October 11, 2023

Trends in General Inflation and Farm Input Prices

by Michael Langemeier

Most of the recent discussion involving input price changes in U.S. production agriculture has focused on fertilizer prices, which have declined during the last few months. Other inputs have not necessarily experienced this decline in prices. Each input used in production agriculture and in other industries has its own set of supply and demand fundamentals. However, input prices can also be affected by changes in general inflation. This article compares and contrasts trends in general inflation with input price changes in U.S. production agriculture. In so doing, it updates input price and inflation information contained in Langemeier (2023).

Long-Term Relationships

Before discussing long-term relationships between general inflation and farm input prices, it is important to define key terms. Inflation represents the decline in purchasing power of a currency over time (). Quantitative estimates of the rate of inflation are typically made by examining the increase or decrease in the price levels of a basket of selected goods. Inflation measures include the consumer price index and implicit price deflators. Though computed using different methodologies, inflation measures are highly correlated over time. Most economists would agree that an increase in the supply of money is the root cause of inflation. Inflation mechanisms can be classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation (Investopedia, 2022). When an increase in the money supply increases overall demand more than the productive capacity of an economy, we have demand-pull inflation. When production costs increase prices, we have cost-push inflation. Quality improvements and technological change are often incorporated into cost-push inflation. Quality improvements would increase prices while technological change tends to reduce prices. Finally, when individuals expect current inflation rates to continue in the future, we have built-in inflation. In general, the longer above average inflation rates persist, the more important built-in inflation becomes. All three of these types of inflation mechanisms have contributed to the inflation we have witnessed in the last couple of years.

As noted above, input price changes in production agriculture and other industries are due to general inflation and its mechanisms as well as supply and demand fundamentals specific to a particular input. Having said that, some inputs are more closed aligned or correlated with general inflation than other inputs.

Using information for the 1973 to 2022 period from the Federal Reserve Bank of St. Louis on inflation rates and farm input price indices from USDA-NASS, we examined the correlation between the implicit price deflator for personal consumption expenditures and agricultural production items (i.e., general input price index for production agriculture), feed, seed, fertilizer, fuels, labor, and machinery. The correlation coefficient between the implicit price deflator and agricultural production items was 0.611. The average annual rate of change over the period was slightly higher (3.9 percent) than the rate of change for the implicit price deflator (3.4 percent). The average annual price changes for labor (4.4 percent) and machinery (5.6 percent) were significantly higher than the average increase in the implicit price deflator. In terms of the six specific input categories examined, the only correlation between the implicit price deflator and the input price change that was not significantly different from zero was the correlation between the implicit price deflator and feed prices. The correlations between the implicit price deflator, and labor and machinery were relatively higher than the correlation between the implicit price deflator and general farm price index (i.e., agricultural production items). This is an important result because it suggests that input prices for labor and machinery more closely follow trends in general inflation than input prices for items such as feed, seed, fertilizer, and fuels.

Relative variability can be measured using the coefficient of variation which is computed by dividing the standard deviation by the average. The coefficient of variation for the rate of change in agricultural production items was 81 percent higher than the coefficient of variation for the implicit price deflator. The coefficients of variation for feed, fertilizer, and fuels were higher than the coefficient of variation for the more general farm input price index (i.e., agricultural production items). The coefficient of variation for the input price index for labor was smaller than the coefficient of variation for general inflation.

Historical Trends in General Inflation and Farm Input Prices

This section compares and contrasts the 1-year, 5-year, and 10-year averages for the implicit price deflator for personal consumption expenditures and farm input prices. Data for the implicit price deflator was obtained from the Federal Reserve Bank of St. Louis. Data for all of the farm inputs except fertilizer and diesel were obtained from USDA-NASS. Fertilizer and diesel price data were obtained from USDA-AMS.

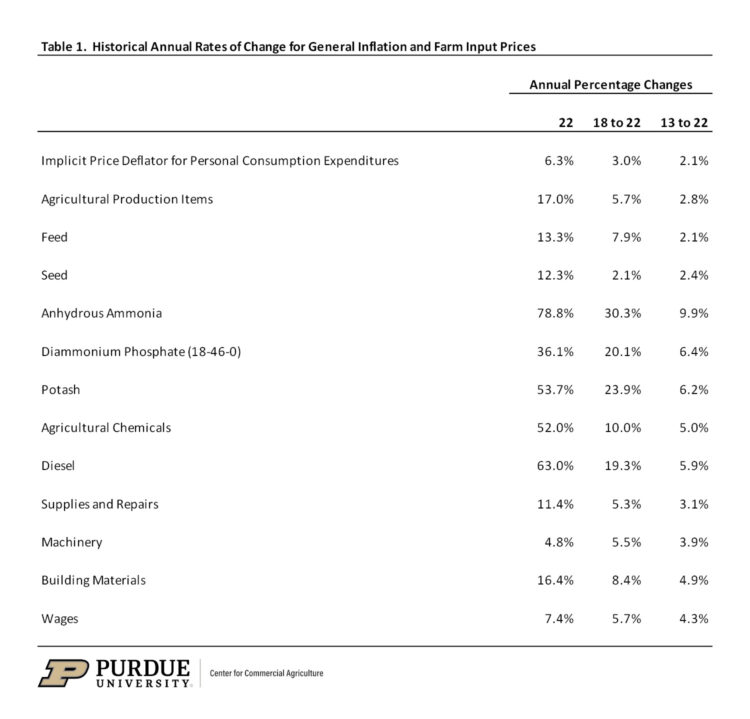

Table 1. Historical Annual Rates of Change for General Inflation and Farm Input Prices

Table 1 presents the average price changes for inflation and farm inputs for 2022, for the 2018 to 2022 period, and for the 2013 to 2022 period. The first thing that becomes immediately apparent is how much higher inflation was in 2022 compared to the 5-year and 10-year averages. The 10-year average inflation rate was only 2.1 percent.

Now let’s compare the rate of general inflation to annual farm input price changes. For the annual change from 2021 to 2022 (labeled 2022 in table 1), the input price changes for all of the farm inputs except for machinery were higher than the annual change in the implicit price deflator. Annual price changes for energy and fertilizer were particularly large. The annual price change for diesel was 63 percent. The annual price changes for fertilizer ranged from 36 percent for diammonium phosphate to 79 percent for anhydrous ammonia. Turning to the 10-year averages, the only farm input with a price change smaller than or equal to the rate of change for the implicit price deflator was feed. The 10-year input price increases for diesel, potash, phosphate, and anhydrous ammonia exceeded 5 percent. The results in table 1 illustrate how much of an outlier the price changes in 2022 were compared to the long-run averages.

Recent Trends in General Inflation and Farm Input Prices

Figure 1. Percentage Change in Inflation and Farm Input Prices in the Last 12 Months

Figure 1 illustrates average input prices for the latest 12 months for which data were available (i.e., August 2022 to August 2023). The percentage change in the implicit price deflator was 3.5 percent. This is down sharply from the annual average in 2022 (i.e., 6.3 percent), but is still above historical averages. The input price changes for all of the inputs listed in figure 1 were below the annual price change for the implicit price deflator. Despite the large decreases in the last 12 months, fertilizer prices are still well above what they were in 2020. For example, though lower than the prices in August 2021 and August 2022, the August 2023 price for anhydrous ammonia is still 20 percent higher than it was in 2020. The input price changes for supplies and repairs, machinery, and wages were approximately 2.5 percent. The results in figure 1 can be used to help explain why the breakeven prices for corn and soybeans are expected to decline from 5 to 10 percent in 2024 after increasing sharply in 2022 and 2023.

Concluding Comments

This article discussed trends in general inflation and farm input prices. Over long periods of time, farm input prices are significantly correlated with general inflation. However, farm input prices are by no means perfectly correlated with general inflation. Each input has its own supply and demand fundamentals. Farm input price indices for machinery and labor were more correlated with general inflation than feed, seed, fertilizer, and fuels.

For the input price categories examined, the prices were below the inflation rate for the implicit price deflator for personal consumption expenditures during the last 12 months. Moderation in input prices, particularly fertilizer prices, is likely to result in lower crop breakeven prices in 2024.

Citations

Federal Reserve Bank of St. Louis. FRED Economic data, accessed on October 4, 2023. https://fred.stlouisfed.org/

Fernando, J., M.J. Boyle, and P. Rathburn. “Inflation.” Investopedia, Updated January 12, 2022. https://www.investopedia.com/terms/i/inflation.asp

Langemeier, M. “Trends in General Inflation and Farm Input Prices.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, April 13, 2023.

USDA-AMS. Illinois Production Reports, accessed on October 4, 2023. https://mymarketnews.ams.usda.gov/viewReport/3195

USDA-NASS. Quick Stats, accessed on October 4, 2023. https://quickstats.nass.usda.gov/

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

January 27 or 28, 2026

Farm Shield is more than a conference, it’s a commitment to helping agricultural families build resilience and plan for a secure future. Don’t miss this opportunity to protect your legacy!

Read MoreJanuary 9, 2026

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture’s future and how you can position your farm to be successful in the years ahead.

Read More