May 1, 2014

Farm Building Rental Rate Survey

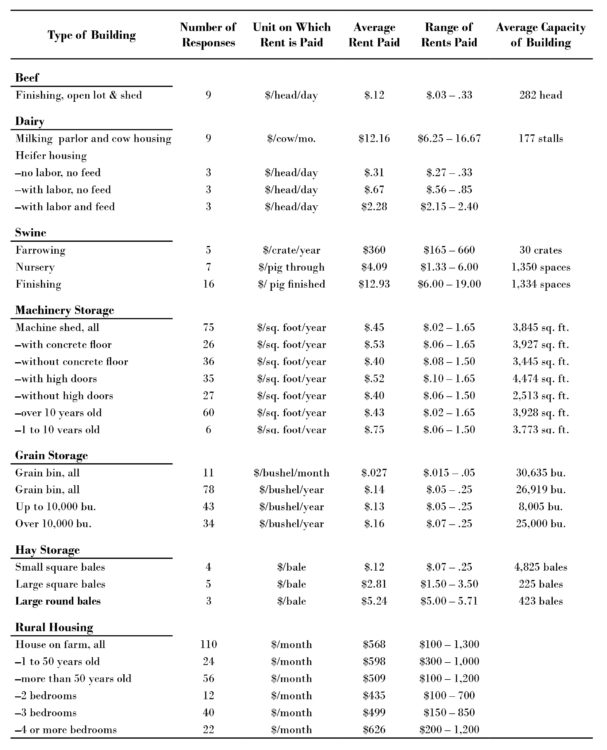

Farm buildings and livestock facilities often outlast their owner’s need for them, but can still provide usable service. Farm operators and livestock producers may be able to make use of certain types of farm buildings but are not in a position to invest in new facilities. Both parties can benefit from a leasing arrangement. However, information about common rental rates for farm buildings is not easily obtainable.

The information in this publication was summarized from the results of a survey of farm operators, farm owners, professional farm managers and rural appraisers in the north central region of the U.S. The North Central Farm Management Extension Committee sincerely thanks all the agricultural professionals who contributed.

The survey assumed that building tenants would provide labor and management and pay the cost of utilities and minor upkeep. Owners would generally be responsible for major repairs and insurance coverage. Individual rental rates will vary according to the age, condition, size, location and efficiency of the particular building being rented.

For more information about determining rental rates and terms see publication NCFMEC-04, “Rental Agreements for Farm Buildings and Livestock Facilities.” For a sample lease form, see publication NCFMEC-04A, “Farm Building or Livestock Facility Lease.” Both publications are available for no charge at the following website: http://AgLease101.org.

*Originally published on Ag Lease 101 by North Central Farm Management Extension Committee.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.