March 8, 2014

Purchasing and Leasing Farm Equipment

Purchase Plans

Most farm equipment is still acquired through some type of purchase arrangement. The farmer obtains title to the machine and adds it to the farm depreciation schedule. The purchase can be financed in several ways.

The simplest type of transaction is an outright purchase. The operator and dealer negotiate an acceptable price for the machine and the operator pays cash. There may also be an allowance for a trade-in item, which represents another area of negotiation. In many cases at least part of the cash paid is supplied by a third party lender, who will usually require that the machine that is purchased be pledged as loan collateral.

Most equipment dealers also offer “in-house” financing arrangements. Capital is made available through a financing company that is directly affiliated with the manufacturer. Interest rates and terms may be quite competitive with those of commercial lenders, especially for models that are in excess supply. Such attractions as below market interest rates and no interest expense accruing for a period of time are common. However, use of a dealer financing plan may also require the payment of a loan origination fee or other fees that effectively raise the true cost of financing.

Some farmers utilize a rollover purchase plan to acquire new or nearly new equipment each year. They agree to purchase a piece of equipment from a dealer with the expectation of trading it in after using it for one year or season for another, newer unit. Under this arrangement a farmer pays the difference between the price of the new model and the trade-in allowance for the old one. In some cases the trade-in value is based on the original price minus a fixed rate for each hour the machine was used.

The farmer is not obligated to trade each year, though, and can decide at any time to keep the current piece of equipment and stop the rollover arrangement. Advantages to the operator include having the latest technology each year and always having a machine under warranty, which eliminates most repair costs. The dealer can be certain of selling a new unit each year and having a late model used unit to resell, as well.

While rollover agreements are usually used to purchase new units, some operators use them to acquire one-year or two-year old machines that have been traded in. In some cases, three or four operators may own the same machine in as many years!

Rental Agreements

A rental agreement is distinguished from a lease by the duration of the control period. Leases typically permit the farmer to control the equipment for one or more years, while rental agreements typically last for less than one year.

Under a typical rental agreement, the farmer agrees to pay a specified rate for every hour registered on the hour meter of the machine. Frequently, payment for a minimum number of hours is also required. The beginning and ending dates of the rental period restrict the total use of the machine. Rental agreements are especially useful for machines that will be used only for a short period of time. Examples of machines that are commonly rented include skid loaders, grain drills, combines and large tractors.

Lease Agreements

For long-term control of equipment, leasing is also a popular choice. Leasing plans offer a large degree of flexibility for payment terms. Farm machinery dealers, manufacturers, Farm Credit Services and independent finance companies all offer lease opportunities. Both company financing and leasing terms change over time, according to the desire of the company to move more equipment. For this reason it is imperative that farmers evaluate each decision carefully. The fact that one option was the most favorable last year does not mean it will be so this year or next year.

Two general types of lease plans are available, and are distinguishable mostly by how they are treated for income tax purposes. A true (or operating) lease calls for a series of regular payments, usually annual or semi-annual, for a period of years. At the end of the lease period the operator can choose to purchase the machine at a price close to fair market value or to extend the lease. If the farmer no longer wants the machine, it can be returned to the dealer or the leasing company that owns it. The lease payments are reported as ordinary expenses on the tax return, and are fully deductible. If the purchase option is exercised, the machine is then placed on the farm’s depreciation schedule, with a beginning tax basis equal to the purchase price.

A finance (or capital) lease has a similar payment schedule to a true lease, but is treated as a conditional sales contract by the Internal Revenue Service (IRS). The farmer is considered to be the owner of the machine, and places it on the farm depreciation schedule. Payments made to the lease company must be divided into interest and principal, with only the interest portion being tax deductible. Many finance leases are very similar to balloon payment loans set up for three to five years. The difference is that at the end of the lease period the operator can still choose to either return the machine to the dealer and give up ownership, or make the final balloon purchase payment. Since the finance lease is not being taxed as a true lease, the final buy-out price can be quite variable, depending on the length of the lease and the size of the payments.

Most leases are for new equipment, but local financial institutions such as banks are often willing to lease good used equipment as well. Typically new equipment leases are for more expensive items such as tractors and combines, although some less expensive items such as drills and grain carts are also leased. National financial companies lease primarily new equipment.

The leasing process

When a farmer enters into a lease for a specific piece of equipment, a sale occurs behind the scene. The equipment dealer sells the machine to a financing company, which in turn leases the equipment to the farmer. The dealer, in effect, acts as a middleman for the transaction.

The dealer and the financial institution must agree on a “selling price” for the equipment at the time of the lease. The dealer usually calculates the selling price by using various markup percentages over the dealer invoice cost. The degree of markup affects the “lease factor,” which is the factor by which the selling price is multiplied to calculate the periodic lease payment. The lease factor also depends on the hours of annual use allowed and the duration of the lease, both of which can be negotiated.

Many dealers offer only standard lease plans. However, if the dealer has the flexibility to enter into leases of different duration and annual hours of usage, then the farmer can negotiate terms that best fit his/her specific situation. Most equipment dealers offer leases backed by the credit company of their own manufacturer. However, many other local and national financial institutions also offer equipment leases. The farmer can make the best purchase deal possible, take that price to an alternative financial institution, and negotiate a lease. The dealer does not act as the middleman in this situation.

Lessor – the owner of the equipment, who receives the lease payments

Lessee – the operator of the equipment, who makes the lease payments

Details of lease contracts

An equipment lease contract specifies:

- the customer and dealer names and information

- the exact piece of equipment being leased

- the beginning and ending dates of the lease

- the base hours defined as the annual number of hours the equipment is expected to be used• the payment due the lessor for use in excess of the base hours

- the dollar amount the farmer must pay to purchase the equipment at the end of the lease if the purchase option is exercised

- the advance payment required

- the payment schedule (e.g. monthly, quarterly, semiannually or annually)

- miscellaneous terms of the agreement including such things as charges for excess wear and tear and evidence of insurance on the equipment

Some equipment dealers accept trade-in items and apply their value against the initial lease payment. Others do not accept trade-ins. Having to sell, rather than trade, used equipment may create a tax liability from recaptured depreciation and capital gains. Nevertheless, equipment that is no longer needed should be traded or sold rather than left to depreciate further on the farm.

Lease terms

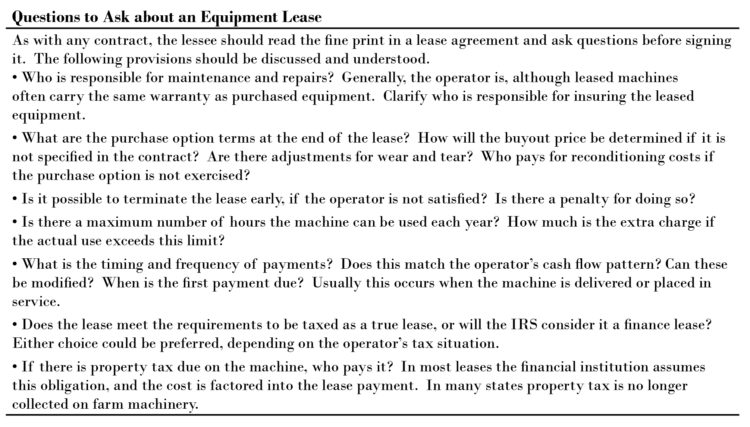

When considering an equipment lease, several points need to be decided. First, the farmer can attempt to lower the price at which the equipment is being sold to the financial institution. Reducing the sales price will lower the annual lease payment and the final purchase option price.The lease duration should fit the lessee’s farming plans for the next several years. Some farmers choose a lease termination date that coincides with some planned change in their business such as retirement, an expansion, or a change in loan obligations. If there is no known need to change equipment in three or four years and if controlling an asset outside of its warranty period is no problem, a longer lease will usually result in lower payments. The number of hours of annual use that is allowed will affect the total equipment cost over the life of the lease. Most leases have limited choices, such as 400, 600 and 800 hours per year. The farmer will not receive any reimbursement for “unused” hours, so it is best not to overestimate the hours of use. However, if the hours of use are underestimated, an extra charge is assessed for every hour in excess of the contracted annual usage. If the equipment is purchased at the end of the lease, the excess hour charges are frequently waived.

The combination of the years of lease and the annual hours of use will affect the purchase option price at the end of the lease. If the lessee intends to return the machine rather than purchase it, lower lease payments and a high option price will reduce cash outlays. However, the company that finances the lease will not take the risk that the option price is less than the salvage value of the machine at that point. The IRS, on the other hand, will not allow an option price significantly below fair market value if the lease is to be considered an operating lease.

Income Tax Considerations

Income tax considerations for a lease are fairly straightforward. The lease payments and all operating expenses are tax deductible in the year they are paid. Income tax considerations for purchases are more complicated, however, and are influenced by such factors as depreciation method and timing of the purchase within the year. For this reason, it is recommended that farmers evaluating a lease or purchase decision consult a professional tax advisor.

With a purchase, the farmer can deduct depreciation and interest on IRS Form 1040, Schedule F, but principal payments are not deductible. The size, term, and interest rate of the loan affect the size of the tax deduction from loan payments. Operating lease payments, on the other hand, are deductible as ordinary operating expenses. Lease payments may generate a larger deduction during the period of the lease, particularly if a purchased machine has a low beginning tax basis, as might be the case if it were acquired in a trade for a small cash difference.

Purchasing may also allow for the use of Section 179 expensing, which puts much of the depreciation deduction at the beginning of the ownership period of the asset. The limit on Section 179 depreciation changes regularly. The operator may prefer to acquire title to the machinery in order to take full advantage of the early depreciation option, especially if the business is in a high tax bracket. However, if the operator acquires other qualifying property in the same year that can fully utilize the Section 179 depreciation limit, then there is less tax advantage to owning over leasing.

If the cost of property qualifying for the Section 179 deduction in a single year exceeds a certain level, the Section 179 deduction is reduced by the excess cost over that level. This means that if the cost of the qualifying property is more than the maximum cost level plus the maximum deduction, no Section 179 deduction is available to the purchaser. Operators who want to use Section 179 should check current IRS limits.

Financial Considerations

As with most large investments, a major equipment acquisition will affect the liquidity, profitability and solvency of the farm business. All three aspects should be considered before making the financing decision.

Liquidity. The effects on liquidity can best be analyzed by calculating the cash outflows associated with each financing option, period by period. Cash outflows include purchase and loan or lease payments, property taxes and income taxes. Outright purchases require a large initial cash outlay, but little or no expenditures later. Purchases financed with credit require only a down payment at first, and even that may be avoided if another unit is being traded. The size of the subsequent loan payments will depend on the term and interest rate negotiated.

If a rollover plan is used, the yearly payment will approximate the economic depreciation during the first year of the machine’s life plus the dealer’s transaction and opportunity costs. In addition, trading for a new machine annually will minimize repair and maintenance costs. Operating leases will usually have the lowest cash payments during the first few years. Of course, one reason the payments are lower is that the operator is building little or no equity in the machine. At the end of the lease period the operator has nothing to show except the right to exercise the purchase option. Exercising the option requires a lump-sum expenditure at that time, or arrangements may be made for a purchase loan.

Profitability. For a given piece of equipment the most profitable financing alternative will be the one that generates the lowest long-run after-tax cost. The most accurate way to calculate this long-run cost is to find the discounted net present value of all the cash outflows and inflows associated with a given alternative. Values for different options can then be compared directly with each other. It is important that each alternative be compared based on either owning the machine at the end of the lease period or loan term, or disposing of it at that time. The same assumption should be used for evaluating each alternative.

Finally, the lessee should compare each financing option by laying out the cash payments side by side over the life of the lease or the loan, estimating the tax savings for each one, and then comparing the after-tax cost of each option. The decision should be based on total after-tax cost as well as near-term cash flow requirements.

The farmer who has enough capital to purchase a machine outright is likely to spend less in the long run by doing so. This is especially true for equipment that will be owned for five to 10 years or more. In addition, equity can be built up through ownership.

Solvency. Whether equipment is owned or leased affects the balance sheet of a business. A purchase increases the long-term asset side of the balance sheet while either decreasing some other asset account or increasing a liability account. Whether capital from current assets or a long-term loan was used to purchase the equipment can affect measures such as the current ratio and debt-to-asset ratio over the life of the equipment.

Sometimes equipment leases are touted as “off balance sheet” financing. If the equipment lease is truly an operating lease, neither an asset nor a liability should appear on the balance sheet. However, the lease still represents a cash flow commitment. The Farm Financial Standards Council recommends that “…operating leases should appear as a note to the balance sheet to disclose the annual amount of minimum rental payments for which the agricultural producer is obligated, the general terms of the lease, and any other relevant information.”

The Council recommends that a capital lease, however, be shown on the balance sheet. The appropriate procedure is to list the next payment as a current liability, and the discounted present value of the remaining payments as an intermediate or fixed liability. The sum of these values would also be listed under intermediate or fixed assets, representing the value of the operator’s right to use the equipment during the lease period. It would not be appropriate to value the machine at fair market value or cost value, because the operator does not actually own it. Showing a capital lease on the balance sheet will usually not affect the net worth of the business, because the asset and liability values are the same. However, it will increase the overall ratio of debts to assets.

Advantages of Purchasing

Owning a machine allows the operator more control over how much it is used and for how long. There are no penalties if the machine is used for more hours than was anticipated, or if it is sold or traded early. Even if the purchase was financed with credit, the loan can usually be paid off early with little or no penalty.

Machinery ownership can also be a store of equity for the business. Well cared for equipment can hold its value for many years, and serve as collateral for obtaining funds to make other capital investments. Moreover, an operator who is skilled in repairing and maintaining farm machinery will usually have 6lower total equipment costs over the long run, and spend less time and effort in identifying replacement units.

Advantages of Leasing

Operators who routinely trade major machinery items every few years will find that leasing generally offers lower payments than a loan to purchase. Machinery leasing utilizes operating capital instead of investment capital. This is particularly beneficial for high volume, low equity operators who cannot afford large capital outlays at a point in time.

A farmer nearing retirement may prefer to lease equipment so that it can be easily liquidated in a few years. Leasing also offers the chance to try out a particular machine without the obligation to own.

Comparing Financing Plans

A reasonable plan for comparing financing plans for an equipment purchase might include:

- Make your best deal on the purchase of the piece of equipment you are interested in controlling.

- Ask dealers about equipment leases they offer. Obtain copies of their lease contracts along with quotes of annual lease payments for various lease durations and annual usage. Note that the best purchase deal might include trade-in of used equipment while a lease may not allow trade-ins.

- Ask the dealers about their financing options for purchases– interest rate, length of loan repayment, periods of interest-free credit, origination fees and payment schedules.

- Check with your farm lender on how the purchase would affect your financial status, and what interest rates and terms would be charged for a loan, if needed.

- Ask your lender or a finance company if they are interested in purchasing the equipment and leasing it to you. If so, obtain their lease contract and annual payment estimates for various lease durations and annual usage levels.

- Analyze the different alternatives for cash flow and profitability.

- Before any lease is finalized, take the arrangement to your lender and tax advisor and ask them how the lease will affect your financial and tax situation.

Comparing Finance Plans: an Example

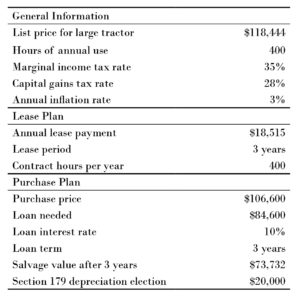

The following example shows how two financing options, a lease contract and a loan/purchase arrangement, can be compared. In the example, the use of a large tractor is obtained for three years. Under the lease the tractor is simply returned to the dealer at the end of the third year. Under the purchase plan the buyer pays off the loan in three years, then receives credit for the estimated salvage value of the tractor.

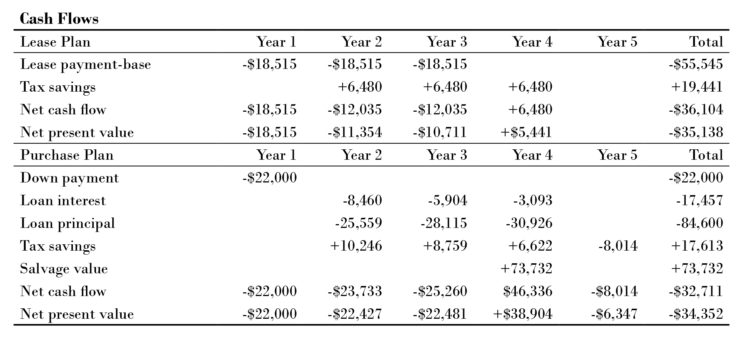

Both the annual cash flows and the long-term cost of obtaining the use of the tractor are shown in the tables below. The cost of the lease plan includes the base lease payment each year (paid in advance), plus an additional charge for the hours of use in excess of the standard level of 400 hours per year. For the purchase plan, the down payment plus the annual principal and interest payments are shown. In both cases it is assumed that the tractor is returned to the dealer after 3 years. Thus, for the purchase plan a cash inflow of $73,732, the estimated salvage value of the tractor, is shown in year 4.

The net present value of each year’s net cash flow takes into account the time value of money by discounting each value back to the date the agreement started. The total net present value can be compared to a one-time, up-front cost for obtaining the same services, that is, the use of the tractor for three years. In the example, the net present value of the lease plan is -$35,138, compared to a value of -$34,352 for purchasing. Since we are comparing costs, the smallest negative value is preferred. In this example, the purchase plan is $786 less expensive than the lease plan. However, this does not mean that purchasing will always be the less costly alternative.

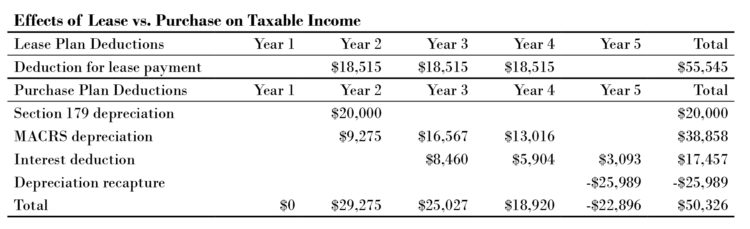

Note that the value of income tax savings was also included in the cash flow analysis. Lease and purchase plans have quite different tax consequences. For the same example, the estimated tax effects are shown in the table below. For the lease plan, only the lease payments are tax deductible, including the penalty for extra hours of use. For the purchase plan, both interest on the loan and depreciation, including a Section 179 deduction, are deductible.

When the tractor is sold, recaptured depreciation of $25,989 must be reported. This is because the tax basis had been reduced to $47,743 as a result of the $20,000 section 179 expensing and $38,125 of regular MACRS depreciation, but the selling price (salvage value) was assumed to be $73,732. This amount is included in taxable income, but not in self-employment income. If the tractor were traded in on another machine, this recapture could be delayed.

Under both financing plans, the tax savings would be equal to the deductions multiplied by the marginal tax rate (tax bracket) for the farm. This example assumes a corporate tax situation where there is no self-employment tax. If the analysis were being done for a sole proprietor, self-employment taxes would have to be considered, as well. In this example, a combined state and federal income tax rate of 35 percent was assumed. The tax savings are assumed to affect cash flows in the year after the tax year in which the deductions are reported.

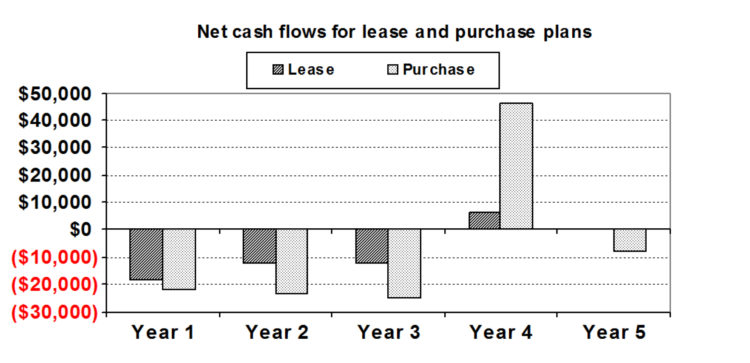

Besides the net present value of the cash outflows, the timing of the cash flows should also be compared. As the chart below shows, the purchase plan had the largest negative cash flows during the first three years. However, the purchase plan builds equity, the value of which is realized in year 4 when the tractor is sold or traded.

Computer Decision Aids

This publication has attempted to highlight several of the important factors that need to be considered when evaluating an equipment lease relative to a purchase. The terms available for a lease contract and the repayment period and interest rate for a loan to purchase influence which decision will be best. Considerations such as the operator’s marginal tax rate and the ability to utilize the Section 179 expensing election will also impact the decision. The many combinations of financial and tax situations cause the lease or purchase decision to be a difficult one to analyze.

A decision making aid entitled Lease Analyzer has been developed to help evaluate the economic consequences of leasing or purchasing equipment. The EXCEL© spreadsheet allows a farmer to enter pertinent information about a purchase and a lease and compare them. By changing key assumptions, such as a one percent decrease in the interest rate for a loan, the manager can quickly compare the alternatives based on both cash flow and profitability.

The same spreadsheet has a section that helps an operator to decide which annual hour election to choose in a lease. It determines the breakeven number of hours for different elections. If you think you will use fewer than the breakeven hours, choose the lesser election; if more, choose the greater election.

Visit the University of Missouri Lease Analyzer spreadsheet tool.

There are at least two other computer decision aids available that help analyze financing alternatives for farm machinery. They can be obtained from the following sources:

“Farm Machinery Financing Analyzer,” Decision Tool A3-21, Iowa State University Ag Decision Maker. Downloadable from http://www.extension.iastate.edu/agdm/decisionaidscd.html

“Machinery Financing,” University of Illinois https://farmdoc.illinois.edu/fast

References

Edwards, Richard, Danny Klinefelter and Dean McCorkle. “Leasing vs. Buying Farm, Machinery.” Publication RM5-4.0, Texas Agricultural Extension Service, College Station, TX. 1998.

La Due, Eddy L., Ronald Durst, Glenn Pederson, James S. Plaxico, and Anne O’Mara McDonley. “Financial Leasing In Agriculture: An Economic Analysis.” North Central Regional Research Publication 303, North Dakota Agricultural Experiment Station, Fargo, ND. 1985

*Originally published on Ag Lease 101 by North Central Farm Management Extension Committee.

TAGS:

TEAM LINKS:

RELATED RESOURCES

This University of Missouri equipment lease analyzer is designed to answer 2 questions regarding leasing farm equipment. First it seeks to determine whether a lease or a purchase is more profitable and feasible from a cash flow perspective. Second it helps decide the annual contract hours for a lease.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.