October 3, 2023

Agility and Producer Sentiment

by Margaret Lippsmeyer, Michael Langemeier, James Mintert, and Nathan Thompson

Introduction

Strategic risks threaten a farm’s ability to meet its long-term objectives and often cause a farm to rethink its long-run strategy. Strategic risk is the risk of being out of position when responding to shifts in the political and social environment, a growing or contracting macroeconomy, or a changing input and output price landscape. Previous articles noted that agility and absorption capacity are two strategies that can be used to build resilience to strategic risk (Lippsmeyer and Langemeier, 2023), and discussed survey results pertaining to absorption capacity (Lippsmeyer et al., 2023b). This article uses survey results to examine the relationship between agility and farm characteristics such as farm growth, producer sentiment, demographics, identification of major threats, management practices, and resilience to strategic risk. For a more general discussion of the survey see Lippsmeyer et al. (2023a).

Agility

Agility is related to a farm’s ability to spot and exploit changes in markets in a timely fashion (Sull, 2009). Agility may be related to improving current farm processes, the ability to shift resources among enterprises, and/or the ability to exploit opportunities in a timely fashion in response to market changes (Lippsmeyer and Langemeier, 2023). Asking the following question may be helpful. How easy is it for our farm to switch our input mix or our enterprise mix in response to changes in relative input or output prices, or new technologies? In general, agility measures a farm’s ability to consistently identify and capture business opportunities more quickly than rivals do.

Our strategic risk survey included three questions pertaining to agility. The first question asked whether a respondent’s farm had established goals, objectives, and core values. The second question asked whether a respondent’s farm looked for opportunities that new enterprises may provide. The third question asked whether a respondent’s farm regularly assessed their advantages and disadvantages compared to other farms. On average, 90% of the respondents indicated that they had established goals, objectives, and core values. Approximately 83% of the respondents indicated that they look for new opportunities, and 71% of the respondents indicated that they regularly assessed their relative advantages and disadvantages.

Relationship between Agility and Farm Characteristics

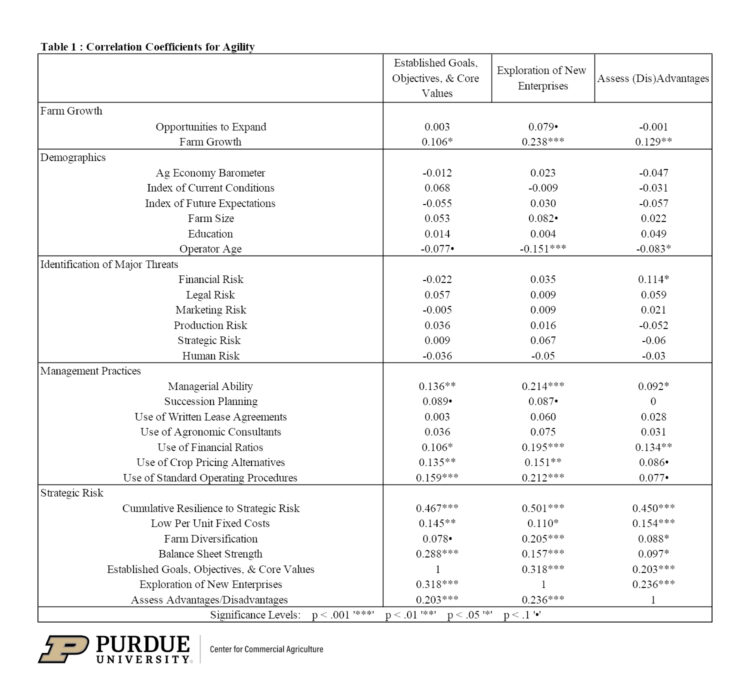

Table 1 presents correlation coefficients between each question pertaining to agility (i.e., agility measure) and farm characteristics such as farm growth, demographic variables, major sources of risk, management practices, and resilience to strategic risk. The discussion below will focus on the farm characteristics that were significantly correlated with one or more of the questions measuring agility.

Table 1: Correlation Coefficients for Agility

The question on farm growth expectations asked whether the respondent’s farm expected to grow over the next five years. All three of the agility measures were positive and significantly correlated with farm growth, indicating that farms that are more agile have higher farm growth expectations.

The three agility questions were not related to producer sentiment as measured with the Ag Economy Barometer, the Index of Current Conditions, and the Index of Future Expectations. The producer sentiment questions replicated the questions used to create the monthly Ag Economy Barometer. The results pertaining to the relationship between agility and producer sentiment differed from the results that examined the relationship between absorption capacity and producer sentiment (Lippsmeyer et al., 2023b), which found a positive and significant correlation between producer sentiment and absorption capacity.

Responses to the three agility questions were not correlated with either farm size or educational achievement. However, there was a significant and negative correlation between the response for each question and operator age, indicating that younger operators were more likely to answer the agility questions affirmatively.

Respondents were also asked to identify the most threatening source of risk on their farm. Choices included financial risk, legal risk, marketing risk, production risk, strategic risk, and human risk. In general, the correlations between agility and each source of risk were low. However, there was a positive and significant relationship between whether a farm assessed advantages and disadvantages and financial risk indicating that farms that are more concerned about financial risk were more likely to assess their relative advantages and disadvantages.

Management practice questions addressed whether farms had written succession plans, written crop lease agreements, used agronomic consultants, used financial ratios, evaluated crop pricing performance, and documented standard operating procedures. We created a metric for managerial ability using the six management practice questions. This metric was positive and significantly correlated with each question pertaining to agility. There was also a positive and significant correlation between each agility measure and whether a farm used financial ratios, crop pricing alternatives, and standard operating procedures. These results suggest that farms that are more in tune with financial performance, crop pricing, and standard operating procedures are better positioned to take advantage of business opportunities.

A strategic risk score or metric, represented by the cumulative resilience to strategic risk variable in Table 1, was created using the three absorption capacity and the three agility measures. Absorption capacity measures addressed whether a respondent’s farm had low per unit fixed costs, had a diversified enterprise mix, and a strong balance sheet. As expected, there was a significant and positive correlation between each agility measure and strategic risk. In addition, the three agility measures were also positive and significantly correlated with each absorption capacity measure. Overall, the strategic risk results suggest that farms that were resilient with respect to one aspect of their business were often resilient with respect to other aspects of their business.

Summary and Conclusions

This article examined the relationship between agility and farm characteristics. Agility was measured by asking survey respondents whether they had established goals, objectives, and core values; explored new enterprise opportunities; and assessed relative advantages and disadvantages. Producers who were more agile expected to grow at a faster rate the next five years, were younger, were more likely to adopt management practices related to financial performance, crop pricing, and standard operating procedures, and were more resilient to strategic risk.

References

Lippsmeyer, M. and M. Langemeier. “Agility and Absorption Capacity.” Center for Commercial Agriculture, Purdue University, April 20, 2023.

Lippsmeyer, M., M. Langemeier, J. Mintert, and N. Thompson. “Resilience to Strategic Risk.” Center for Commercial Agriculture, Purdue University, June 20, 2023a.

Lippsmeyer, M., M. Langemeier, J. Mintert, and N. Thompson. “Absorption Capacity and Producer Sentiment.” Center for Commercial Agriculture, Purdue University, September 26, 2023b.

Sull, D. (2009). How to Thrive in Turbulent Markets. Harvard Business Review, February 2009.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Margaret Lippsmeyer, Michael Langemeier, James Mintert, and Nathan Thompson segment U.S. farms by farm resilience, management practices, and producer sentiment. This paper was presented at the Southern Agricultural Economics Meeting in Atlanta, Georgia in February.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.