May 12, 2019

How Hog Diseases Impact Supply, Demand and Profit

by Chris Hurt

Hog prices and profits are way up right now. One of the primary reasons is a terrible disease known as African swine fever, which has been boosting prices since April. Thus, currently a hog disease is having a positive impact on pork producer incomes.

While our first reaction is that hog diseases are always bad for the pork industry, we need to understand how a disease will affect either supply or demand. Further, we need to identify where the disease might impact supply or demand, as well as if we’re looking at the income impacts on individual producers or the U.S. pork industry.

In this current case, ASF is reducing pork production outside the U.S., particularly in China. A reduction of supply in China is likely to result in greater pork exports from the U.S. Thus, ASF in China is increasing demand for U.S. pork and providing higher prices. All U.S. producers are sharing in the benefits of higher prices due to the disease, and the entire U.S. production industry is benefiting.

However, the impacts could change if ASF should break out in the U.S., as some fear and as USDA and other agencies are working hard to avoid. The initial question is whether an outbreak in the U.S. would cause pork consumers to reduce demand. A very important aspect of an outbreak would be to assure consumers that ASF is a hog disease that has no impact on human health. Maintaining consumer confidence in our product is vital to maintaining producer incomes.

If consumer demand is little impacted from a U.S. outbreak, then the primary impact would be from the reduction in production as hogs would need to be destroyed to control the spread. The magnitude of this lost supply is apparently large in China, but could be considerably smaller in the U.S.

Previous example

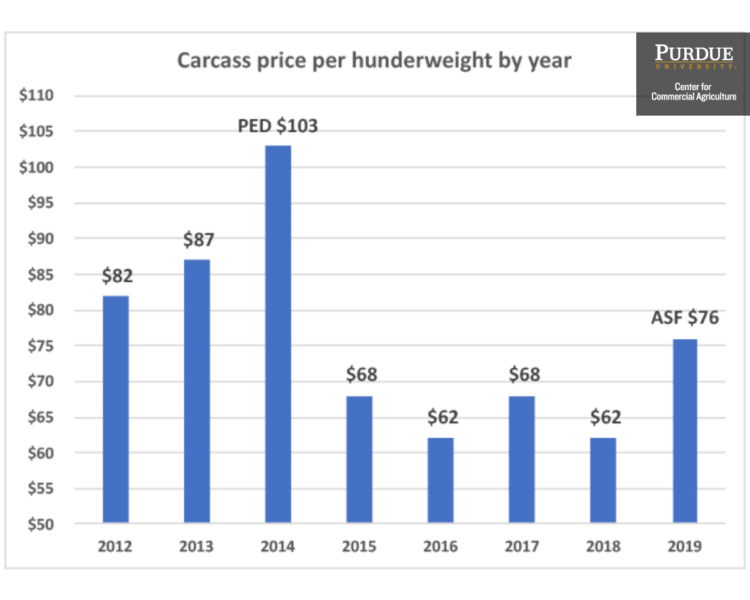

An example is the 2014 porcine epidemic diarrhea outbreak in the U.S. that resulted in a reduction of about 8% of production. Due to reduced supply, carcass prices set a high above $100. PED was a hog disease that had no implications for human health. The industry was able to get that scientific message out, and there was no serious erosion of public confidence in U.S pork.

If ASF should come to the U.S., and assuming consumers do not reduce pork demand, then the reduction in supply from measures to control the disease would boost pork prices even more. This again would be a positive economic outcome for the industry. But those producers directly affected by the disease could have near catastrophic losses, depending on potential government compensation.

The most recent examples of hog diseases — PED in 2014 and ASF today — have had a positive impact on U.S. hog prices and producers’ incomes. In fact, both can be regarded as an unexpected economic windfall for the industry. However, in the case of PED, some producers who had the disease on their farms had severe negative impacts.

ASF in China has had a major positive impact on incomes, with U.S. carcass prices expected to average near $76 this year. The story of ASF is still being written, so continue to expect volatility and potential changes to the outlook.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.