August 21, 2020

Pork Export Strength Reliant on China

by James Mintert

World pork markets have been disrupted the last couple of years, first by African Swine Fever (ASF) in China followed by a U.S.-China trade dispute and then, in 2020, by the coronavirus. ASF drastically reduced pork production in China starting in 2018 and continuing into 2020. The reduction in China’s domestic pork production created a tremendous opportunity for the U.S. to increase pork exports to China to help fill the animal protein void in Chinese consumers diets. So, what has actually taken place so far in 2020?

Despite pork supply chain disruptions in the U.S. resulting from coronavirus, U.S. pork exports increased dramatically. From January through May 2020 pork exports rose 21% above the prior year. But it’s pretty clear that pork exports would have been even larger if it were not for the disruptions that took place as a result of COVID-19 cases leading to processing plant closures and slowdowns as well as weakness in some major importers economy’s. You can see this when looking at the monthly totals as U.S. pork exports during January rose 39% above a year earlier while February’s total was up 46% compared to February 2019. But by April and May pork exports, although remaining strong, rose a combined 22% above the same period in 2019. That was still an impressive export performance, however, given that pork production during that two-month period was actually 13% lower than during April-May 2019 as a result of plant closures and slowdowns.

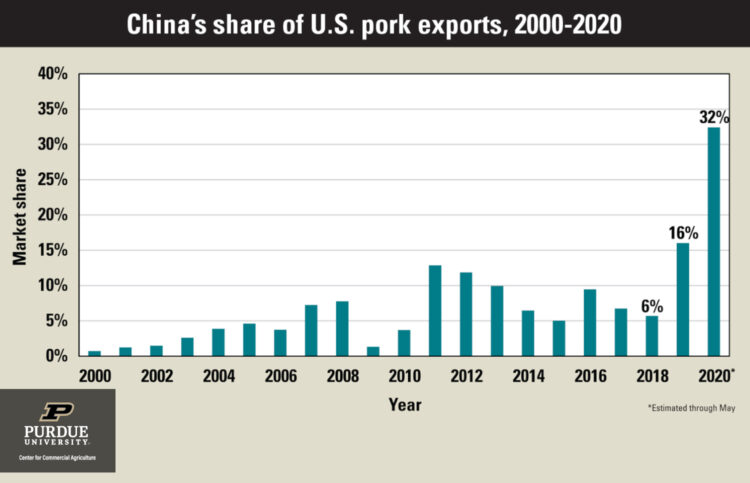

It comes as no surprise that rising exports to China were almost entirely responsible for the increase in U.S. pork exports. During the first 5 months of 2020, exports to the Chinese mainland rose by 427% compared to 2019, totaling nearly 1.1 billion pounds in 2020 compared to 202 million pounds in 2019. Exports to Hong Kong, although much smaller than exports to the mainland, more than doubled rising to over 30 million pounds vs. a year earlier total of a little more than 14 million pounds. Combined, exports to China and Hong Kong amounted to one-third of all U.S. pork exports in 2020 compared to just 17% of exports during the same period in 2019.

Exports to other major importers of U.S. pork either changed little compared to a year earlier or in several cases were actually weaker during January-May 2020 vs. a year earlier. Exports to Mexico, the number one destination for U.S. pork exports in 2019, from January through May were virtually unchanged compared to a year earlier while shipments to Japan, the number two destination in 2019, rose just 7% from January to May. By May, as the impact of COVID-19 was spreading, exports to both of these major pork importers fell well below a year earlier.

Pork exports during January-March 2020 absorbed 29% of U.S. pork production. To help put that in perspective, pork exports from 2017 through 2019 ranged from 22 to 23% of U.S. pork production. For the rest of 2020, it looks like strength in U.S. pork export volume will be dependent on how much pork China imports from the U.S. Recovery in pork exports to other major importers of U.S. pork will require economic recovery in those countries, which could take some time.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.