June 18, 2014

Mini-Boom Ahead for the Livestock Industry

Overview

The U.S. livestock industry has entered a new era of much higher product prices, lower costs of production, and favorable margins for producers and their input suppliers. This new era is a reversal of what took place starting in about 2007 through mid-2013 when margins were often negative, producer balance sheets were eroding, and lenders anxiety about the health of their livestock accounts was growing continuously.

What’s driving this new era of prosperity in the livestock sector? A large-scale shift in meat supplies combined with a rebound in U.S. and world feed supplies and improving economic conditions are the primary drivers of change

To better understand why the livestock industry’s outlook is so favorable for the next few years, we need to review why economic conditions in the livestock industry were so dismal from about 2007 to 2013. First, and most importantly, feed prices skyrocketed in the mid-2000’s, which drove production costs up dramatically. The increase in feed prices was driven by huge new demands for corn to be used for ethanol and equally huge new purchases of soybeans by China. Second, poor weather conditions also contributed to the feed price run-up. On-going drought in the Central and Southern Plains states, and a near-record Midwest drought in 2012, combined with poor weather elsewhere in the world to reduce crop production. Third, worldwide recession in late 2008 and 2009 exacerbated the poor operating environment by weakening demand for animal products, which held livestock prices down. The result was unprecedented losses throughout the livestock production sector

Livestock producers could not immediately pass-on their higher feed costs to consumers, rather they had to absorb the higher production costs, which pushed operating margins into the red. But financial losses eventually led some producers to leave the industry and others to reduce production, which reduced the available supply of meat over a series of years, starting in the late 2000’s. This process is shown in Figure 1, which depicts the annual per capita supply of beef, pork, chicken, and turkey, combined. In 2007, these animal industries made 222 pounds of product per person available for U.S. consumers. Over the course of the next seven years, however, that meat supply shrank to just over 200 pounds per capita, a reduction of nearly 10 percent.

Reducing supplies is the mechanism the livestock industry effectively used to obtain higher prices from consumers. The decline in available supplies after 2007 eventually pushed livestock prices high enough that producers were starting to operate in the black, even with corn prices at $7 per bushel or more. Looking ahead, the new era of livestock prosperity will be driven primarily by high animal prices combined with sharply reduced feed costs. The result will be multiple years of favorable margins that will induce animal producers to expand leading to increasing meat supplies. Although some expansion was expected to begin in 2014, the PED virus in hogs and low hatchability in the chicken industry have pushed large scale expansion back until 2015.

The period from 2007 to 2013 was a boom era for the crop sector, but it was a dismal economic time for the animal industries. The compensating balance is that 2014 to 2018 will be a mini-boom era for the animal industries, but one of substantially weaker returns for the crop sector. The mini-boom will be led by lower feed prices as world grain and oilseed supplies have caught up with demand growth. Continued world economic growth, boosting demand for meat around the world, and potential for drought abatement in the U.S., providing more assurance of feed supplies, are also encouraging signs for long-term continued prosperity.

Favorable operating margins will encourage the animal industries to expand over the next several years. The resulting rise in meat supplies will eventually lead to moderation in both retail meat prices and animal prices. But it will take some time for supplies to expand significantly. In the meantime, strong animal prices, weaker feed prices, continued expansion of foreign demand for U.S. animal products and continued U.S. population growth mean the stage is set for a mini-boom in the U.S. livestock sector.

Beef Industry in Midst of Profit Rebound

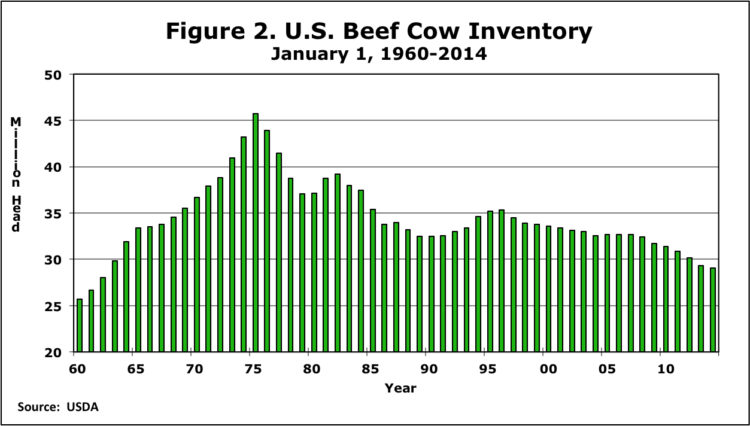

The U.S. beef industry suffered the effects of both high feed prices and drought conditions over the last several years. The run-up in productions costs, and resulting negative operating margins, led the nation’s cow-calf operations to reduce the size of the U.S. “beef factory”, pushing beef cow inventories down to a level not seen since the early 1960’s (figure 2). The result? U.S. per capita supplies of beef are the lowest they’ve been since the early 1950’s and will remain low through the latter part of this decade.

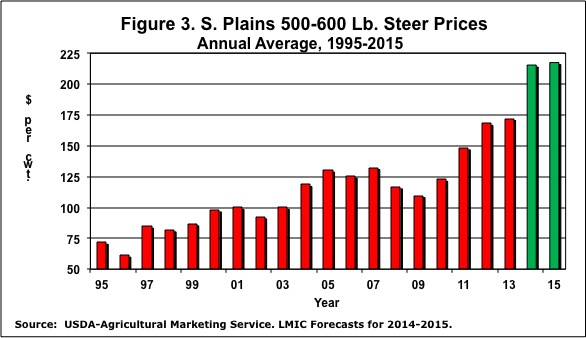

The dramatic decline in beef supplies has pushed retail beef, slaughter cattle, and calf prices all to record levels in 2014. Moderating feed grain prices, combined with improving moisture conditions that will help increase forage supplies and record high calf prices (figure 3) will encourage cow-calf producers to start expanding their herds. But it will take several years before expansion produces significantly larger beef supplies and weaker cattle prices. In the meantime, cow-calf operations will reap the benefits of the strongest margins they’ve experienced in decades over the course of the next several years.

The key to changes in future beef supplies, and prices, is what takes place in the cow-calf production sector. The run-up in feed grain prices that took place beginning in the mid-2000’s had an unprecedented impact on cow-calf operation’s production costs and profitability. For example, Kansas Farm Management Association data indicates total production costs for Kansas beef cow operations rose from just over $600 per cow in 2005 to more than $1,000 per cow in 2013, an increase of nearly 70 percent. At the same time, revenues were flat to declining until 2010, when smaller beef supplies started to push prices higher. Even though revenues were increasing the last several years, many cow-calf operations were still unable to cover all their production costs as recently as 2013.

Profitability and availability of forage supplies drives cow-calf producers expansion decisions. Production costs will decline in 2014 compared to 2013 and could decline again in 2015 with normal weather conditions in the U.S. Combined with sustained record high calf prices, a dramatic turnaround in profitability will take place in the U.S. cow-calf sector this year and next. The improved profit picture will encourage some producers to begin holding back females from slaughter, especially if pasture and range conditions continue to improve in key beef producing states, leading to a gradual rebuilding of the nation’s beef cow herd. But female slaughter reductions in 2014 will not start to increase beef supplies until 2016 and the supply change in 2016 will likely be small. The real impact of herd expansion will not be felt until 2017 and beyond as cow-calf producers look for confirmation that feed grain prices will remain below the highs of recent years and that forage production will be adequate to support larger cow inventories. As a result, U.S. cow-calf operations should see sustained profitability through at least 2017 and, likely, through the end of the decade.

The cattle feeding profit picture has also improved dramatically as average feeding margins for yearling steers in the Southern Plains increased to over $100 per head in early 2014. The improvement in profitability was attributable to both strong slaughter cattle prices and declining feed costs as feeding costs of gain dropped from $1.15 per pound in early fall 2013 to less than $1 per pound in early spring 2014. Cattle feeders are margin operators that benefit from reduced feed costs, but their costs for replacement cattle are surging and, as a result, their margins will tighten later in 2014 and into 2015.

As recently as 2008 cattle feeders marketed 22.4 million head from U.S. feedlots, but those numbers have been declining. Using 2008 as a benchmark, industry feeding capacity exceeded actual marketings by 4 percent in 2013. Looking ahead, available supplies of cattle suitable for placement on feed will decline the next couple of years, leading to more competition among feeders to fill feedlots. The result will be a tightening of cattle feeding margins by 2015 as cattle feeders competing to fill feedlot bunk space bid up feeder cattle prices. The beef processing sector faces a similar problem because processing capacity also exceeds the available supply of cattle. Again, the result will be narrower margins for beef processors as they compete for limited supplies of market ready cattle.

Longer term, profitability in the cattle sector will be determined in part by the strength of consumer demand, both in the domestic and international markets, in the face of record high beef prices. Beef exports have been growing and in 2013 finally exceeded the record level attained in 2003, prior to identification of BSE in the U.S. Although record high beef prices could lead to modest declines in beef export volume the next couple of years, long-term export prospects will be tied closely to consumer income growth in importing nations. If consumer incomes continue to grow in key importing nations, beef export growth will resume when supplies start to increase. On the domestic side, look for very tight per capita beef supplies to support retail beef prices at record levels for the next several years, until supplies start to increase in 2017 and beyond.

Pork: PEDv Contributes to Record Profits

The unfolding saga of PEDv will continue to casts its long shadow over the pork industry. Surprisingly, total pork supplies were only down 1 percent during the first half of 2014 as 4 percent fewer animals arriving at market were largely offset by 3 percent heavier weights. The full impacts of PEDv death losses from this past winter will result in further reductions of animal numbers in July through September. USDA inventory counts suggest that summer hog numbers will only be down about 4 percent, compared to a year earlier. However, a number of industry analyst believe slaughter volume could drop by as much as 10 percent in August and September when the most extreme winter death losses become evident.

Pork producers have responded to record high hog prices and record profitability by increasing market weights and thereby substantially compensating for death losses from PEDv. In May, hog weights were up nearly 5 percent compared to 2013, and are expected to continue on this path into the summer. If so, pork supplies this summer may not change much from year-ago levels. Fall pork supplies could actually expand somewhat as producers intend to farrow 2 percent more sows in spring 2014. Although PEDv may reduce litter size, high market weights may again compensate for smaller animal numbers. Unfortunately, the actual impact of PEDv losses on summer and fall animal numbers is still a matter of speculation.

So far in 2014, pork supplies have been down only 1 percent, yet hog prices are up by more than 25 percent, year-over-year. This suggests that demand is very strong being supported by record high beef prices, smaller than expected poultry supplies, and robust export demand. There may also be elements of speculative buying related to the uncertainty around actual death losses from PEDv.

Pork producers will have record high prices to help compensate for death losses. Total revenues for the entire industry are expected to reach a record high, with prices on a liveweight basis averaging about $81 per hundredweight this year compared to a previous annual high of $66 in 2011

The new mini-boom era is underway for the pork industry with high hog prices, low corn prices and the likelihood that soybean meal prices will finally drop sharply this fall. Margins for producers who have not been impacted by PEDv will exceed $60 per head this year. So, 2014 should be a balance sheet builder for most hog producers.

Total income for the hog production industry will be at record high levels in 2014, and thus the greatest costs of PEDv will be felt by pork consumers in the form of higher retail pork prices. Margins for pork processors will also be negatively impacted due to reduced hog numbers.

The expansion of the sow herd is likely already underway. Low sow slaughter numbers suggest the industry began to move toward expansion starting in September 2013 when corn prices dropped sharply. Since that time sow slaughter has been down about 6 percent, compared to a year earlier. Breeding herd numbers are expected to rise a couple of percent above a year earlier by late summer and early fall. If PEDv can be better controlled, this sets the stage for a 2 to 4 percent increase in pork supplies in 2015 with live hog prices moderating to the mid-$60s. But total productions costs are expected to remain between $55 and $60 per hundredweight, providing profitability through 2015.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.