May 7, 2024

Discussing Key Resources and Risk Exposure in Your Farm Business Plan

by Margaret Lippsmeyer, Michael Langemeier, and Michael Boehlje

Introduction

Developing a business plan for your farm helps align day-to-day operations with overarching business goals. In this article, we explore the importance of assessing current business resources and exposure to risk while creating a business plan. We provide discussion on risks to your business’s key resources, a framework to evaluate the strength of your farm’s resource base, and an outline of how to craft an effective business plan. These topics link back to our previous articles on integrated risk management (Lippsmeyer, Langemeier, and Boehlje, 2024a) and key resources (Lippsmeyer, Langemeier, and Boehlje, 2024b) where we discussed how macroeconomic factors and other external shocks can influence timing and effectiveness of investments in key business resources.

Assessing Resources

Availability and strength of key resources—including financial, physical, human, organizational, and information technology—should shape your business objectives and determine an effective business plan. Business objectives and business plans should focus on strengthening your farm’s key resource base. This resource base acts as a foundation for potential farm expansion, or ability to withstand shocks or stresses in the business environment. Evaluating key resources is a critical initial step in business planning, ensuring you have accurate benchmarks for your business’s resources. These benchmarks help to identify which key resources to leverage and which need to be strengthened.

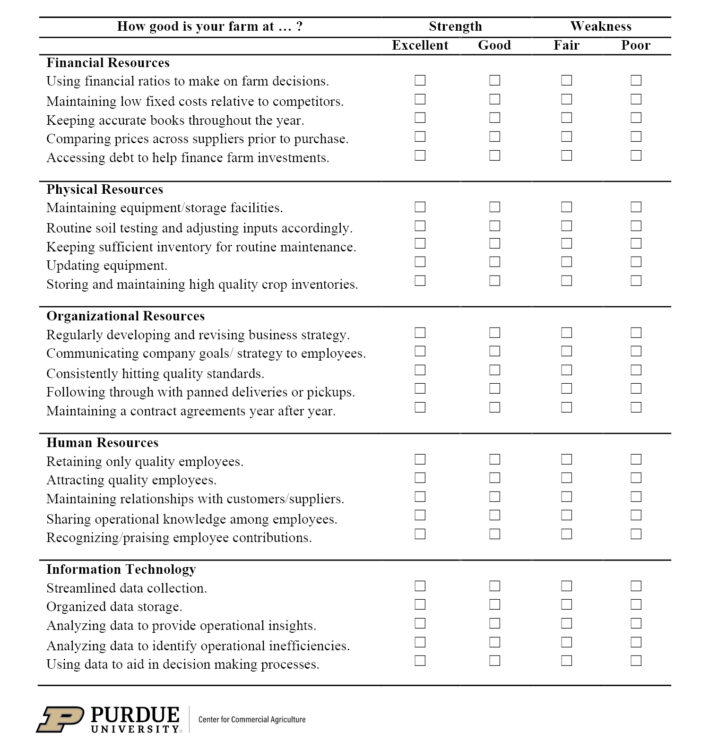

In the next sections we discuss different types of key resources and major risks associated with each. In addition to this discussion, Figure 1 poses a series of questions which can be used to assess the strength of your farm’s key resources. These questions are intended to pinpoint potential shortcomings in a farm’s resource base, thereby assisting in the development of a business plan that addresses resources needing improvement. Figure 2 illustrates risk exposure by resource category.

Organizational Resources

Organizational resources are the glue which binds together physical, financial, human resources, and information technology, giving direction and meaning to a farming operation. Organizational resources include business reputation, core values, operational structures, and systems, and play a vital role in differentiating your farm from competitors. For example, most operations can effectively produce yellow corn, but consistent product quality, reliable logistics, trustworthy relationships with input suppliers and product distributors are ways in which your organizational resources may yield a competitive advantage.

Many risks associated with organizational resources are considered strategic risks. Strategic risks are caused by external shocks or stresses which create a misalignment between a farm’s business strategy and available resources and capabilities (Lippsmeyer, et al., 2023). These risks lack off-the-shelf risk mitigation strategies, making them particularly threatening for businesses. Risks to organizational resources exemplify strategic risk: coming from a variety of sources, are known to cause brand erosion, tarnish reputation, obscure business strategy, and lack effective tools to mitigate these risks.

Adverse weather conditions reducing crop yield is often categorized as a production risk. However, if as a consequence your operation fails to fulfill a sales contract, the risk becomes a strategic risk, impacting your business’s reputation. Although distributors may have alternative sources to compensate for your shortfall, your farm’s reliability in meeting contractual obligations could come under scrutiny. This could adversely affect your future prospects of securing contracts with the same distributor.

Brand erosion and loss of reputation frequently relate to three factors: price, timeliness, and quality. Balancing a competitive price and product quality is a challenge which impacts a farm’s ability to maintain a positive reputation and retain customers. Moreover, perceptions of certain farming practices (i.e., production using certain chemicals or hormone treatments), negative publicity, or increases in competition may also contribute to brand erosion and reputation loss.

The clarity of a business strategy is another component of strategic risk. Business strategy may become compromised due to complexities of relationships between operators, employees, and outside parties; or through attempts to expand to seize economies of scope. For example, business strategy may become unclear during periods of high employee turnover or when a business expands into new market channels. Periods high turbulence, when structure, goals, and values become unclear, are when resilience is most necessary. Operational resilience can serve as a dynamic buffer, enabling quick adaptation to internal and external pressures, and sufficient slack resources to provide leeway while maneuvering through unforeseen challenges (Lippsmeyer and Langemeier, 2023).

Information Technology

Information technology draws parallels between the collection and use of farm data to the concept of ‘surveillance capital’ used to enhance social media platforms (Lippsmeyer, Langemeier, and Boehlje, 2024b). In the context of production agriculture, information technology provides data-driven insights, helping producers identify operational inefficiencies, and assisting in on farm decision-making. The effectiveness of this resource is highly dependent on data collection, organization, and ability to accurately analyze the data and draw correct interpretations.

A common risk associated with information technology is data security. Whether it is financial data collected by a lender, input supplier data, or your farm production data, there are significant concerns about how to protect data from being stolen or accessed without permission. Strategies to limit data accessibility include user authentication to ensure only authorized users can access your farm records, data encryption for sending sensitive information, and access control limits to restrict who can view, modify, or delete data. In the age of increasing data collection and use, it is critical to read and fully understand contracts with equipment or information technology companies prior to signing away rights, and subsequently, knowing how to revoke access if necessary.

Risks relating to information technology span beyond data security. Often even if data collection and storage is done in a secure manner, there remain difficulties or limitations associated with data processing. This poses potential issues of uninformed or ill-informed farm decisions if incorrect conclusions are drawn from analysis, despite best efforts to use data driven insights.

Financial Resources

Financial resources include cash, investments, equity, and receivables, all of which provide liquidity to fund business expenses and updates to physical resources. Sufficient financial resources ensure farming operations can pursue new opportunities when they arise and have ability to weather through unexpected periods of high input costs or low market prices. Risks to financial resources include limited access to debt or equity capital and insufficient liquidity. Without the availability of financial resources, the ability to grow or seize new opportunities is significantly constrained, if not entirely unfeasible.

Physical Resources

Physical resources include land, machinery, buildings, and inventories. These assets are characterized by significant initial investment, continual need for maintenance, and a lack of liquidity relative to financial resources. Assessments of physical resources may vary based on the type of farming operation and the type of resource but generally take into account the resource’s useful life, initial level of investment, quality of maintenance, and salvage value. For example, maintaining land resources may involve soil testing, use of fertilizers to improve nutrient content, or use of cover crops to prevent erosion. While other physical resources like planters and combines need much more frequent maintenance and replacement after exhaustion of their useful life.

One of the major risks related to physical resources is inefficient use (i.e., low utilization rates). Inefficient use of machinery or storage facilities results in higher than necessary production costs. However, inefficient use may be justified in some scenarios. While inefficient use of physical resources is undesirable in the long run, for an operation that plans to grow, having some degree of slack may increase flexibility.

Other risks include improper care and overuse of a resource. These risks are often attributed to poor management or lack of investment due to ownership structure – for example, producers who rent versus own machinery or farm ground are typically more hesitant to make major investments because there is no guarantee they will reap the future benefit from the investment.

Inventories are the final physical resource we will address. Inventories, particularly stored crops, present unique risks including contamination with aflatoxin, insect infestation, or fire in storage bins from inadequate drying procedures. Inventories are the most liquid physical resource for farming operations, typically being sold within one year of harvest, and often used to supplement financial resources.

Human Resources

There are two varieties of human resources we will discuss: those internal to an operation and those which are external. Internal human resources include employees, management, company owners, as well as the relationships, knowledge, and competencies of each. These resources have extensive operational and industry knowledge which is built through time. Prior research shows experience displays positive relationships with profitability and financial efficiency (Vanhuyse, Bailey, and Tranter, 2021). Lippsmeyer, Langemeier, and Boehlje (2024b), discuss the importance of human resources and provide strategies for how to attract and retain quality employees. Risks relating to internal human resources include talent shortages, insufficient workforce, employee retention, and lack of experience. Losing employees incurs significant operational costs, both directly (due to insufficient labor availability) and indirectly (due to loss of tacit operational knowledge) (Spender and Grant, 1996).

External human resources include customer relations, interactions with and knowledge of suppliers. These relationships are more challenging to control due to their indirect connection with a business, yet remain critical for success. Risks relating to customer relations include losses of long-term customers and related market opportunities. Often these risks are closely related to product quality, pricing, and timeliness, as well as organizational resources. If customers perceive you as an unreliable supplier, relationships will deteriorate quickly. Maintaining consistent product quality, efficient logistics, knowledgeable employees, and quality service are all strategies businesses use to encourage longevity of reliable customer relationships (Claycomb and Martin, 2001).

Supplier risks include untimely deliveries, varying quality of inputs, and excessive or unexpected costs. These factors have the potential to influence quality or price of a product, potentially reflecting poorly on your business. Careful and frequent evaluation is necessary to decide which suppliers to continue doing business with, how to set and maintain input standards, and strategies to reward suppliers for desirable behaviors.

Setting Business Objectives

Obtainable business objectives are a critical part of every good farm business plan, so a direct path can be plotted from current performance levels to improved performance where objectives are met. Objectives may vary by enterprise, but likely revolve around improving quality standards, profitability metrics, and timeliness.

Objectives may include achieving specific quality benchmarks for products, retaining a specific proportion of contract agreements from year to year, ensuring a given percentage of deliveries are completed on time, or having management take part in strategy, business, or leadership improvement workshops. Objectives relating to information technology include learning to collect and store yield data, or developing systems to analyze the impact of different inputs on crop health. Objectives for financial resources include achieving specific financial ratio benchmarks, paying off high-interest lines of credit, or saving to invest in a new piece of machinery. Objectives to enhance and maintain human resources might involve hiring additional staff, offering career development opportunities, or offering incentives for loyal customers.

Developing A Business Plan

Using Figure 1, we encourage you to evaluate each of your farm’s key resources to help pinpoint any weaknesses in your resource base and subsequently identify areas in your operation needing improvement. Business plans should begin by identifying strengths or weaknesses of current resources, assessing the implications of relative strengths (or weaknesses) in achieving business objectives, and then focus on setting up step by step plans to achieve those objectives.

Once your business plan has been created, considerations also need to be made for the timing of major organizational changes or substantial investments. Both external shocks (e.g., macroeconomic uncertainties) and available operational slack must be considered to identify optimal timing to improve your resource base (Lippsmeyer, Langemeier, and Boehlje, 2024b).

In order to identify actions effective in making change, regular evaluations with consistent standards must be used to assess resource strength and progress made towards achieving objectives. Continually assessing strengths and weaknesses of key resources and identifying potential improvements can prevent businesses from developing a ‘needs-based strategy’ which waits for major issues to arise, then scrambles to control damage.

Conclusions

This article has provided a discussion of key resources and risks associated with each. By considering the strengths and weaknesses of your resource base, combined with the appropriate timing for investments, you will be better equipped to develop an effective business plan. Using the tools provided in this article, we prompt you to critically assess your farm’s key resources and develop a business plan which progresses from your current resource base to achieving business objectives.

References

Claycomb, C. and C.L. Martin, C. L. (2001). “Building Customer Relationships: An Inventory of Service Providers’ Objectives and Practices.” Marketing Intelligence & Planning, 19(6). doi:https://doi.org/10.1108/EUM0000000006109

Lippsmeyer, M. and M. Langemeier. (2023). “Agility and Absorption Capacity.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, April 20.

Lippsmeyer, M., M. Langemeier, J. Mintert, and N. Thompson. (2023). “Resilience to Strategic Risk.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, June 20.

Lippsmeyer, M., M. Langemeier, and M. Boehlje. (2024a). “Integrated Risk Management: Developing an Asset-Based Business Strategy.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, March 15.

Lippsmeyer, M., M. Langemeier, and M. Boehlje. (2024b). “Key Resources Determining the Future of the Farm.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, April 4.

Olsen, E. (2007). Assessing Your Business and Its Capabilities. In Strategic Planning for Dummies (pp. 121-140). Indianapolis: Wiley Publishing, Inc.

Spender, J., and R. Grand, R. (1996). Knowledge and the Firm: Overview. Strategic Management.doi:https://doi.org/10.1002/smj.4250171103

Vanhuyse, F., A. Bailey, and R. Tranter. (2021). “Management Practices and the Financial Performance of Farms.” Agricultural Finance Review, 81(3). doi:https://doi.org/10.1108/AFR-08-2020-0126

TAGS:

TEAM LINKS:

RELATED RESOURCES

Margaret Lippsmeyer, Michael Langemeier, James Mintert, and Nathan Thompson segment U.S. farms by farm resilience, management practices, and producer sentiment. This paper was presented at the Southern Agricultural Economics Meeting in Atlanta, Georgia in February.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.