April 24, 2013

Thoughts on the Relationship between Corn Price Expectations and Farmland Values

Over the course of the last few years I and my colleagues have repeatedly made the point that farmland values are driven by investor expectations of the magnitude of the future earnings that the farm will generate [1,2,3,4]. This view is based on the belief that the inherent reason for purchasing farmland is to obtain the earnings that it will generate over time and that investors consider opportunity costs. I consider such beliefs to be well grounded, but using them to value farmland is complicated by the fact that one must make forecasts of an unknown future in order to arrive at a farmland valuation[5]. This task is always challenging, but is particularly so in an environment where the supply and demand for agricultural commodities is rapidly shifting by great magnitudes.

Farmland is the U.S. Corn Belt clearly illustrates this issue. Commodity demand has undergone a number of substantial shifts ranging from rapidly growing demand in emerging economies and the widespread adoption of biofuel policies. On the supply side, the world has witnessed a number of weather induced negative supply shocks in critical growing regions which have limited supply availability. At the same time, world cropland acreage has begun to increase, and farmers in the U.S. are rapidly adopting technology that has the potential to increase supplies. All of these factors make it difficult to estimate future incomes. Keep in mind uncertainty surrounding monetary policies that have held interest rates to very low levels also impacts the expected value of these future earnings. The result is a rapidly evolving and complex farmland valuation environment.

One intriguing question is what do actual farmers and landowners expect regarding future income associated with a farmland investment? How are investors actually approaching the investment decision? What are their expectations for income? Are their expectations for income consistent with how they value farmland? Do they typically put these two concepts together or simply value farmland based on the last sale in their county or what the last person paid for a property? We have sought to gather some evidence on these questions.

The results from our first survey on these questions a little over a year ago were interesting. Most investors view the world with a great deal of uncertainty and there was a very wide range of expectations particularly regarding future agricultural output prices. While this is to be expected, many investors’ views of the level of output prices and farmland values seemed to be disconnected. In other words, some people thought future output prices would be low, but placed high values on farmland investments and vice-versa[6]. These results caused me to wonder if farmland values and expectations had become broadly disconnected.

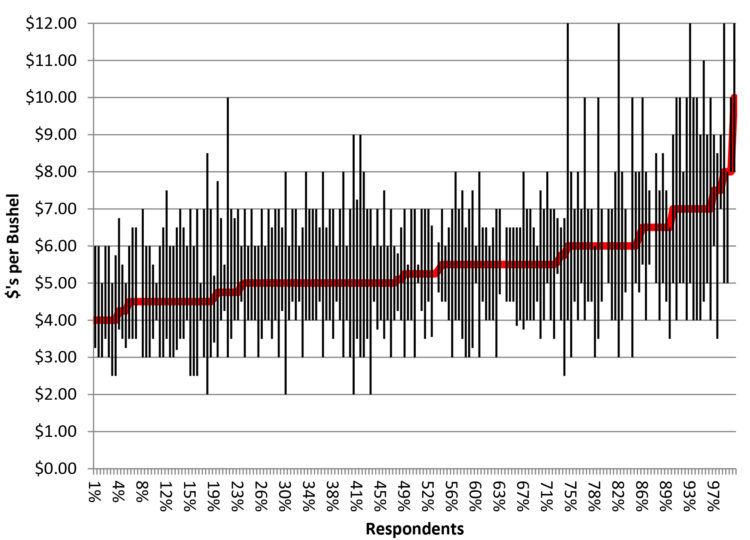

Consider Figure 1 which illustrates the March 2012 survey respondent’s views on corn prices. Respondents were asked to estimate the average cash corn price that they expected to receive over the next five years. We also asked them to place some high and low ranges around their estimates. The high and low price bands were 5-year average prices levels that respondents felt had a 1 in 10 chance of occurring (Figure 1). Casual observation of this figure shows that very few participants placed much likelihood on the chance that cash corn prices would average less than $3.00 per bushel over the next five years, and many put the bottom range at $4.00 per bushel.

These responses are summarized in more detail in Table 1 which shows that on average, respondents felt that cash corn prices would most likely average $5.41 per bushel over the next 5 years (Table 1). The median response was slightly lower at $5.25 per bushel. These price and relatively low interest rate expectations would go a long way in explaining the dramatic increase in farmland values that we have experienced in recent times.

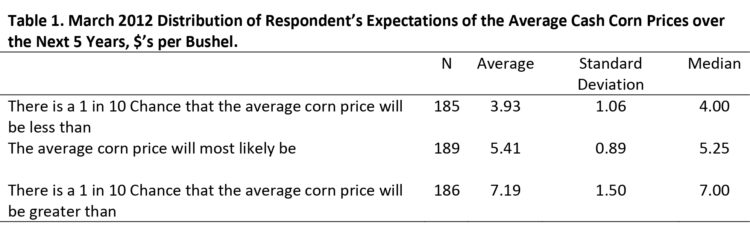

Table 1. March 2012 Distribution of Respondent’s Expectations of the Average Cash Corn Prices over the Next 5 Years, $’s per Bushel.

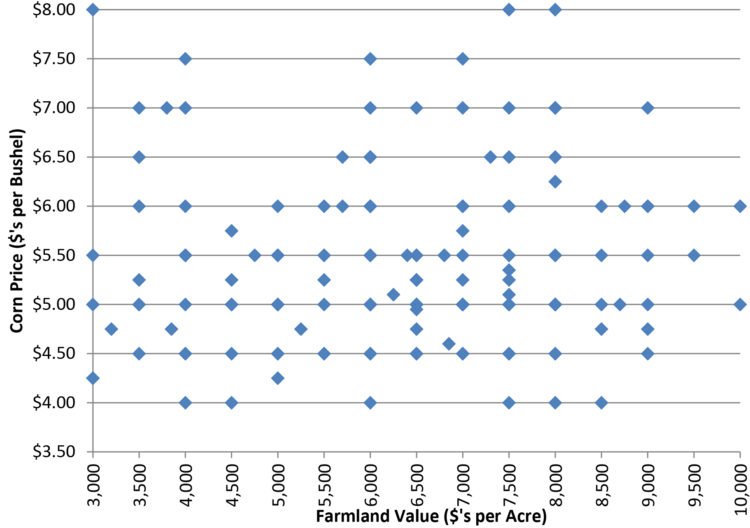

However, when respondent’s corn price expectations were compared to their views on farmland values a surprising result emerged. Figure 2 illustrates the relationship between the farmland value estimates and the most likely estimate of the 5-year average corn price. One would expect that those who place higher values on farmland would also expect that corn prices would be high. While it is certainly possible to find respondents in the sample that demonstrate the expected positive relationship between output prices and farmland values, there are also large numbers of respondents that express an opposite view. Quick observation reveals that there is essentially no systematic relationship between the view on corn prices and estimates of farmland values. Indeed, the correlation between these two variables was close to zero, meaning that while some individuals with high land value estimates also feel that corn prices are likely to be quite high, others with high land value estimates feel that corn prices will be low.

Figure 2. March 2012 Relationship between Forecast of Most Likely Corn Price and Estimate of Farmland Value. (Figure shows respondents with land value estimates between $3,000 and $10,000 per acres).

These results were indeed surprising, but let’s be clear about what is surprising. The level of corn price expectations can be expected to vary widely. The market is rapidly evolving and widely diverging corn price views should be expected. However, one should expect to see a relationship between output prices and land values, unless you believe that:

- as corn prices rise, input costs increase proportionally more than corn prices so that they consume the entire amount of revenue increases and vice‐versa, at lower corn prices input prices decline in a greater proportion than corn prices in order to keep the net returns constant;and/or

- that the differences are accounted for by differing interest rate and opportunity cost expectations such that people with high corn price expectations and low land value expectations have different interest rate/opportunity cost outlooks than those with high corn price and land price expectations. While possible to envision a world where these explanations explain all of the differences, it seems somewhat unlikely[7].

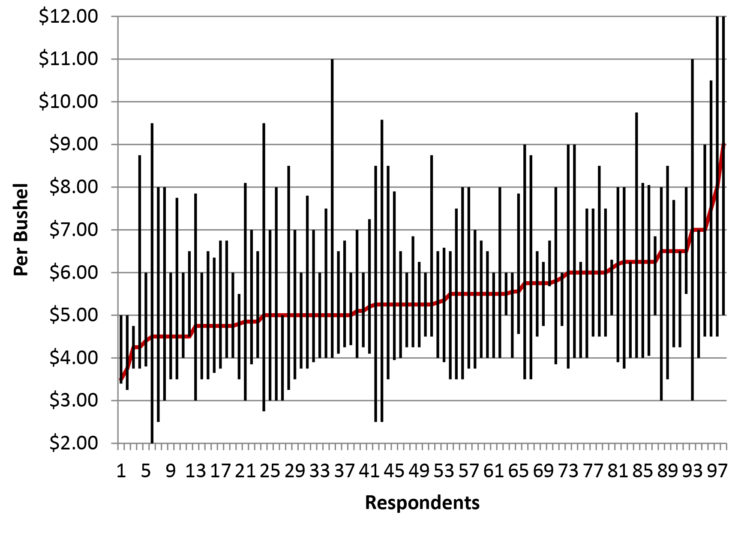

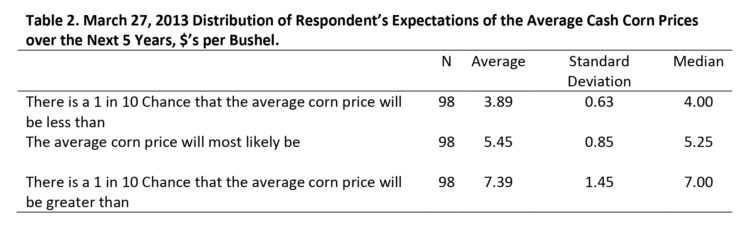

Certainly, the results deserve more study, so at a recent Center for Commercial Agriculture conference on farmland values we asked 100 respondents a similar set of questions[8]. Figure 3 shows the corn price distribution and the results are summarized in Table 2.

Figure 3. High, Low, and Most Likely Average Corn Prices over the Next 5 Years, 98 Respondents, March 2013.

Table 2. March 27, 2013 Distribution of Respondent’s Expectations of the Average Cash Corn Prices over the Next 5 Years, $’s per Bushel.

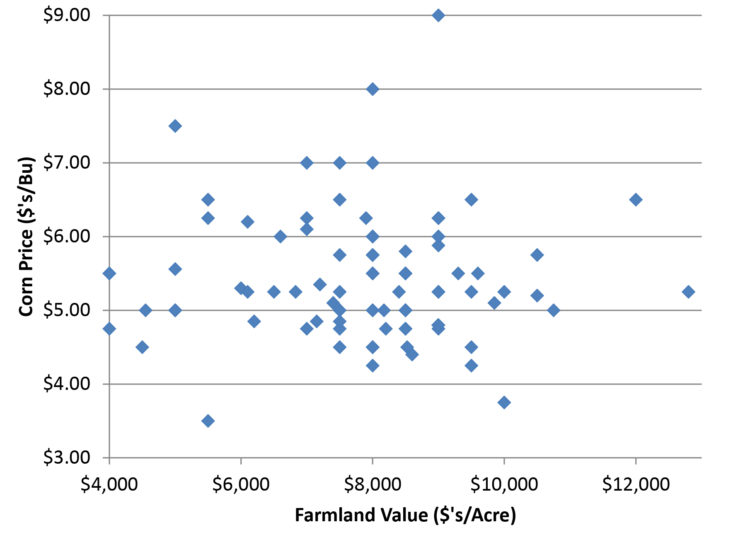

It is interesting to note that the corn price expectations were strikingly similar to the group that we surveyed in March 2012 even though the survey samples were from different individuals. The corn price results show the same wide disparity in price expectations as the previous study. It is not clear that the distribution of expectations is narrowing at all. We also asked this group to value a farm[9]. The relationship between corn price expectations and farmland values for this group is shown in Figure 4 and we see much the same picture as was found in the previous study.

Figure 4. March 2013 Relationship between Forecast of Most Likely Corn Price and Estimate of Farmland Value, 92 Respondents.

So What Do We Take from these Results?

While most people will eventually agree that fundamentals such as income and interest rates are a critical factor in the value of farmland, I have observed that many people frequently do not make this connection when determining their own valuation of farmland. When looking at these results, many people would like to attribute seeming disconnects to factors such as differing views on the future cost of production associated with farming. Others suggest that interest rate expectations might explain the result. In other words, most want to believe that investors form valuation based on a view about the present value of future earnings. While in the long‐run fundamentals almost certainly determine value, it is not clear that in the short run that these beliefs play a great role in that many people’s approach to valuation of farmland. Depending upon your view of the situation one might take a glass is half‐empty or half‐full view of this outcome. The half‐empty view would be that many market participants are forming value expectations without much apparent consideration of the fundamental forces that impact farmland values. The half‐full view would be that even though there is no strong positive relationship between output prices and farmland values, at least there isn’t a strong negative relationship between the two. The market is made up of individuals with a wide range of opinions and while any individual opinion may seem surprising or inconsistent with rational approaches to valuation, on average, the market may come to a rational consensus. In other words, if you look at the averages of these opinions you likely come up with a fundamental view that is rational. Clearly, the results in figures 2 and 3 are not as troubling as if there were a strong negative relationship between output price expectations and farmland values. If one uses the corn price expectations at the higher end of the range of our survey participants, farmland values are likely to be well supported at levels reported by many farmland surveys throughout the Corn Belt. If one chooses values toward the lower end of the range, values may be too high. What the future holds will determine which view is correct. The next paper in this series examines more detailed long‐range forecasts and what they might mean for farmland values.

A Final Word on the Comparable Sales Approach to Valuation

The view that asset prices should reflect the expected present value of future earnings is well grounded in economic theory. The most common critique that I receive about this approach is from people who argue that farmland is worth what someone else will pay for it. In other words, why worry about fundamentals when we have real data from actual sales to establish a value. To some extent I agree with these statements, but my agreement is conditioned on the fact that we must ask the question of what would motivate the next person to buy the asset. When the expected inherent value of the product (its earnings in the case of farmland) is of little consideration to buyers one must be cautious in using this approach, as buyers/sellers are simply making purchases based upon speculative logic about what the next person will think about prices rather than what the earnings of the asset might actually amount to. Some less tactful people than I have referred to this process as the find a greater fool approach to asset pricing and it is probably best applied to things like beanie babies and bitcoins rather than farmland. The approach of establishing value based on recent market transactions is widely used inpractice and essentially reflects the comparable sales approach to appraisal. While I agree that comparable sales reflect what someone is willing to pay for a property in a specific location at a specific time, it suffers from a number of problems in rapidly increasing or decreasing price environments and environments where limited or excess supply is available for transactions. This is particularly important for agricultural lenders to consider as they estimate collateral values. It should also be noted that the income approach to appraisal also suffers from these problems because the capitalization rate applied to incomes is almost always derived from recent comparable sales. Comparable sales approaches tend to lag the market and accentuate trends. For instance, since farmland prices have been trending upward, it is clear that comparable sales estimates will continue to rise as recent farmland sales results are tabulated, even if the most recent sales numbers start to fall and vice‐versa. Likewise, a fundamental shift in the long‐term outlook for demand or supply would not be captured incomparable sales data for a number of periods. If longer term fundamentals change, past prices do not matter, nobody will care what the previous owner or neighbor paid for a farm. New buyers will focus on what they might expect to gain by owning the asset in the future. In periods of relative tranquility for the outlook regarding the long‐term supply/demand situation, the comparable sales approach to valuation is likely to work quite well. When shifts in the view of long‐term supply and demand are underway comparable sales approaches, particularly for appraising agricultural loan collateral, should be used with caution.

1. Gloy, B.A. “Farmland Values: Will the Boom Turn Bust?” Center for Commercial Agriculture, Research Paper, (Also Published in Proceedings for 2012 Agricultural Symposium of the Kansas City Federal Reserve http://www.kansascityfed.org/publicat/rscp/2012/gloy‐paper2012.pdf), July 20, 2012.

2. Gloy, B.A., C. Hurt, M. Boehlje, and C. Dobbins. “Farmland Values: Current and Future Prospects.” Center for Commercial Agriculture, ResearchPaper, January 11, 2011.

3. Dobbins, C., B. Gloy, M. Boehlje, and C. Hurt. “Are Current Farmland Values Reasonable?” Purdue Agricultural Economics Report, April 2011.

4. Gloy, B.A., M.D. Boehlje, C.L. Dobbins, C. Hurt, and T.G. Baker. “Are Economic Fundamentals Driving Farmland Values?” Choices, 26:2(2011).

5. Gloy, B. et. al., 2012. “Farmland Value Expectations and Influences: Evidence from the Field.” Center for Commercial Agriculture, Purdue University, May 2012.

6. For a discussion about other approaches to thinking about valuation see the last section of this paper.

7. Other plausible explanations include that actual auction participants and investors with their own money at stake would be have more rationally, and/or that the questions didn’t make sense or were misleading or that one just doesn’t believe the survey results. These explanations should not be dismissed out of hand and everyone will have to judge their appropriateness for themselves.

8. The conference was held March 27, 2013. A full report of the results and description of this study are currently being developed and will be available here.

9. Participants were provided with an auction brochure and additional descriptive information about the farm. The production capacity of this farm was higher than the farm that was described in the March 2012 survey.

TEAM LINKS:

PART OF A SERIES:

RELATED RESOURCES

UPCOMING EVENTS

January 27 or 28, 2026

Farm Shield is more than a conference, it’s a commitment to helping agricultural families build resilience and plan for a secure future. Don’t miss this opportunity to protect your legacy!

Read MoreJanuary 9, 2026

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture’s future and how you can position your farm to be successful in the years ahead.

Read More