March 5, 2025

Contingency Planning with Cash Flow Shortages

by Michael Langemeier

A contingency plan is a course of action designed to help a business determine how to respond to possible future events. Contingency plans are often referred to as “Plan B”. One of the most common contingency plans used by a business, particularly a small business, relates to how to respond to the departure or absence of key personnel. Contingency plans related to how to respond to changes in projected cash flows are also important. Given the expected drop in crop prices this fall and wide variability in expected prices, it would be prudent for a farm to examine the sensitivity of their cash flow and repayment capacity to changes in crop prices. This article illustrates the use of contingency plans for a case farm in southwest Indiana.

Sources and Uses of Funds

In addition to providing a mechanism for reporting how a farm’s performance during an accounting period influenced and was influenced by major funding activities, a sources and uses of funds statement is useful when developing contingency plans. Specifically, this statement can be used to examine whether the farm has enough cash flow from the farm to repay debt and purchase assets. An example of a sources and uses of funds statement using historical data is illustrated and described by Langemeier (2020).

The five primary categories of a sources and uses of funds statement are beginning cash balances, cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, and ending cash balances. Cash flows from operating activities are computed by subtracting cash farm expenses, owner withdrawals (e.g., family living withdrawals), and income and self-employment taxes from cash farm receipts. Cash flows from investing activities are computed by subtracting capital asset purchases from capital asset sales. If a farm is planning on purchasing assets, cash flows from investing activities will be negative. In other words, cash flows from operating activities or from financing activities will need to be used to help pay for the assets. Cash flows from financing activities are computed by subtracting principal payments from loans received during the year. If principal payments are higher than loan receipts, cash flows from financing activities are negative. Conversely, if principal payments are smaller than loan receipts, cash flows are positive.

Financial metrics and sources and uses of funds for a case farm in southwest Indiana will be examined below using a pro-forma spreadsheet that is available on the Center for Commercial Agriculture’s website. To use the pro-forma spreadsheet the following information is needed: current assets, current liabilities, crop acres, crop income (bushels in storage, crop prices, and crop yields), other income (e.g., beef income), crop and livestock expenses per acre or head, assets sales and purchases, and nonfarm income and expenses (e.g., family living expenses). When conducting a pro-forma analysis, it is common to use more than one scenario. In this article, we will use three crop price scenarios for sales this fall and ending inventories. The price scenarios were developed using historical basis and futures prices. For futures prices, the 25th percentile, the 50th percentile, and the 75th percentile for corn and soybeans were obtained in late February from the iFarm Price Distribution Tool. Cash prices were then computed by adding historical basis to futures prices.

Case Farm Example

Let’s use the cash flow definitions above to look at an example. The case farm is located in southwest Indiana and has crop acres and a small beef cowherd. Gross revenue and net farm income in 2024 were $584,482 and -$83,839, respectively. The operating profit margin in 2024 for the case farm was -14.7 percent. The farm has solid liquidity and solvency positions. The farm did not purchase any machinery in 2024. The capital debt repayment margin was negative in 2024 indicating that the farm did not have enough cash to cover owner withdrawals and principal on term debt. The farm used liquidity to cover these items. The farm is primarily interested in whether there will be enough cash to cover owner withdrawals and principal on term debt. If the capital debt repayment margin is positive, the farm may consider purchasing machinery and equipment.

There are least four different sources of cash that can be used to purchase machinery and equipment. Having said that, it is likely that a combination of these sources would be utilized. First, the farm could draw down cash balances. This would reduce liquidity, which may not be prudent. Second, the farm could use cash flows from operating activities, assuming that this number is positive. Third, the farm could sell other assets to help make the purchase. Fourth, the farm could borrow money to help pay for the asset. Where does contingency plans come in? If cash flow becomes relatively tight as the year progresses, cash flows from operating activities may be relatively small. In this instance, the farm will likely not purchase additional machinery in 2025.

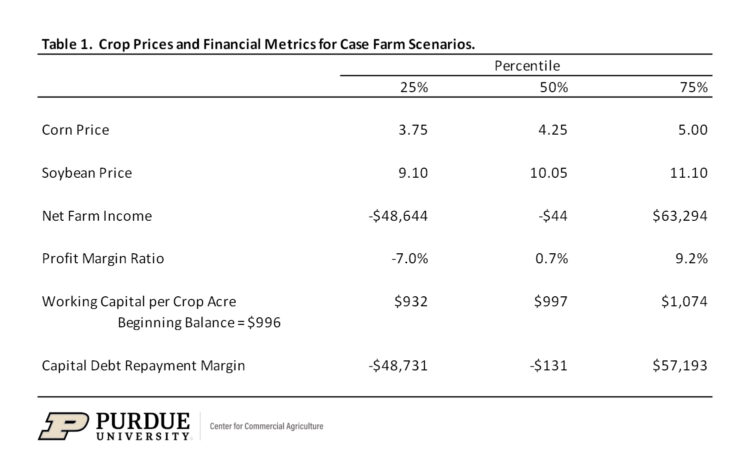

Table 1 presents crop prices and financial metrics for each crop price scenario. The only difference between the scenarios are the expected crop prices for fall sales and ending inventories. Net farm income was negative for the first two scenarios, while the operating profit margin ratio was negative for only the first scenario. Similarly, the capital debt repayment margin was negative for the first two scenarios. The negative capital debt repayment margin indicates that this farm does not have enough cash flow from operating and financing activities to fully cover principal and interest payments on noncurrent debt. Net farm income, the operating profit margin ratio, and the capital debt repayment margin were positive for the third scenario (75th percentile). Working capital per crop acre declined $64 for the 25th percentile, and increased $1 and $78 for the 50th and 75th percentiles, respectively. Crop prices under the third scenario (75th percentile) were high enough for the farm to breakeven. Given the relatively low net farm income, even under the third scenario, the case farm will likely defer machinery and equipment purchases to a later year. Depreciation for this farm is approximately $71,000. Thus, if the farm does not purchase any machinery in 2025, it will not be able to replace the value of machinery that was depreciated during the year. Long-term, it will need to do so.

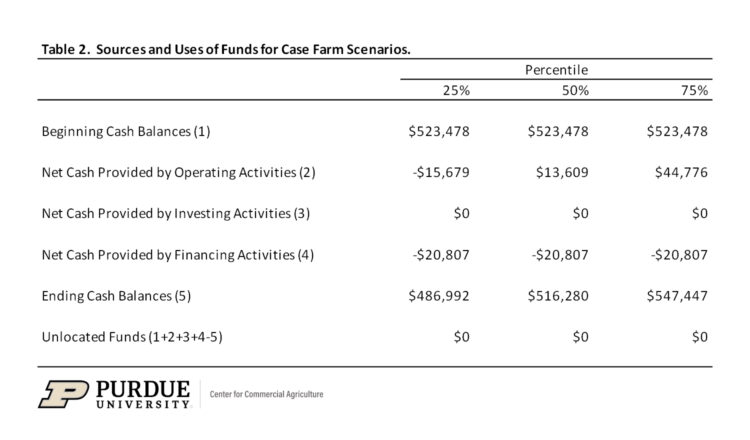

The primary categories for projected sources and uses of funds are illustrated in table 2. The net cash provided by investing activities excludes potential asset sales and purchases. The net cash provided by financing activities was negative reflecting the payment of term debt during the year. Net cash from operating activities was negative for the low crop price scenario, and was $13,609 and $44,776 for the medium price and high crop price scenarios, respectively. Note that depreciation, because it is a non-cash expense, is not subtracted from cash farm receipts when computing net cash provided by operating activities. As noted above, depreciation is projected to be approximately $71,000 in 2025. Thus, to at some extent this farm will be living off of depreciation in 2025. Net cash provided by operating activities would have been much lower without the relatively strong crop prices experienced for the sale of the remaining crop inventories from the 2024 crop in early 2025. The ending cash balance was lower than the beginning cash balance for the low price and medium price scenarios. For the high price scenario, the ending cash balance was approximately $24,000 higher than the beginning cash balance.

Summary and Conclusions

This article briefly discussed the use of contingency planning to project cash flow and repayment capacity. As cash flows from the farm operation become tighter, it is necessary to find other funds to help pay for asset purchases or delay asset purchases, and to repay debt. A case farm was used to illustrate how contingency plans could be used. Unless crop price prospects improve it would be difficult for the case farm to purchase assets, such as machinery and equipment, later this year. Working capital will be drawn down to meet term debt obligations under two of the three crop price scenarios examined, even if the farm does not purchase machinery and equipment in 2025. Given the potential volatility of crop prices this summer, it would be prudent to periodically update cash flow projections.

References

Langemeier, M. “Sources and Uses of Funds Statement.” Center for Commercial Agriculture, Purdue University, August 26, 2020.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.