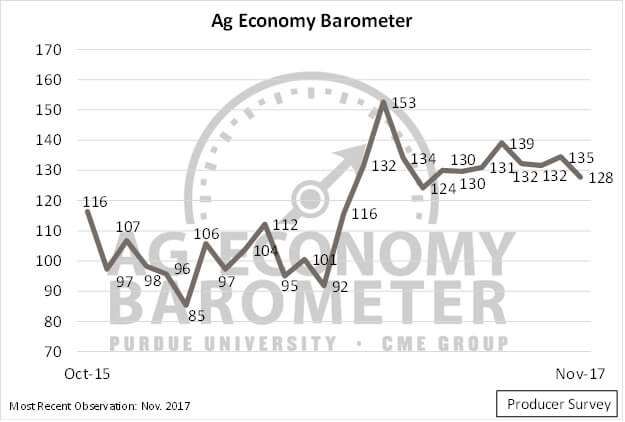

Ag barometer: Producer sentiment slips following harvest

Producers expressed lower sentiment toward the agricultural economy in November on the heels of fall harvest, according to the Purdue University/CME Group Ag Economy Barometer.

The November barometer read 128, a 7-point decline from October’s 135 and the second-lowest reading of 2017. The barometer is based on a monthly survey of 400 agricultural producers from across the country.

“The November slide in sentiment was primarily driven by reduced optimism about the future,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “We saw the Index of Future Expectations fall by 10 points, while the barometer’s other sub-index, the Index of Current Conditions, held steady at 129.”

In one of the survey questions, producers were asked whether they thought the next 12 months would be good times or bad times financially for the agricultural economy as a whole. Sixty-two percent said they thought the next 12 months will be bad times financially in U.S. agriculture. The percentage of producers expecting bad times in agriculture has been increasing since July when 50 percent of survey respondents said they were expecting bad times.

Throughout 2017, survey respondents have been asked about agricultural trade in an effort to understand how proposed policy changes might be impacting producer sentiment. When asked about the importance of agricultural exports to the overall U.S. agricultural economy, 96 percent rated them as important.

The survey also asked producers about the North American Free Trade Agreement (NAFTA).

“When we asked producers about NAFTA specifically, they were less confident about its importance to the U.S. agricultural economy,” Mintert said. “While 70 percent did rate it as important, a substantial 20 percent rated NAFTA as neutral, meaning neither important or unimportant.”

On a regular basis, the survey asks respondents about their expectations for farmland prices. For the first time in survey history, more producers said they expect higher farmland values than lower farmland values. Twenty-one percent said they expect farmland values to turn higher in the next 12 months, whereas 62 percent thought values would remain unchanged and 17 percent expect lower farmland values.

Read the full November report at http://purdue.edu/agbarometer. This month’s report includes additional information both sub-indices, farmland values and trade.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.