January 31, 2013

Strategies for Success in Turbulent Times: Ten Strategic Initiatives

Farm businesses are facing increasing complexity and uncertainty in today’s turbulent business climate. Farms continue to be family based businesses and are modest size compared too much of the industrial sector, but an increasing number of farms are becoming multi-million dollar gross sales businesses with a sizeable work-force and rapidly increasing financial capital and land resources. Managing this rapidly growing business in a business climate increasingly being shaped by global economic forces requires more skilled managers. What are the critical management strategies that will be required to be successful in this incr3easingly complex farming business – what is required to build a championship farming business? Ten strategies are identified here.

Choose a Strategic Direction (Commodity vs. Differentiated Production)

The agriculture of the past has been primarily a commodity business, and consequently the key to long-term success in farming has been to be a low-cost producer. Although in the short-run prices may be sufficiently above cost to generate handsome above normal profits, over time a number of producers expand their operations sufficiently that supplies increase and prices decline, thus reducing profit margins. As producers increase their efficiency through better management and adoption of technology, cost declines and margins increase, but over time adoption of the cost saving technologies by more producers again results in increased production and margin pressures. So in the long-run the only way to compete successfully in the farming business dominated by commodity production is to be a low-cost producer. Some producers are low cost because they do not consider all costs in their decision making.

Some producers have been willing to use their equity capital and even their labor in agricultural production and not require market compensation of those contributed resources. Given the significance of capital and labor in the production of most agricultural products, if these resources are assumed to be free or costed at low compensation rates, costs of production are substantially reduced. Consequently, those farmers that are willing to give their time and money away or require low rates of return on their money and low wages for their labor will continue to produce even though prices may not cover cost computed at market rates of return. This puts additional margin pressure on those producers who want market rates of compensation for their resources. Commodity industries where a large proportion of the producers are willing to use their resources to produce, even though they are not fully compensated to do so, will continually suffer from very low or negative margins until those producers exit the industry.

But the basis and dimensions of competition in agriculture are changing. As agriculture is transformed from a commodity to a differentiated product business, competition becomes multi-dimensional – it is not just being cost competitive that will lead to financial success. Differentiated products typically have a broader spectrum of quality features than commodities, and those quality dimensions or features often improve over time. In most non-food products consumers’ purchase, quality standards have continuously improved over time, and thus consumers are expecting food products to exhibit similar continuous quality improvement. Furthermore, product differentiation is not a permanent phenomenon. Differentiating attributes become commoditized over time so the successful farmer must constantly evaluate new opportunities for differentiation and be an early adopter or first mover in these new differentiated products before the premiums or margins are pressured by increased numbers of producers who enter the market. Consequently, in differentiated product markets producers not only compete with respect to cost; they also compete with respect to quality attributes of their products and with respect to the speed or response time to introduce new products as consumer demand and market conditions change. And speed of entering new value added or differentiated product markets may be critical not only to obtain the best premiums, but also because those who attempt to enter the market later might find that it is adequately supplied. Contracts and other business arrangements to produce the differentiated product may have already been negotiated and consequently new production and producers are not needed.

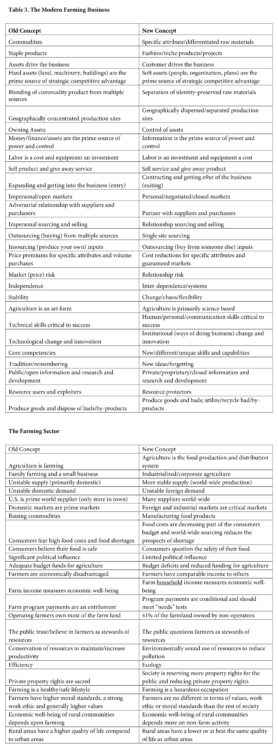

The skills and capabilities to be successful in differentiated product production are very different than in commodity product as summarized in Table 1. This new agriculture profoundly changes the competitive environment in farming. In the commodity agriculture of the past, farmers had to compete only in terms of cost. If you were a low-cost producer and did not expand beyond the sustainable growth rate of the business, you could expect to be a successful producer – to survive and maybe even thrive in the long-run. In the new agriculture that includes differentiated products and more tightly aligned marketing/distribution systems with producers being raw material suppliers for manufacturers and food processors, competition includes quality features and responsiveness or time to market as well as cost. In the agriculture of the future farmers will need to be better, faster, and cheaper to have a sustainable competitive advantage.

Capture the Potential of Uncertainty

The types and sources of risks and uncertainties faced by agribusiness decision makers have exploded in recent times – “unanticipated surprises” resulting from changes in government policy and regulation; mergers and acquisitions that change the competitive landscape and disease and food safety crises such as H1N1, BSE and salmonella contamination, for example. These new uncertainties are more complex and difficult to analyze and manage than traditional business risks — they are not as predictable in frequency and consequence, and they often create opportunities for gain as well as exposures to financial losses.

Firms must be proactive in managing uncertainty to create long-term value because uncertainty has upside potential as well as a downside exposure. Focusing only on uncertainty avoidance as is typically the case in analyzing risk could cause a firm to overlook opportunities to create value. Table 2 summarizes the key strategic uncertainties faced by agribusiness firm and various potentials and exposures for each.

Capturing the potential or opportunities from a strategic uncertainty and simultaneously mitigating the exposures is not easily accomplished. Raynor argues that for companies to succeed in an unpredictable future, they must develop practical strategies based on multiple choices that respond to the requirements of different possible futures rather than on a single strategic commitment. He suggests that the key to such decisions is strategic flexibility.

Real options concepts are useful in structuring a decision to manage downside risk while maintaining the possibility to capture upside potential. In essence, a real option is like a financial option – investing a modest amount today to take a position in the future. When the future arrives, the option can be exercised or allowed to expire. This approach is regularly used in making business decisions where option payments are made to maintain the right to acquire a particular parcel of real property in the future, minority investments are made in startup companies with an agreement to have the first right to buy a majority interest in some future time period, or pilot plants are constructed to test an idea before a full scale manufacturing facility is built.

An options approach explicitly considers the benefits additional information will have on the value of a decision or investment. A real options framework is appropriate for situations where the manager can make incremental decisions throughout time, thus creating flexibility in the decision. Such options might include deferring, abandoning, or expanding a given project. Thus, real options are a learning model that allows management to make informed and accurate decisions over the course of time.

Manage/Mitigate Risk

Farming has always been a risky business with the returns to reward that risk available for only brief periods of time. The risk in agriculture today, particularly in crop production, is greater than it has been in the past, but there is opportunity to be rewarded for taking that risk. The risk for a farming operation comes from two sources – operations and financing. Operational risk results from price, cost and yield fluctuations, whereas financial risk is created by the fixed nature of interest obligations on the debt funds used to finance the business. Each of these sources of risk will be discussed in turn.

As to operating risk, price volatility has increased dramatically in recent years as reflected in daily price movements in the futures markets, the range in monthly cash bid prices, or any other metric one would choose. Some would argue that price fluctuations are more than double what they were 5-10 years ago. Yield variability depends largely on weather conditions – erratic and intense rain-fall patterns in the Spring and Fall of the last two years have resulted in significant variability and yields across counties, and even within the same field for many farmers compared to the past. And adding to price and yield variability has been cost variability. The fluctuations in fertilizer, chemical and energy costs have been the most dramatic — seed, equipment and land cost have not fluctuated as much, but have been in a general upward trend. The resulting volatility in operating margins (price minus cost) has been even more dramatic than that of prices, costs or yields. In general, volatility in operating margins has more than doubled, and some have argued that they have increased by as much as 3 to 4 times compared to the past. There is no doubt that the operating risk in grain farming has increased dramatically in recent times.

What about the financial risk? A combination of reduced debt utilization for many farm businesses and historically low interest rates has resulted in much lower financial risk for farming operations than in the past. So even though operating risk has increased, the total risk from operations and financing faced by farm businesses has not been magnified or compounded by high debt loads and interest rates, as for example occurred during the 1980s. But one should be cautious. Interest rates currently are seductively low, and some farmers have a significant proportion of their debt on variable rate terms. Thus when interest rates rise, their cost of funds and financial risk will increase as well. And some farmers have been aggressive in expanding their businesses in the past decade or so using historically low cost debt funds, so industry average debt loads may understate the leverage position of those who have grown their farming business much more rapidly in recent years.

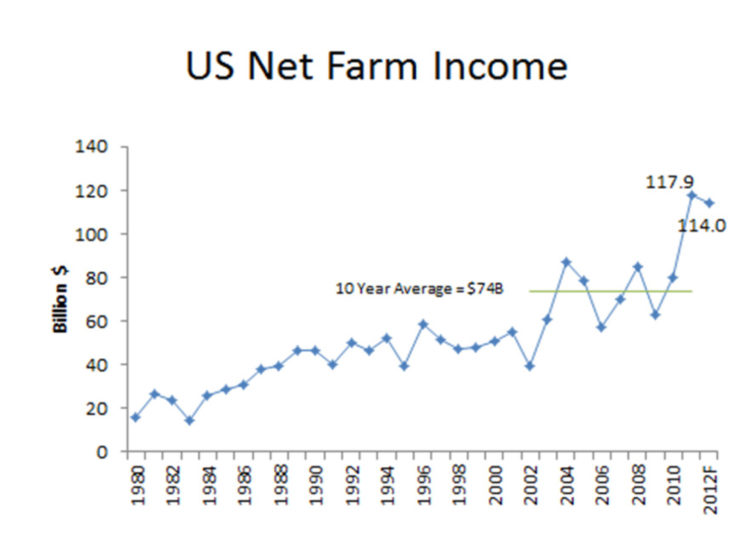

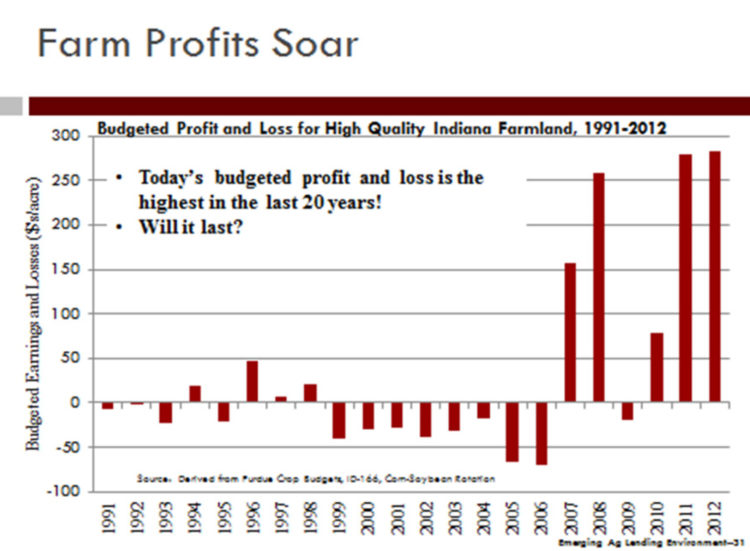

The “bottom line” is clear however – even for those farmers who have not used leverage and debt capital extensively, the total operating and financial risk has increased in recent years. But what about the returns — have farmers been rewarded for these increased risks by the potential of higher returns. The evidence favors the answer of “yes” to this question. At the aggregate level, net farm income is more volatile than in the past as illustrated in Figure 1, but the average for the past 8-10 years appears to be higher than in the previous decades. Margins per acre in recent times appear to also exhibit more volatility but higher levels in general as reflected in Figure 2. So there is at least some evidence that rewards in the form of higher potential returns are available to compensate for the additional risk in the farming sector. But the volatility in these returns or margins as illustrated in Figures 1 and 2 present an important implication — these higher returns are clearly not guaranteed and it is critical to implement strategies to capture higher returns when they are available, because those higher returns are fleeting.

Operational risks are relatively easy to manage compared to strategic risk, in part because information is generally available to measure these risks, and because of the availability of accepted tools and techniques to transfer the risk to others, such as insurance and futures markets. But most strategic risks cannot be managed or transferred through conventional means. Strategic risk is multidimensional, so managers cannot assume the simple one-to-one mapping between exposures and risk managing instruments. Creative strategies must be developed to manage strategic risk. In the past enterprise diversification, vertically integrating to better manage inputs or outputs, flexibility and/or adaptability, and maintaining a certain level of liquidity have been strategies for mitigating strategic risk.

Manage Slack/Flexibility

With the tighter margins earlier this decade, most farming businesses focused on being “lean and mean” – making sure that costs are working out of the system, efficiencies are maximized and all resources are fully employed. But the catch-22 of lean and mean is that the capacity to take advantage of opportunities that might arise is not there. As noted earlier, in periods of increased uncertainty, opportunities can surface quickly and being prepared is essential. This preparation might include maintaining some “slack” capacity – not necessarily in the form of physical resources such as extra machinery or livestock or storage facility space, but in financial resources and management capacity. Holding some cash reserves or a stronger liquidity or working capital position not only is a good buffer against the downside of uncertainty, but also provides some financial resources to capture the upside of opportunities arise. Having a conversation with your lender about how much additional borrowing capacity your business might have and the circumstances that might trigger access to that capacity is part of that preparation. And take a look at your management team – do you have the additional capacity and “deep bench” to capture new opportunities.

Expansion opportunities, such as building new facilities, starting new ventures or buying other businesses, require extra managerial time and energy, as well as access to additional capital and financial reserves. It takes time and resources to get through the due diligence, setup and implementation stages before the new project becomes profitable. With most projects there is a shortage of capital and managerial expertise, particularly during the start-up phase.

An additional skill or competency during turbulent times that is critical is the capability to choose what not to do. Some of the activities or enterprises that have been part of the business for decades may no longer be profitable or can be obtained elsewhere at a lower cost. And for most successful farmers, the opportunities that can be pursued are more numerous than the resources and capability to do so. So a constant review of what we should quit doing, as well as what initiatives fit the strategic direction as well as financial performance goals of the business is critical to long-term success. The mantra should be to be flexible in strategic direction, but focused in implementation and operations.

Manage Capital Cost and Structure

Capital costs have been abnormally low in recent years, and eventually they will go up. Five actions should be considered to manage capital cost and structure.

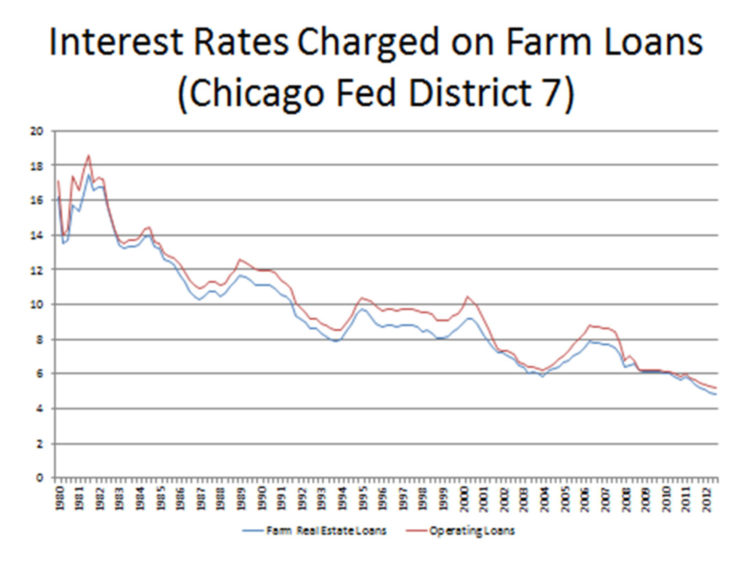

- Fix interest rates — Interest rates have been in a long downward trend during the past 20 years as suggested in Figure 3, and they are at uniquely low rates at the current time. Financial futures markets suggest that interest rates will increase over the long term as reflected in Figure 3. Interest rates are unlikely to decline much further — they are instead more likely to go up — the uncertainty is how fast and how far. In fact, the yield curve which reflects the rate of interest for different maturities of financial instruments is currently relatively flat between maturities of one to five years, and then rises sharply as maturities increase from 5 to 10 years. With only about a 1.5% (150 basis points) spread between short-term variable rates and 5 year fixed rate loans today, it would appear to be a good time to lock in 5 year rates unless one believes that the market expectations of higher rates as reflected in Figure 3 are in fact incorrect.

- Deleverage (pay down debt — The current yield curve combined with futures markets indications of future interest rates suggests that after 5 years, interest rates will be much higher than they are today. For those firms that have grown aggressively and have used increasingly lower cost debt to finance that aggressive growth, the prospects of higher interest costs suggest less aggressive use of debt capital in the future. Consequently, more highly leveraged firms should consider de-leveraging their position over the next few years. From the perspective of managing the short and long-term financial risk of the farm business, this is a very unique time. The current yield curve allows farmers to lock in relatively low interest rates for the next five years. Current prices for commodities allow farmers to lock in high margins for at least the next year or two. And these high margins can be used to pay down debt so that if margins are lower and financing cost higher in future years as is highly likely, the financial risk to the business is reduced substantially.

- Hold financial reserves — In periods of high margin volatility, the first line of defense against financial stress is financial reserves — more working capital, higher cash or liquidity positions and reduced current debt obligations so that there is more financial cushion to buffer against the potential for financial reversals resulting from higher cost, lower prices, lower yields or higher interest rates.

- Conservative buying/bidding — The current high margins encourage aggressive buying and bidding behavior. Producers should be cautious in their bidding for farmland purchases and cash rents in particular. As indicated earlier, history suggests that margins in the future are more likely to be lower than higher, and one must be careful to not suffer the” bidders remorse” or “winners course” from over-bidding the land purchase or land rental market.

- Slow growth/fund with equity — Capital costs is expected to be higher in the future, suggesting that growth will come at a higher cost. Consequently, farmers who have been encouraged to grow relatively rapidly because of low and declining cost of capital in the past may want to alter their growth strategy. Growth in the future with higher capital cost should likely be slower than in the past, be focused on acquiring assets more through rental arrangements and less through ownership, and should be funded with less debt and more equity.

Adopt New Technology

Three types of technology are critical for the championship farm: 1) monitoring/measuring and information technology, 2) biotechnology and nutritional technology, and 3) process control technology.

Monitoring/measuring and information technology – The focus of this technology is to trace the development and/or deterioration of attributes in the animal and plant growth process, and to measure the impact of controllable and uncontrollable variables that are impacting that growth process. In crop production, yield monitors, global positioning systems (GPS), global information systems (GIS), satellite or aerial photography and imagery, weather monitoring and measuring systems, and plant and soil sensing systems are part of this technology. In animal production, systems to monitor humidity, temperature, air quality and other characteristics of the feedlot or building environment along with systems to monitor feed formulations, water characteristics, and animal waste and feed ingredient composition are included. In future years, in-animal sensors to detect growth rates and disease characteristics may be part of such information and monitoring/measuring systems. And these systems will be tied to growth models to detect ways to improve growth performance, as well as to financial and physical performance accounting systems to monitor overall performance.

Biotechnology and nutritional technology – The focus of biotechnology and nutritional technology is to manipulate the attribute development and deterioration process in plant and animal production. An improved scientific base to understand how nutrition impacts not only growth but attribute development is providing additional capacity to manipulate and control that process. And biotechnology is advancing our capacity to control and manipulate animal and plant growth and development including attribute composition through genetic manipulation. By combining nutritional and biotechnology concepts with mechanical and other technologies to control the growth environment (temperature, humidity and moisture, pest and disease infestation, etc.), the process control approach and thinking that is part of the assembly line used in mechanical manufacturing becomes a reality in biological manufacturing.

Process control technology – The concept of process control technology is to intervene with the proper adjustments or controls that will slow the gap any time actual performance of a process deviates from potential performance. For example, servo mechanisms in a hog building automatically turn on the ventilation system, the coolers or a heating system if the temperature deviates from what is desired for optimal animal growth. Greenhouse production increasingly utilizes such technology to manipulate sunlight, humidity, temperature, and other characteristics of the plant growth environment. Irrigation systems are an example of this technology with respect to field crop production; modern irrigation systems tied to weather stations and plant and soil sensors automatically turn irrigation systems on when moisture levels are adequate for optimum growth. Boom control and variable rate chemical and seed application technology are additional examples of process control applications.

The integration of these three types of technology increases the precision of agricultural production and at the same time reduces the managerial complexity of managerial decision making. Information systems and automation reduce the need for human intervention to monitor performance and make appropriate adjustments, and biotechnology such as Round-Up-Ready and triple stock corn and bean genetics has simplified weed and insect control decisions.

Improve Operations/Efficiency

With increased understanding and ability to control the biological production process, routinization becomes increasingly possible. Tasks become more programmable. Routinization generally fosters more efficient use of both facilities and personnel as well as less managerial oversight and overhead. Hourly work schedules that identify specific tasks to be done at specific times on specific days are but one example. Precision crop farming is another example. In essence, agricultural production is becoming more a science and less an art. Systemization and routinization fosters precision production which uses science and technology to “real time monitor” the production processes and exercise control over those processes through biotechnology and nutritional technology. Farmers are adopting technology and management practices (Standard Operating Procedures or SOPs) to standardize, routinize, and generally manipulate and control the biological processes of crop and livestock production. These procedures accommodate the increased expectations from end-users for conformance quality and quantity assurance.

A further implication of the manufacturing paradigm in agricultural production is increased emphasis on facility utilization, flow scheduling, and process control. In the past, variability associated with the delays in adjustment of output to current and expected prices and inherent lags in the biological production processes have mad facility use and scheduling and process control difficult if not impossible. Many production units have in essence maintained excess plant capacity (for example, excess planting or harvesting capacity) as one means of accommodating the uncertainty of the output of the biological production process. Undoubtedly, rainfed crops will still be subject to weather variability, but increased knowledge of biological production should facilitate prediction as well as control of production processes. With increased ability to predict and control the biological production process, facility use can be more accurately scheduled, and process control concepts to improve efficiency and reduce cost are more applicable and useful than in the past.

Farmers can also use new business models and management strategies to more fully utilize their machinery and equipment. One of those strategies is multi-site production. Growers are increasingly producing in more than one locale, and in many cases are choosing those locales based on both weather patterns and transportation/logistics capacity and systems. They then move equipment from site to site, in essence allowing them to not just increase the utilization and lower the cost of machinery operations, but to again relax the timeliness constraint on size of operation without investing in additional machinery or equipment. Another newer business model for many growers is the use of operating leases or machinery sharing to cost effectively acquire additional machinery services. Precision farming combined with creative ways to schedule and sequence machinery use including 24 hour-per-day operations, moving equipment among sites and deployment based on weather patterns has the potential to increase machinery utilization and lower per acre machinery and equipment costs as well.

Finally improved efficiency can also occur through an emphasis on recycling, capturing value from all products (and by-products) produced and closed loop sustainable systems. Livestock producers have redefined manure as a waste product to be disposed of at the lowest cost into a plant nutrient product that needs to be efficiently transported and applied to cropland to create the most value. And the biorefinery revolution is taking this recycling and closed loop production system concept a step further. Closed loop systems, or ‘integrated biorefineries,’ convert manure from cattle into methane to power an ethanol plant, and distillers grains leftover from the ethanol-making process into cattle feed. While the cattle or dairy cows create beef and milk, the ethanol plant creates fuel at a much lower cost thanks to the ‘recycled’ power source (cow manure); if a plant doesn’t need all the energy from its digester, it can sell to the local power grid creating yet another profit stream. Closed loop technology allows livestock farmers to feed many more animals because they will no longer be limited by the among of land they have in proportion to the amount of manure they must disperse. Clearly these concepts are essential to organic production which is increasingly moving from small scale to large scale farms where the fixed costs of complying with the rules and regulations of organic certification can be spread over more output. They will be increasingly critical for all farmers as “sustainability” requirements and life cycle concepts become more mainstream in agriculture.

Besides the benefits of lower costs and increased revenue streams, self-sustaining systems typically use less fossil fuels, reduce environmental concerns from manure loss, and help large-scale operations expand within pollution restrictions. Increasingly the mindset of the modern farmer is to move from a disposal mentality to create and capture value mentality.

Partner With Buyers and Suppliers

The traditional approach to agricultural production has been that of an independent producer who purchases inputs and sells products through various market mechanisms to other independent businessmen. And this business was financed with the producer’s equity and only limited amounts of debt.

Increasingly, producers are joining or partnering with other resource suppliers in various ways to expand volume with limited capital outlays. This is occurring through the growing use of contracting for machinery services in crop production or buildings in livestock production, leasing of land, and custom farming. In essence, the grower is leveraging volume by investing his funds in only part of the total fixed assets needed to produce the crop or livestock product while maintaining a high degree of control of the other phases through the ownership of the product and the specification of the growing conditions. The critical dimension of such partnering or alliances is that more resources and services are obtained from others if that is a less expensive technique for acquiring production inputs, and more linkages along the chain to the food or industrial product end-user are used to capture value in additional stages of that chain. Creative financing arrangements that combine equity from investors and “permanent” as well as traditional amortized debt with the farmers/entrepreneur’s equity investment in an “optimal capital structure” are increasingly common.

With the increasing use of rental arrangements to acquire control of farmland, “partnering” with land owners to not only farm the land but even to jointly invest in improvements such as drainage and conservation practices are increasingly common. And partnering or collaboration with input suppliers as “preferred” customers beyond the typical cooperative structure will be increasingly important to access the newest technology at competitive prices and obtain the best service.

The relationship between producers and processors is also changing from one of a market seller to a qualified supplier. What will processors expect of qualified suppliers? First, they expect them to be cost competitive in producing raw materials. Although processors in the future may source their raw materials from producers through contracts or other longer-term agreements rather than single transactions, they will still expect to buy those raw materials at the lowest cost possible.

The second requirement is consistent quality. Increasing quality expectations of end-users requires processors to source raw materials with more consistent quality characteristics. Producers may be rewarded for quality through premiums (or discounts on those raw materials that don’t meet quality standards), or alternatively product that doesn’t satisfy quality expectations may simply not be accepted by the processor.

A third requirement of a qualified supplier is that of reliability. Processors will increasingly schedule suppliers to deliver a specific quantity of raw materials at a particular time, and expect that supplier to do so. This reliability expectation will again impose more structure and tighter alignment in the supplier/processor arrangement.

A fourth expectation of the processor from a qualified supplier will be that of flexibility and adaptability. At the same time that the processor wants reliability, he or she will also want to have suppliers that can make adjustments in delivery schedules if needed, or over time change their production system to adapt to different end-user requirements. This balance (or maybe conflict) between reliability and adaptability, and the rewards processors provide the supplier for maintaining that balance, is one of the critical conflicts faced by a qualified supplier.

But being a qualified supplier is not a one-way street. What should a qualified supplier expect from his or her processor? First, a qualified supplier should expect equitable compensation for product and services provided, and equally if not more important, equitable sharing of the risk. In many fixed price contracts used in agriculture today, the risk between the producer/supplier and processor is not equitably shared; some form of revenue or profit-sharing based on resources contributed may be a more equitable risk and reward sharing arrangement then fixed price contracting.

A second requirement a qualified supplier should expect of the processor is market presence. With increased competition in the agricultural markets, a processor who does not have significant size or market presence may not be viable even in the short to intermediate run. Becoming a qualified supplier to such a processor may be committing to a company that may not be a long-term player in the market.

A third requirement or expectation of the qualified suppler should have of the processor is dependability – the processor will take delivery of the specified product and compensate the supplier according to the agreement. And this dependability extends beyond a single transaction – the processor must be consistently committed and able to fulfill his or her commitment under the qualified supplier agreement.

Finally, a qualified supplier should expect the processor to provide him or her access to innovative products and services, and to consistently develop new markets. As competition results in substitute products and margin compression over time, the benefits of being a qualified supplier for a processor who does not innovate will be constantly challenged or undercut by competitive forces. So the producer must be willing to adapt to changing market conditions, and should expect his or her processor to not only have the market presence to anticipate these changing conditions, but to assist their affiliated qualified suppliers in adapting to these new markets.

Grow the Business

Growth is a natural phenomenon of success in managing a business the logic of this assertion starts with the concept of economies of size. Few debate the fundamental shape of the cost curve – smaller firms generally have higher per unit cost of production/distribution than larger firms. The real issue however is not whether costs per unit of output decline as output increases, but whether at some size or scale, do costs per unit begin to rise. The key question is whether the classic academic U shaped cost curve characterizes agricultural businesses, or whether the cost per unit of output remains relatively constant as size increases after the initial decline from smaller scale to minimum efficient size firms and plants. The detailed empirical evidence is available elsewhere, but in essence, studies of the cost structure for agricultural businesses as well as most other industries indicate that the cost curve driven by production and technical efficiency is relatively flat after the minimum efficient size is achieved, and that successful managers are generally available over time to continue to constrain any cost per unit increases as the firm expands or grows.

One of the fundamental reasons why costs continue to decline as output increases is because of the experience curve. The basic premise of the experience curve is that as a firm accumulates more knowledge and expertise over time, the work force learns how to become more efficient and effective, and consequently productivity (output per unit of input) increases – thus resulting in lower cost per unit of output. Studies in a number of industries suggest that the cost reductions associated with the experience curve can be as much as 20% with each doubling of accumulated output. Consequently, as a firm grows over time efficiency increases and costs decline even after all economies of size have been exploited because of the cost reductions associated with the experience or learning curve.

Augmenting the technical efficiency/productivity benefits of size economies and the experience curve are the advantages a growing larger scale business has in its supplier and buyer relationships compared to a smaller scale business. Economists call these phenomena pecuniary economies of size. Larger businesses can typically negotiate better prices or more attractive terms from input suppliers, and thus have better and lower cost access to production inputs including capital and other raw materials. They also typically have more advantageous access to product markets and thus can obtain higher prices and better terms for the output they produce. The classic economic arguments therefore are that larger scale and growing businesses generally have lower costs, higher prices and better operating profit margins than smaller scale operations.

But this is not the end of the story. The larger operating profit margins per unit of output for larger size businesses when combined with the higher output results in more total income and profit for larger compared to smaller businesses as one would expect. The use of this income is equally if not more important in understanding the growth of successful businesses than the efficiency/productivity arguments presented thus far. Particularly for small and modes size family owned businesses, the salaries/withdrawals/payouts to the business owners/managers typically account for a higher percentage of the firm’s annual earnings compared to larger scale/size businesses. In essence, larger businesses have lower “payout” percentages, and this lower cash drain on earnings combined with the typically higher earnings results in substantially more retained earnings for larger scale businesses compared to those of smaller size/scale. A larger absolute amount of retained earnings means that larger scale businesses can acquire more resources and increase their output more rapidly than a smaller scale business that may need to use most of its earnings to support the withdrawals or payouts to the entrepreneur and management team. Even if the larger scale operation does not have any higher profit margins per unit of output, if the size of the business is sufficient that the payout percentage is lower than that of the small business, the larger business has more potential to grow faster because of the more rapid accumulation of retained earnings. In this context, growth is a “natural” result of business success, and larger businesses have more “natural” growth potential because of their typically higher savings or retention rate compared to smaller businesses. In essence, larger scale businesses have a higher sustainable growth rate, resulting in the big getting bigger.

We have yet to introduce issues of debt financing and risk management into the discussion. The key questions are whether small or large firms have a relative comparative advantage in either accessing debt or managing risk that would mitigate the efficiency and financial advantages of larger scale units discussed thus far. As to debt utilization, firms that accumulate retained earnings more rapidly are typically better positioned to obtain more debt as well (strictly in absolute terms) – a larger portion of the business earnings are available to service that debt. So larger scale businesses typically have both more debt and equity resources available to expand operations compared to smaller scale businesses, and thus have a faster rate of growth.

As to risk management, larger scale businesses typically have the resources to acquire the capabilities and the instruments to manage operating risk at a lower cost per unit of output compared to their smaller scale counterparts. More effective management of operating risk enables those firms to safely use more debt in both absolute and relative terms compared to smaller scale businesses. The combination of more income available for debt servicing combined with a more predictable/less variable operating income because of better risk management means that larger scale units can be more highly leveraged. This additional access to credit augments further the ability of the larger scale operations to acquire more resources, produce more output and grow at a faster pace compared to smaller scale businesses.

Much of the expansion of agriculture in the past can be described as that of incremental expansions – producers would add an additional 40 acres to their 240 base acreage for example. But increasingly expansion is of the large-scale new venture variety. These new venture projects require substantial capital investments (often in excess of a million dollars) and frequently require significant labor and managerial resources as well to be successful. This new venture approach to production agriculture is a dramatic change in the way of doing business compared to the incremental expansions of the past.

Furthermore, more and more of today’s expanding farmers are adopting the common business strategy of mergers and acquisitions compared to buying assets as in the past. Thus, farmers are buying businesses or acquiring the package of assets (including leased land) rather than purchasing individual parcels of land or pieces of equipment. And in fact, an increasingly common growth strategy for some growers is to approach a current operator with say 1000 to 1500 acres of farmland, who is near retirement, offer to buy the “farm business,” and retain the current operator and his/her machinery to operate the equipment on that acreage. In essence, the acquiring farmer obtains control of not only the owned but also the rented acreage of the current operator, and also increases his capacity to farm this additional acreage by outsourcing some of the machine and other operations to a skilled grower who likely is uniquely qualified to farm that particular acreage. This strategy of acquiring businesses rather than acquiring assets usually involves obtaining control over a larger asset base, and thus accelerates the rate of growth and consolidation of large scale operations.

Become a CEO (Chief Executive Officer)

Most successful farmers might be best described as hands-on, walk-around managers. Their success comes in large part because of their intimate involvement in the operations of the business. They know the production technology, the farrowing schedule, the field operations, the machinery operational performance and maintenance issues – in essence the daily functioning and operations of the plant better than most foreman in an industrial plant setting. But as farm businesses expand, it becomes increasing difficult for the farm manager to have this level of intimate knowledge about his plant. He no longer runs the combine – an employee does that. He doesn’t do all the machinery maintenance; he doesn’t run the feed mill or the feed truck to fee the cattle; he doesn’t scout the fields for insects or weeds. Increasingly, agriculture is looking a lot like other industries where employees do most of the physical work, herdsmen manage daily operations and are equivalent to the foreman of an industrial plant in terms of responsibility, and the “farmer” – to be successful in this increasingly complex agricultural industry – must function as a general manager.

To be successful in the 20th century the farmer/grower was required to be a good plant manager. If they were able to control cost, increase efficiency and productivity, be timely in operations, and generally operate the farm – the plant – effectively and efficiently, they could be successful. And success was measured primarily by being a low cost producer with high yields and productivity.

But production agriculture is going through a major structural realignment. The changes that are part of this realignment can be characterized as: 1) adoption of manufacturing processes in production as well as processing, 2) a systems or food supply chain approach to production and distribution, 3) negotiated coordination replacing market coordination of the system, 4) a more important role for information, knowledge and other soft assets (in contrast to hard assets of machinery, equipment, facilities) in reducing cost and increasing responsiveness, and 5) increasing consolidation at all levels raising issues of market power and control. In general we are observing the application of modern industrial manufacturing, production, procurement, distribution, and coordination concepts to the food and industrial production supply chain. These changes suggest a new management paradigm will be important to be successful in the future.

The successful farm managers of the 21st century must not just be outstanding plant managers, they must also be successful general managers. General managers are concerned about managing people or personnel; managing money and resources; and negotiating and managing relationships with buyers and sellers, landlords and lenders, and investors and alliance partners. They know how to effectively use not only the skills of plant managers and other personnel within the business, but consultants and advisors from outside the business. General managers worry not only about cost, efficiency and productivity – but about labor productivity, capital turnover ratios, profit margins, return on assets, and return on equity. General managers think strategically – they think about the long-term future of their business.

The “New” Agriculture

During the last two decades, dramatic changes have occurred in the agricultural sector: changes in technology, in the economic climate, in institutional structure, and ways of doing business. This “new” agriculture requires a significant change and new concepts to successfully manage the farm firm. Table 1 attempts to capture the essence of these changes.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Margaret Lippsmeyer, Michael Langemeier, James Mintert, and Nathan Thompson segment U.S. farms by farm resilience, management practices, and producer sentiment. This paper was presented at the Southern Agricultural Economics Meeting in Atlanta, Georgia in February.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.