September 22, 2021

Exports More Important to Pork than Beef or Chicken

by James Mintert

It’s no surprise that exports are an important market outlet for U.S. pork production. But did you know that exports are even more important to the pork industry than they are to either the beef or poultry industries?

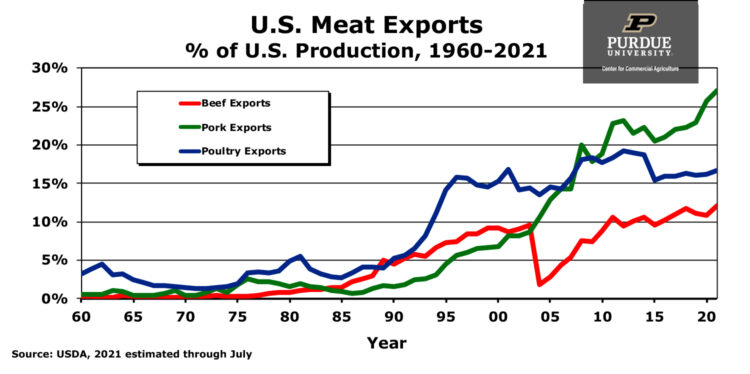

U.S. exports of pork, beef and poultry all began to increase significantly starting in the mid-1980s and have grown sharply since then. For many years, however, pork exports expressed as a share of total U.S. pork production were smaller than either beef exports as a share of beef production or poultry exports as a share of poultry production. But that began to change just after the turn of the century as pork exports began to grow rapidly. The share of U.S. pork exported has exceeded that of beef every year since 2003 and has exceeded the share of poultry exported for over a decade. Through July of this year, 27 percent of U.S. pork production was exported, up from 26% in 2020 and 23% in 2019. In comparison, combined exports of chicken and turkey during January-July 2021 totaled 17% of poultry production while beef exports equated to just 12% of U.S. beef production.

Although exports are often thought of as a single market, meat exports are really comprised of a multitude of individual markets. Through the first seven months of 2021, U.S. pork exports were virtually unchanged from a year earlier, but who the U.S. was selling pork to did change compared to a year earlier. China’s share of U.S. pork exports rose from 6% in 2018 to 16% in 2019 before peaking in 2020 at 28% of all U.S. pork shipments. African swine fever’s decimation of the Chinese hog herd and pork production fueled the rise in exports to China. But in 2021 exports to China have slowed, running 35% below year ago levels from January through July.

Fortunately, other countries increased their imports of U.S. pork to help offset the decline in exports to China. The biggest gains so far this year have been in pork exports to a traditional long-term customer, Mexico, and to a host of smaller markets which comprise the “other” countries category. Exports to Mexico from January through June rose 24% to over 1 billion pounds making Mexico the number one destination for U.S. pork while the “other” countries imports rose 31% to over 800 million pounds, making this group of countries the third largest market for U.S. pork.

The rapid rise in U.S. pork exports over the last two decades is indicative of the U.S. pork industry’s strong competitive position as a low-cost supplier of quality pork products. Export increases fueled the U.S. pork industry’s growth since the turn of the century. It looks like future pork industry growth will require ongoing development of new and expanded export markets for U.S. pork.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.