October 5, 2023

Corn and Soybean Basis Weaken as Harvest Heats Up

by Nathanael Thompson

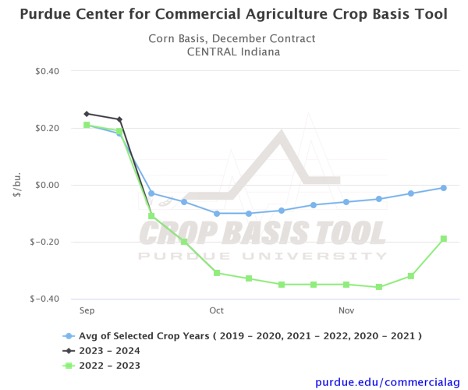

As harvest heats up across the Midwest corn and soybean basis have been weakening. Weakening basis during harvest is typical of seasonal basis patterns. Therefore, to give context to current basis levels it is helpful to compare them to historical basis levels. For example, looking at the 2019-2020, 2020-2021, and 2021-2022 crop marketing years, corn basis in Central Indiana declined by $0.31/bu. on average from the first week of September to the first week of October (blue line in Figure 1). However, notice that corn basis last year declined by more than $0.50/bu. over this same time period (green line in Figure 1). Weaker than normal basis last fall was largely influenced by transportation disruptions caused by low Mississippi River levels. Low river levels are again a factor in the fall of 2023. As a result, corn basis levels in Central Indiana are tracking 2022 basis levels nearly identically (black line in Figure 1).

Figure 1. Corn Basis, December Contract Central Indiana, Purdue Center for Commercial Agriculture Crop Basis Tool

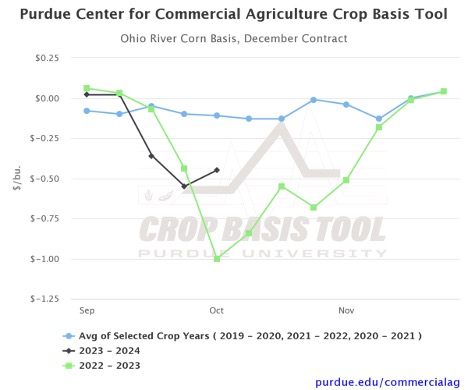

Looking at corn basis levels for terminals along the Ohio River paints a slightly different picture (Figure 2). While current basis levels are much weaker than normal—basis during the first week of October is $-0.45/bu. compared to an average of -$0.11/bu. during the 2019-2020, 2020-2021, and 2021-2022 crop marketing years—notice that basis appears to have firmed this week and is $0.55/bu. stronger than the same date last year.

Figure 2. Ohio River Corn Basis, December Contract, Purdue Center for Commercial Agriculture Crop Basis Tool

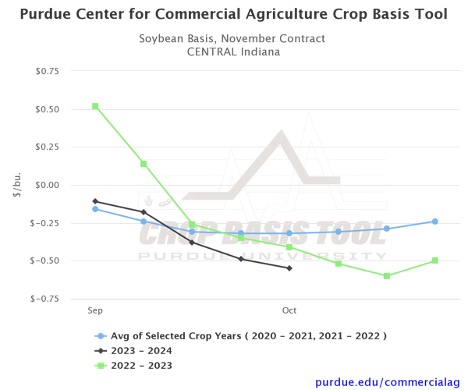

The story for soybean basis is similar. Soybean basis in Central Indiana has declined by $0.66/bu. from the first week of September to the first week of October 2023 (black line in Figure 3). As a result, current soybean basis for the first week of October—$0.55/bu. under November 2023 soybean futures—is $0.14/bu. weaker than the same week last year and $0.23/bu. weaker than the two-year average of the 2020-2021 and 2021-2022 crop marketing years.

Figure 3. Soybean Basis, November Contract Central Indiana, Purdue Center for Commercial Agriculture Crop Basis Tool

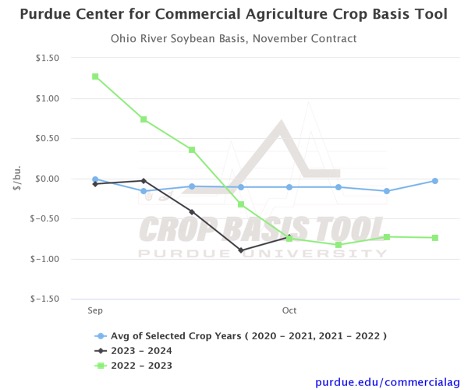

However, similar to corn, soybean basis at terminals along the Ohio River have actually firmed this week (Figure 4). Nonetheless, soybean basis at these locations—currently $0.73/bu. under November 2023 soybean futures—are $0.62/bu. weaker than the two-year average of the 2020-2021 and 2021-2022 crop marketing years and very similar to soybean basis at these locations for the same week last year.

Figure 4. Ohio River Soybean Basis, November Contract, Purdue Center for Commercial Agriculture Crop Basis Tool

Corn and soybean basis levels typically reach their seasonal lows during the month of October. However, it is important to point out that river levels are not projected to improve over the next month. Therefore, the risk of lower basis levels remains yet this fall.

Visit the Purdue Crop Basis Tool to check current corn and soybean basis levels and historical basis trends for your local area.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Margaret Lippsmeyer presented during agri benchmark’s 2024 annual conference in mid June, which was hosted by the Spanish Ministry of Agriculture in Valladolid, Spain. An increase in soybean acreage may come from either (a) shifting away from continuous corn rotations to corn-soy and (b) shifting corn-soy rotations toward corn-soy-soy. Based on agri benchmark data, Margaret showed that option (a) would require an increase in soybean prices of 6% and option (b) of 8% to make these rotations preferable over existing ones.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.