May 12, 2019

International Benchmarks for Soybean Production (2019)

by Michael Langemeier and Rachel Purdy

Examining the competitiveness of soybean production in different regions of the world is often difficult due to lack of comparable data and agreement regarding what needs to be measured. To be useful, international data needs to be expressed in common production units and converted to a common currency. Also, production and cost measures need to be consistently defined across production regions or farms.

This paper examines the competitiveness of soybean production for important international soybean regions using 2013 to 2017 data from the agri benchmark network. Earlier papers used 2012 to 2014 data (here), 2013 to 2015 data (here), and the 2013 to 2016 period (here) to examine competitiveness. The agri benchmark network collects data on beef, cash crops, dairy, pigs and poultry, horticulture, and organic products. There are 40 countries represented in the cash crop network. The agri benchmark concept of typical farms was developed to understand and compare current farm production systems around the world. Participant countries follow a standard procedure to create typical farms that are representative of national farm output shares, and categorized by production system or combination of enterprises and structural features.

The analysis in this paper was comprised of seven typical farms with soybean enterprise data from Argentina, Brazil, Russia, Ukraine, and United States. The Russian farm did not produce soybeans in 2013 and 2014. The Ukraine did not produce soybeans in 2013, so rapeseed was used. All of the farms analyzed also produced corn. For information pertaining to corn production see Langemeier and Purdy (here). It is important to note that soybean enterprise data is collected from other countries. For more information, visit the agri benchmark website. These five countries were selected to simplify the illustration of costs and discussion.

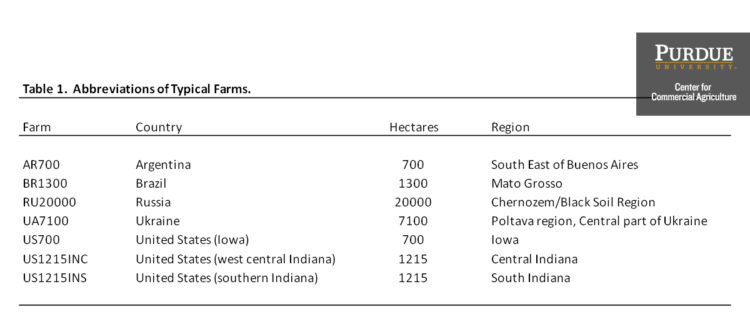

The farm and country abbreviations used in this paper are listed in table 1. Typical farms used in the agri benchmark network are defined using country initials and hectares on the farm. There are four U.S. farms with soybean production in the network. The three United States typical farms used to illustrate soybean production in this paper are the Iowa farm (US700), west central Indiana farm (US1215INC), and the southern Indiana farm (US1215INS).

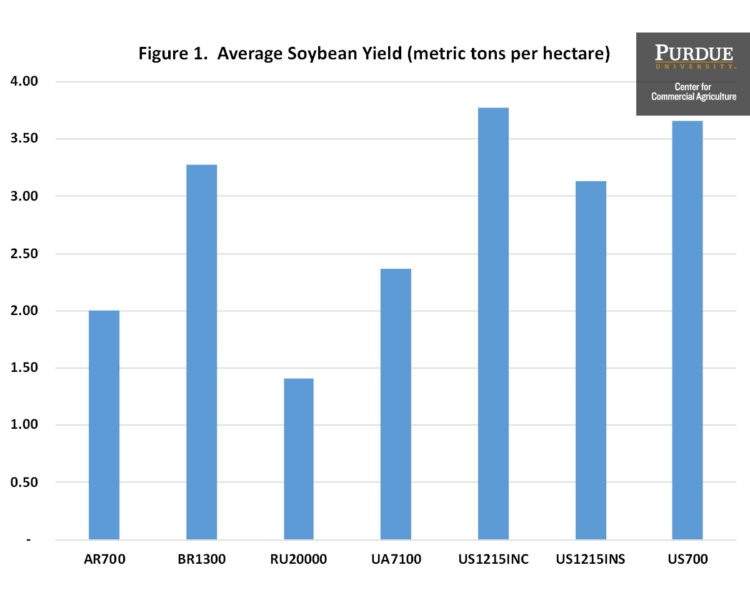

Soybean Yields

Although yield is only a partial gauge of performance, it reflects the available production technology across farms. Average soybean yield for the farms in 2013 to 2017 was 41.7 bushels per acre (2.80 metric tons per hectare). Average farm yields ranged from 21.0 bushels per acre for the typical farm in Russia (1.41 metric tons per hectare) to 56.2 bushels per acre for the west central Indiana farm (3.78 metric tons per hectare). Figure 1 illustrates average soybean yield for each typical farm. It is important to note that the southern Indiana farm contained both full-season and double-crop soybeans.

Input Cost Shares

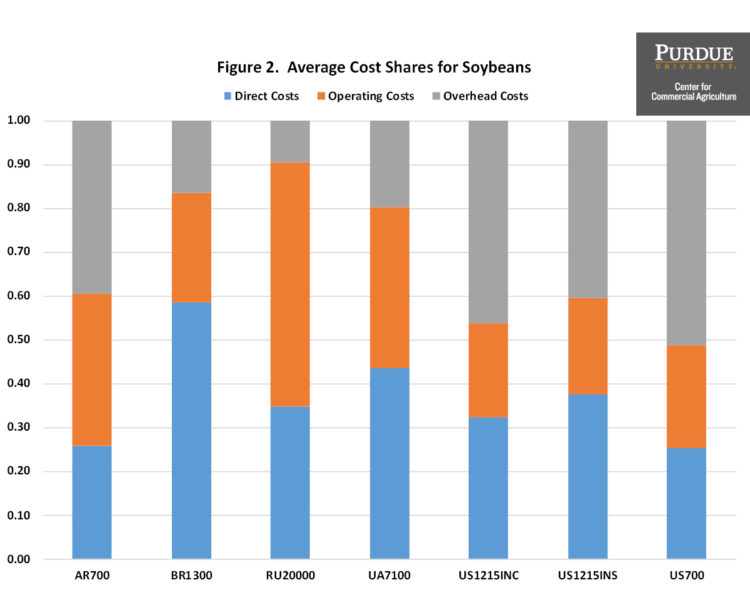

Due to differences in technology adoption, input prices, fertility levels, efficiency of farm operators, trade policy restrictions, exchange rate effects, and labor and capital market constraints, input use varies across soybean farms. Figure 2 presents the average input cost shares for each farm. Cost shares were broken down into three major categories: direct costs, operating costs, and overhead costs. Direct costs included seed, fertilizer, crop protection, crop insurance, and interest on these cost items. Operating cost included labor, machinery depreciation and interest, fuel, and repairs. Overhead cost included land, building depreciation and interest, property taxes, general insurance, and miscellaneous cost.

The average input cost shares were 36.9 percent for direct cost, 31.3 percent for operating cost, and 31.8 percent for overhead cost. The Iowa farm had the lowest average cost share for direct cost at 25.4 percent and the highest average cost share for overhead cost at 51.2 percent. The Brazilian farm had the highest direct cost scare at 58.7 percent. The west central Indiana farm had the lowest average cost share for operating cost over the time period at 21.7 percent. The Russian farm had the highest cost share for operating cost at 55.6 percent. All of the U.S. farms had below average cost shares for operating cost, and an above average cost share for overhead cost. The relatively large cost share for overhead cost in the U.S. reflects, in part, our relatively high land cost.

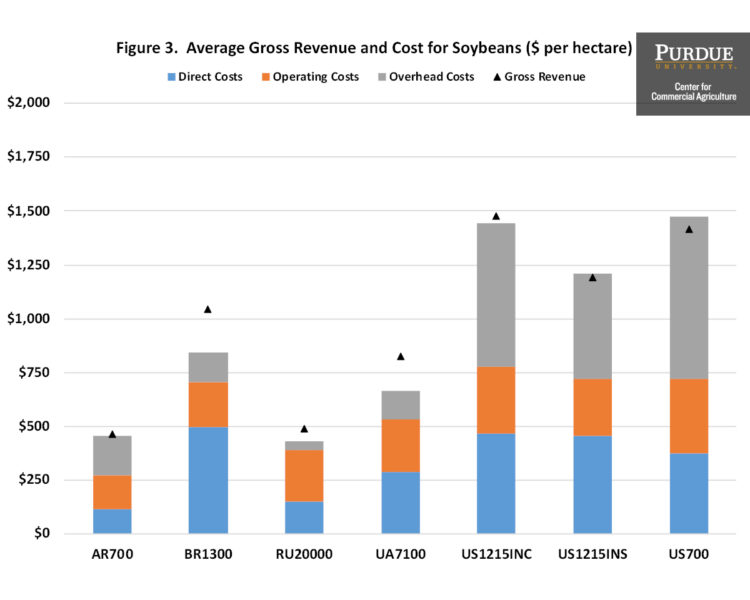

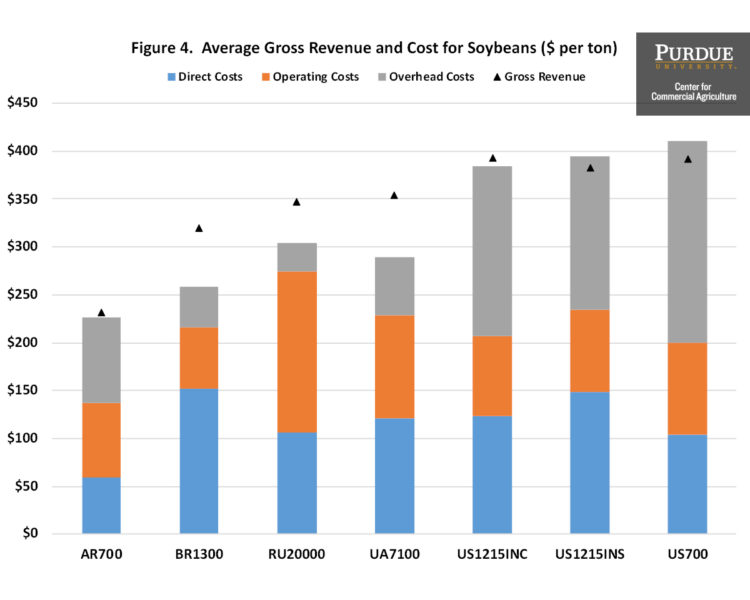

Revenue and Cost

Figures 3 and 4 present average gross revenue and cost per hectare and per ton for each typical farm. Gross revenue and cost are reported as U.S. dollars per hectare and per ton. Soybeans are a major enterprise on all of the typical farms presented in figures 3 and 4. It is obvious from figures 3 and 4 that total cost of soybean production is highest for the U.S. farms on a per hectare and per ton basis. Gross revenue for the U.S. farms ranged from $482 per acre ($1,191 per hectare) for the southern Indiana farm to $598 per acre ($1,477 per hectare) for the west central Indiana farm. The average total cost of soybean production for the U.S. typical farms averaged $556 per acre ($1,374 per hectare). Average total cost of soybean production for all of the typical farms analyzed was $377 per acre ($930 per hectare).

The only typical farms that did not earn an economic profit producing soybeans during the 2013 to 2017 period were the southern Indiana farm and the Iowa farm. Average losses for these farms were $6 per acre ($16 per hectare) for the southern Indiana farm and $23 per acre ($58 per hectare) for the Iowa farm. The west central Indiana farm realized profits of $14 per acre ($36 per hectare). Average economic profits for the typical farms in Argentina, Brazil, Russia, and Ukraine were $4, $82, $25, and $65 per acre, respectively ($9, $203, $62, and $161 per hectare, respectively). It is important to note that despite having relatively low yields, the Russian farm was profitable. On average, soybean production was more profitable than corn production over the 2013 to 2017 time period. The same set of farms had a negative profit over this time period in corn production. The average profit for soybean production for these farms over the five-year time period was $23 per acre ($57 per hectare). For corn production, the same group of farms lost an average of $9 per acre ($23 per hectare).

Conclusions

This paper examined yield, gross revenue, and cost for farms with soybeans in the agri benchmark network from Argentina, Brazil, Russia, Ukraine, and United States. Cost of soybean production was substantially higher for the U.S. farms. Yield was highest for the U.S. farms and the Brazilian typical farm. With the exception of the Iowa and southern Indiana farms, every farm analyzed realized economic profits over the 2013 to 2017 time period.

References

Agri benchmark. http://www.agribenchmark.org/home.html. Retrieved on 5/1/2019.

Langemeier, M. “International Benchmarks for Soybean Production.” Center for Commercial Agriculture, Purdue University, September 2016.

Langemeier, M. and E. Lunik. “International Benchmarks for Soybean Production.” Center for Commercial Agriculture, Purdue University, December 2015.

Langemeier, M. and R. Purdy. “International Benchmarks for Corn Production.” Center for Commercial Agriculture, Purdue University, May 2019.

Purdy, R. and M. Langemeier. “International Benchmarks for Soybean Production.” Center for Commercial Agriculture, Purdue University, June 2018.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.