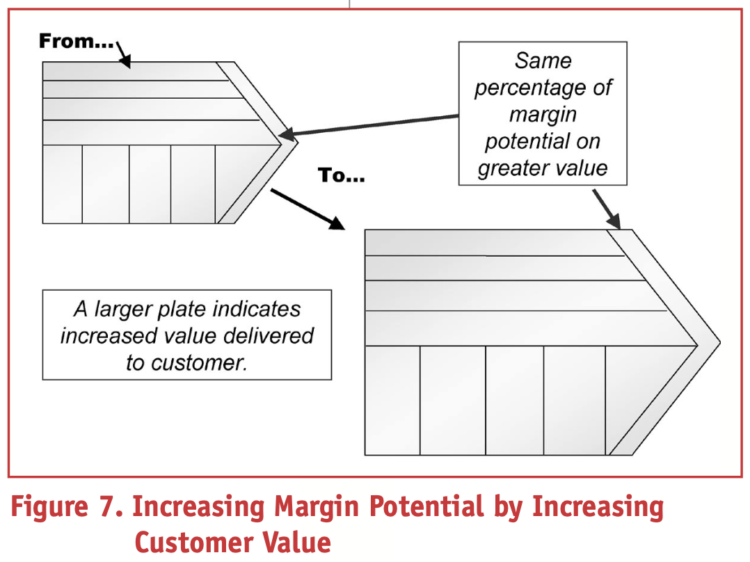

The typical strategy to create value and generate a margin is to accomplish the activities at the lowest cost, to have the lowest fertilizer cost per acre or feed cost per cwt. gain, or to purchase seed and chemical inputs at the best prices. But in some cases, more margin is generated by carrying out activities that actually increase cost, if those activities create additional value for upstream or downstream partners that exceeds the incremental cost of value creation. For example, grain processors may not want to invest in inventory or storage and handling facilities and will compensate the farmer/supplier to do so. Even though the producer is incurring additional costs, he or she is creating more value for the buyer (a bigger value plate), and there is additional margin if the additional value created exceeds the costs.

Figure 7 illustrates the concept of increasing the value delivered to the customer

and the additional margin generated. Here the size of the overall value plate is being increased. Along with the increase in the overall value comes an increase in the cost of performing the activities to create that value. Thus, the margin potential may remain the same as a percentage of the product’s value, but the product is worth more. As long as the increased cost associated with creating more value is less than the additional value created, there will be potential additional margin.

While the first approach to improving margins was concerned with reducing the costs associated with delivering the current value, the focus of this approach is on creating additional value for the customer. This can be a substantially different mindset. This approach requires a keen understanding of customers and what exactly they value. Once the customers’ needs are understood, this approach focuses on delivering that value efficiently, not on making sure costs for individual activities were lower than competitors’ costs.

With increased interest in specialty products, quality attributes, and identity preservation and segregation, opportunities for producers to create more value are increased. However, creating value only allows the potential for an increase in margin. For the in- creased potential to be realized, the farm business manager must find a way to capture the increased margin. In a similar vein, farmers can create additional value for suppliers and have the potential to capture higher margins. One example of this concept is in the land rental market, where a tenant may incur additional costs of weed control and building/fence/land maintenance and repair that is of value to the landlord. In turn, the landlord may offer more favorable rental terms or a longer term rental contract or make investments in drainage or clearing that will benefit the tenant. A similar value- creation activity might occur when a farmer incurs the cost of putting in test plots for a seed company. Often in this situation the farmer is rewarded with a discount on seed purchased from the dealer or with preferred access to the highest yielding varieties.

Final Comment

Gathering data about the activities a farm performs via the value plate is the first step in assessing a competitive advantage. As part of a value plate analysis, a number of internal factors important to the farm business should be clear. The farm business manager can refine these factors by dividing them into strengths and weaknesses. Next, farm business managers will want to evaluate their readiness to use their strengths and weaknesses (i.e., resources, capabilities, and core competencies). To help organize your thoughts about your business, two worksheets are provided: “Farm Value Plate Analysis” and “Assessing Strengths and Weaknesses.” Suggested procedures for using these worksheets are presented below.

DOWNLOAD THE WHOLE PUBLICATION, WITH WORKSHEETS!

This publication is part of a series on applying strategic thinking to your farm. Each publication has a unique focus, enabling you to select those topics of greatest interest to you. Other publications help build a guiding vision for your farm business (EC-720), identify the important industry trends (EC-717), and assess how well your business can respond to opportunities and threats (EC-716).

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.