August 7, 2025

Flexible Cash Lease Comparisons

by Michael Langemeier

A recent article used a case farm in west central Indiana to illustrate net returns to land derived from crop share, fixed cash rent, and flexible cash lease arrangements. This article compares the net returns of a crop share arrangement with two flexible cash lease arrangements.

Crop Share & Flexible Cash Lease Arrangements

Net return to land from 2007 to 2025 from a landowner perspective were computed for a case farm in west central Indiana. Information for 2025 was projected using income and cost projections in early August. The case farm had 3000 crop acres and utilized a corn/soybean rotation. The three lease arrangements compared in this article are briefly discussed below.

With the crop share arrangement the landlord receives one-third of all revenue (crop revenue, government payments, and crop insurance indemnity payments). Where this crop arrangement differs from most crop share arrangements is the splitting of costs. Under this arrangement, the landlord does not split or share any of the non-land costs.

The first flexible cash lease arrangement used a base cash rent that was 75 percent of fixed cash rent. In addition to the base cash rent, the landowner receives a bonus to the extent that the average corn and soybean revenue is higher than 30 percent of corn revenue and/or 40 percent of soybean revenue. These percentages represent the long-run average land cost for these two crops as a percentage of total cost (includes both cash and opportunity costs). Bonuses are frequently paid out under this arrangement.

The second flexible cash lease arrangement used a base cash rent that was 90 percent of fixed cash rent. In addition to the base case rent, the landowner received a bonus of 50 percent of the revenue above non-land cost plus base cash rent if revenue exceeded non-land cost plus base cash rent. Revenue included crop revenue, government payments, and crop insurance indemnity payments. All cash and opportunity costs, except those for land, were included in the computation of non-land cost. This arrangement was compared to traditional crop share and cash rent arrangements in an earlier paper.

Net Return Comparisons

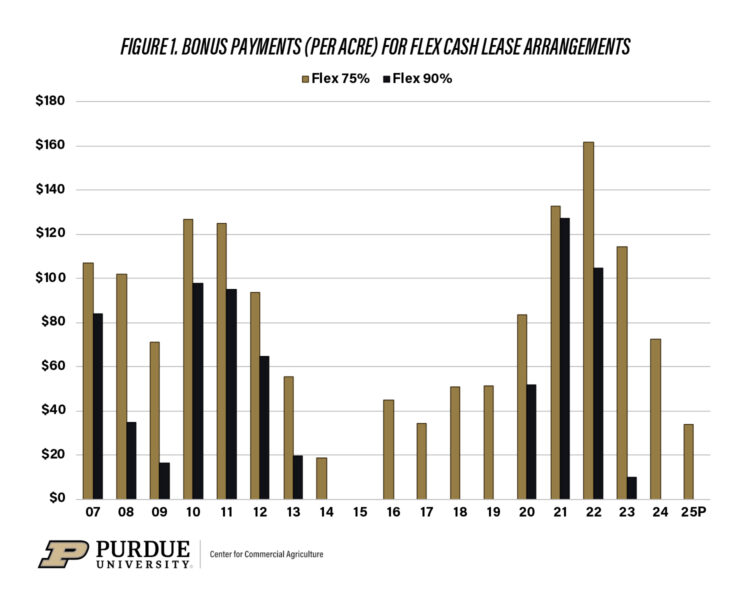

Before making comparisons between leases, we will briefly discuss bonus payments for the flexible cash leases. Per acre bonus payments for the two flexible cash leases are illustrated in figure 1. For the arrangement with a 75 percent base, bonus payments were incurred in every year except 2015. Payments ranged from $19 per acre in 2014 to $162 per acre in 2022. Bonus payments were incurred in 11 out of 19 years from 2007 to 2025 for the arrangement with a 90 percent base. For this lease arrangement, payments ranged from less than $10 per acre in 2023 to $127 per acre in 2021. From 2007 to 2013, the average bonus payment was $97 per acre for the arrangement with a 75 percent base and $59 per acre for the arrangement with a 90 percent base. During the 2020 to 2023 period, the average bonus payment was $73 for the 90 cash rent base and $123 for the 75 percent cash rent base.

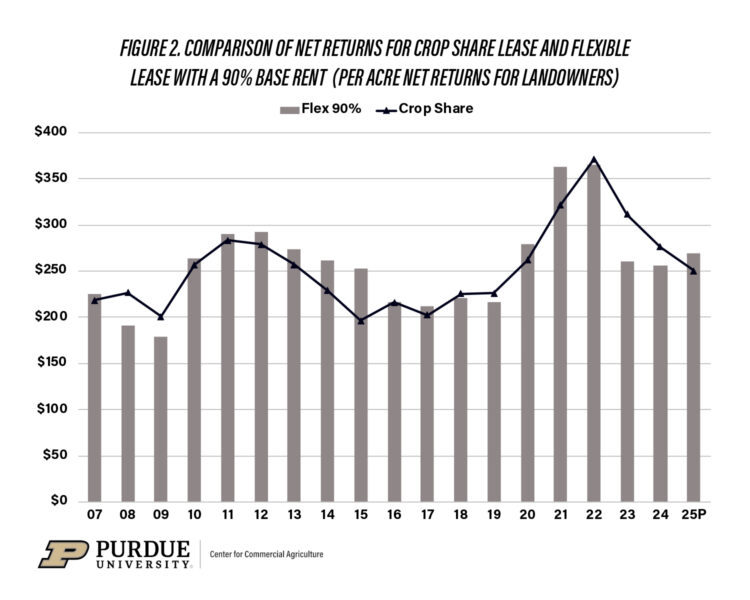

Pairwise comparisons were used to compare the three leasing arrangements. Specifically, the crop share and the flexible cash lease with a 75 percent base were compared with the flexible cash lease with a 90 percent base. Figure 2 compares the crop share lease to the flexible cash lease with a 90 percent base. The crop share lease had a higher net return in 2008, 2009, 2018, 2019, and from 2022 through 2024, and a lower net return in each of the other years. The net return for this lease was particularly low compared to the flexible cash lease in 2015.

Figure 2. Comparison of Net Returns for Crop Share Lease And Flexible Lease with a 90% Base Rent (Per Acre Net Returns for Landowners)

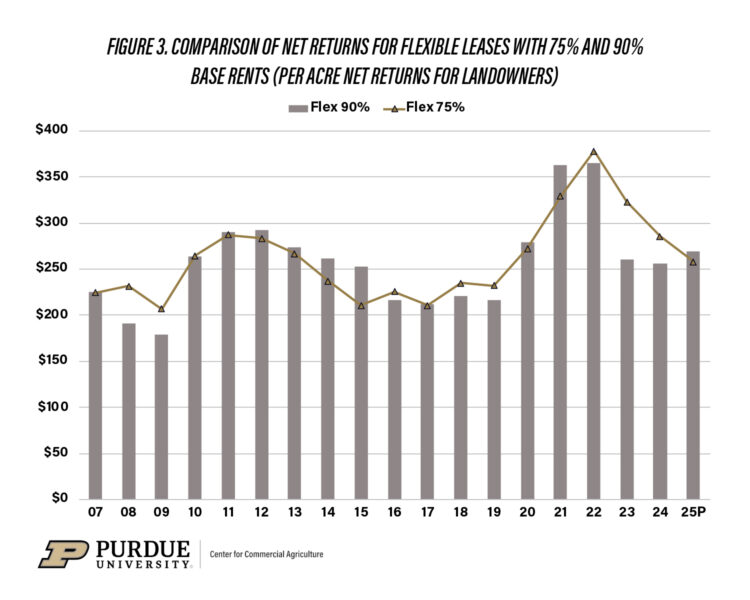

Figure 3 compares the net return for the two flexible cash leases. The flexible cash lease with a 75 percent is more correlated to the crop share lease than the flexible cash lease with a 90 percent base. Because of this, figure 3 looks very similar to figure 2. The net returns for the flexible cash lease with a 75 percent base were higher than those for flexible cash lease with a higher base in 2008, 2009, 2010, 2016, 2018, 2019, and from 2022 through 2024; and lower for the remaining years. As with the crop share lease, the net returns for the flexible cash lease with a 75 percent base were particularly low in 2015.

Figure 3. Comparison of Net Returns for Flexible Leases with 75% and 90% Base Rents (Per Acre Net Returns for Landowners)

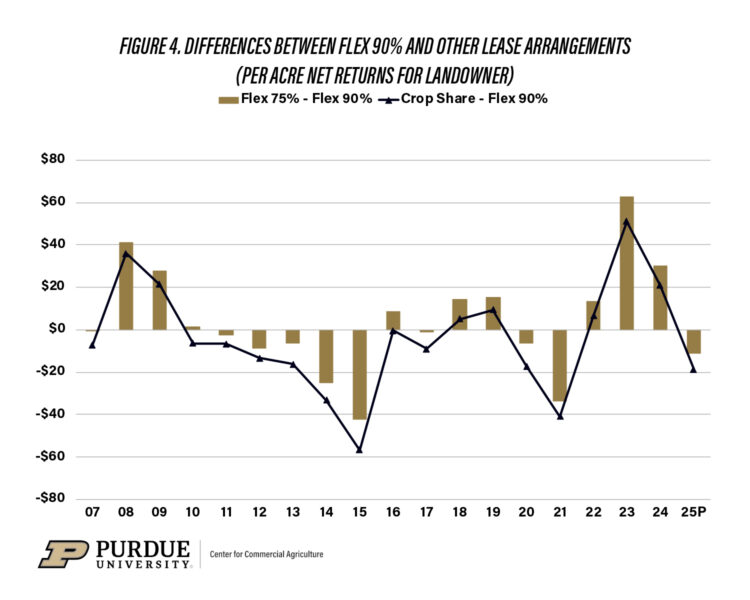

Differences between the flexible cash lease with a 90 percent base and the other two leasing arrangements are illustrated in figure 4. This chart was created by subtracting flexible cash lease payments for the arrangement with a 90 percent base from the net return for the crop share lease and the flexible cash lease with a 75 percent base. As was noted above, the net returns for the flexible cash lease with a 75 percent base mimic those for the crop share lease. However, there are a few differences in the trends for these two leases. For example, the decline in net returns for the crop share lease were more pronounced from 2010 to 2015, and in 2020 and 2021, and in 2025.

Figure 4. Differences Between Flex 90% and Other Lease Arrangements

(Per Acre Net Returns for Landowner)

Summary & Conclusions

This article used a case farm in west central Indiana to compare the net return to land for a crop share lease and two flexible cash lease arrangements. Using the results of a previous article along with those from this article, provides important insights. First, a landowner that is searching for a lease arrangement that combines the features of a traditional cash rent lease and crop share lease should examine the flexible cash lease with a 90 percent base rent. This lease arrangement provides protection against downside risk and provides bonus payments in years where gross revenue is relatively high. Second, there are minor differences between the traditional crop share arrangement and arrangements in which the landowner received one-third of all revenue or a flexible cash lease with a lower base rent and more frequent bonus payments.

References

Langemeier, M. “Comparing Net Returns for Alternative Leasing Arrangements.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, August 2025.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

September 16 at 7 pm or September 23 at 9 am

The Flexible Lease virtual Workshop, presented by the Purdue Extension Land Lease Team, will include a presentation and discussion to help you decide if a flexible land lease arrangement is right for your farm.

Read More