November 22, 2023

2024 Crop Cost and Return Guide

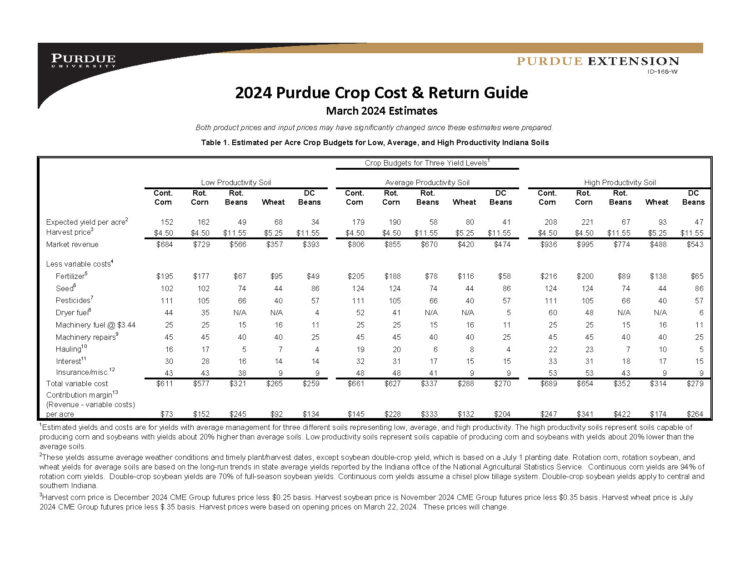

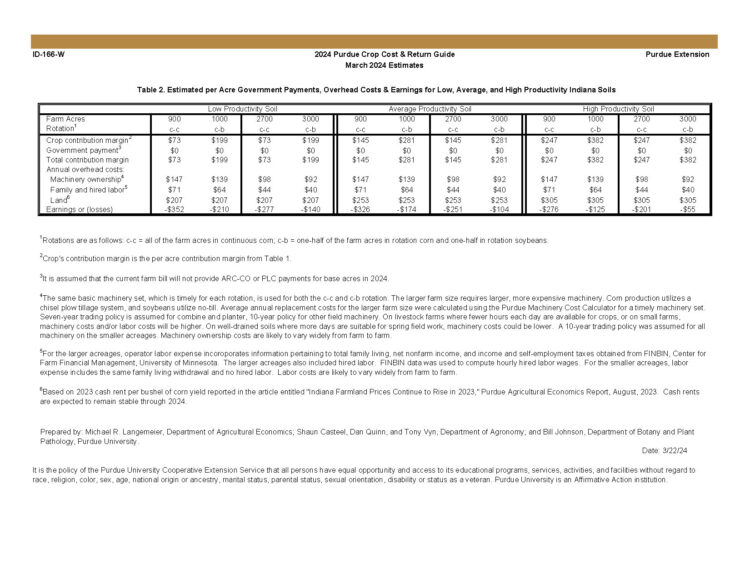

March 2024 Estimates

The Purdue Crop Cost and Return Guide offers farmers a resource to project financials for the coming cropping year. These are the March 2024 crop budget estimations for 2024; prepared by Purdue faculty members Michael R. Langemeier, Department of Agricultural Economics; Shaun Castell, Dan Quinn, and Tony Vyn, Department of Agronomy; and Bill Johnson, Department of Botany and Plant Pathology, Purdue University.

**Find the companion spreadsheet tool to examine gross revenue, costs, and earnings for crop enterprises here. A user can evaluate up to three full-season crops, and the wheat double-crop soybean system. Gross revenue, cost, and net returns are evaluated on a per acre and per unit basis. Breakeven prices to cover variable and total cost are computed for each crop.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.