June 1, 2023

Corn Basis Implications from July-September Futures and Weather Conditions

by Nathanael Thompson

Corn and soybean basis has been relatively steady in recent weeks in most regions of the eastern Corn Belt. At the end of April James Mintert and I discussed the inversion in old crop corn futures contracts and the impact on basis and old crop marketing. See our conversation here. As anticipated, July ’22 corn futures have strengthened relative to September ’22 corn futures since the May ’22 corn futures contract went off the board. Corn basis has also remained very strong in many regions in the eastern Corn Belt. However, as we discussed in our conversation in April, attention now shifts to the July-September corn futures price spread, which has a strong inversion—September trading for $0.73/bu. less than July. How will this impact basis patterns for the remainder of the summer?

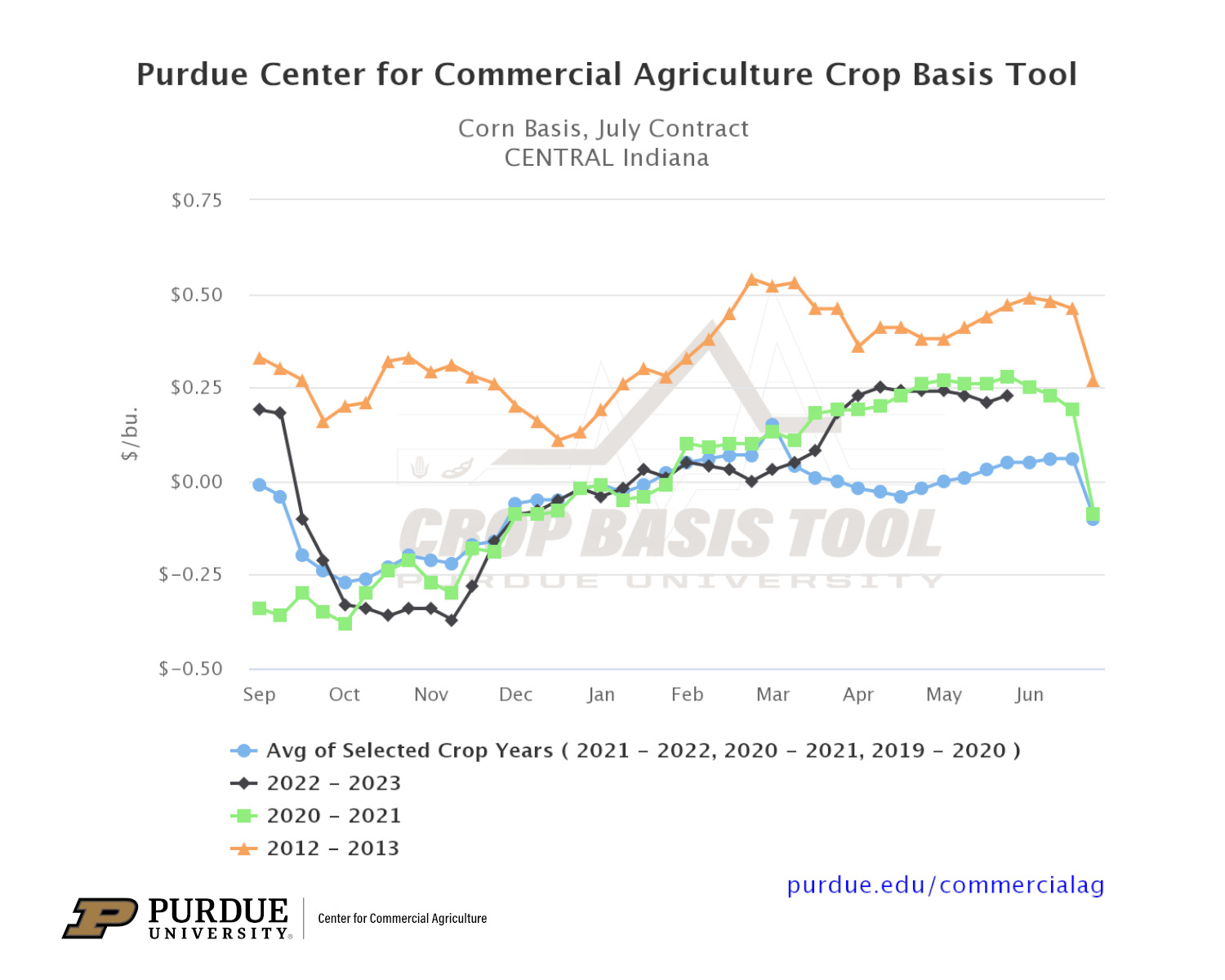

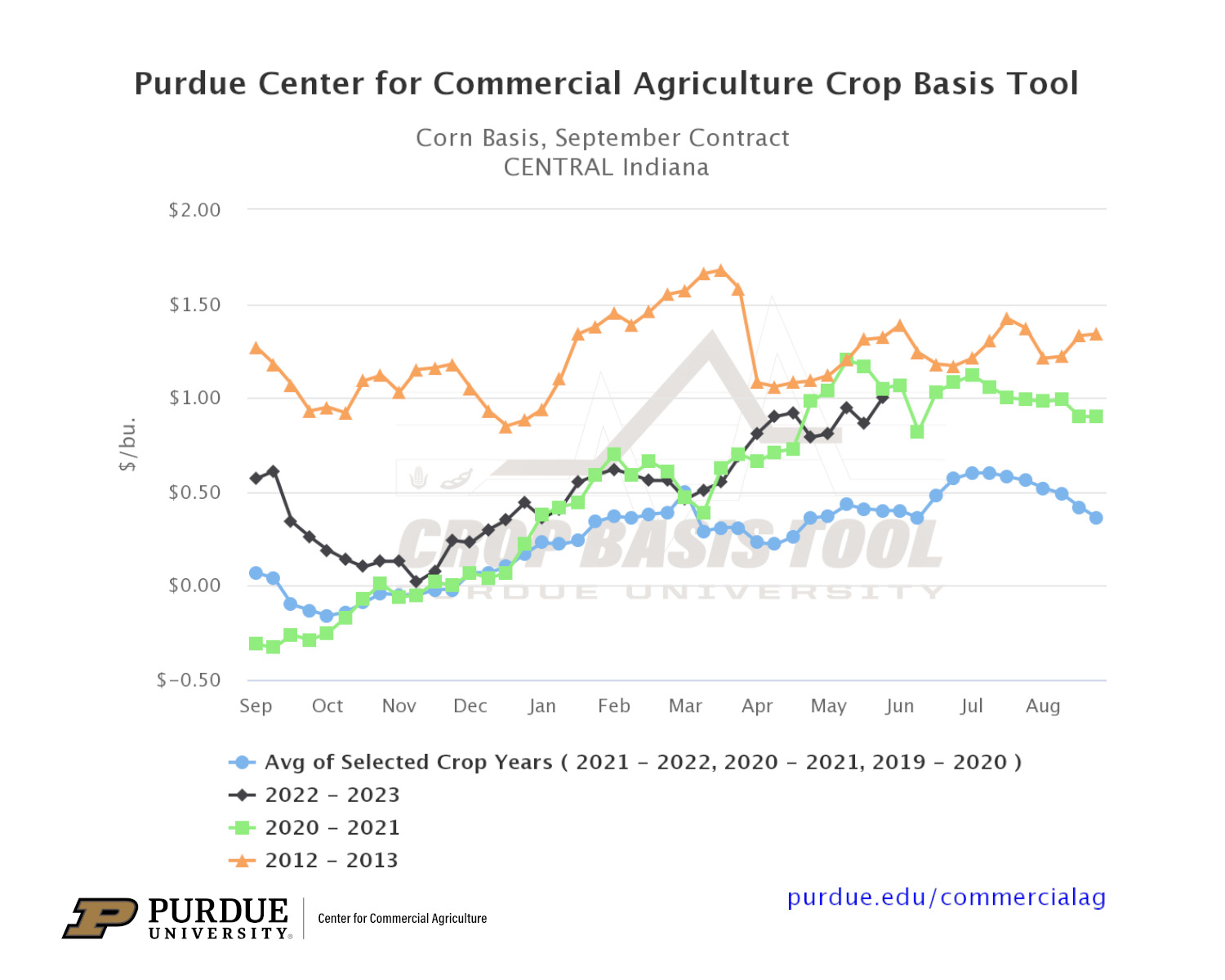

If we look at recent years with an inversion in the July-September corn futures spread, we find 2013—following the 2012 drought—and 2021—following increases in Chinese export demand. Looking at the basis patterns in these two years indicates that basis relative to July futures (Figure 1) will likely weaken in the coming weeks as we approach expiration of the July futures contract and basis relative to September futures is likely to remain strong (Figure 2).

However, weather in the coming weeks could impact both futures price spreads and basis patterns. If hot and dry conditions continue in the Midwest, we would expect to see the spread between July and September corn futures to narrow and basis to likely strengthen at locations that need corn this summer. However, if weather is favorable and crop conditions remain good, then this spread is likely to remain wide and basis will likely follow its seasonal pattern steadily weakening as we approach harvest in the Fall of 2023. Be sure to check out these basis patterns in your local market using the Purdue Center for Commercial Agriculture’s new and improved Crop Basis Tool.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.