November 9, 2023

November 2023 Corn & Soybean Basis Update

by Nathan Thompson

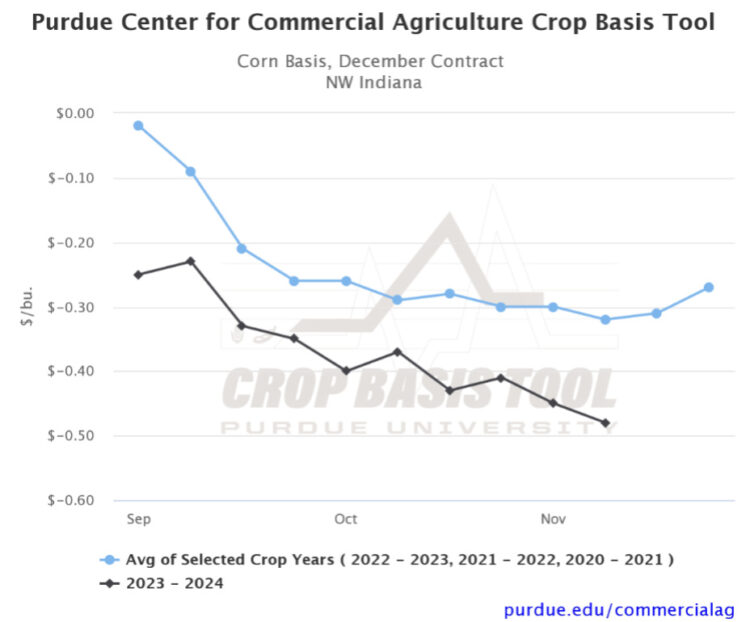

As the calendar turns to November, many farmers in the eastern Corn Belt still have corn left to harvest. According to USDA, 68% of corn in Indiana has been harvested as of November 5th. Wet corn in the primary culprit. As a result, many elevators are full and are at drying capacity. One might expect this to result in weaker basis bids and in some locations it has. For example, corn basis in north west Indiana is $0.48/bu. under Dec. ’23 corn futures, which is $0.16/bu. weaker than the 3-year historical average for the region. However, basis is not the only tool that elevators use to control the flow of grain into the elevator. Many elevators are operating on reduced hours to limit the amount of corn they take in likely limiting basis impacts.

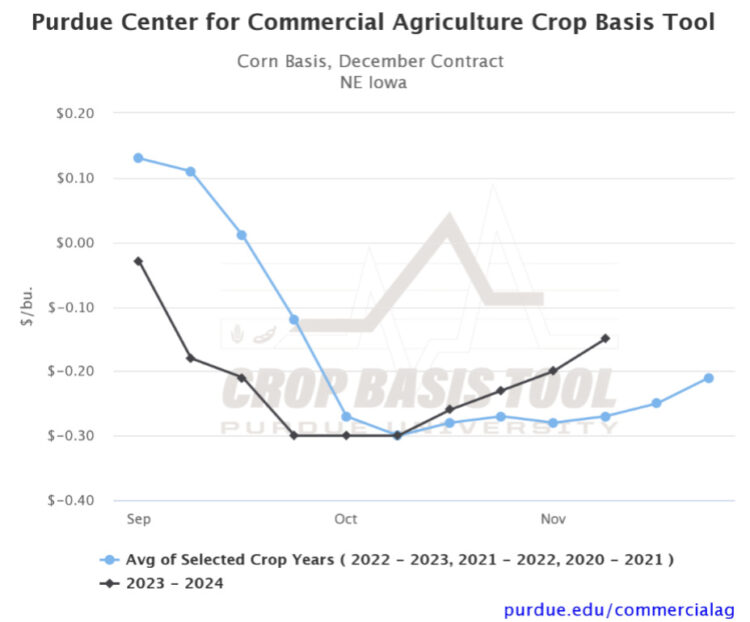

It is interesting to contrast this with what is happening in Illinois and Iowa, where corn harvest is around 90% complete. Corn basis across much of these states has started to strengthen. In particular, regions such as eastern Iowa are experiencing stronger than normal basis due to severe drought in the region during 2023. For example, corn basis in north east Iowa is $0.15/bu. under Dec. ’23 corn futures, which is $0.12/bu. stronger than the 3-year historical average for the region.

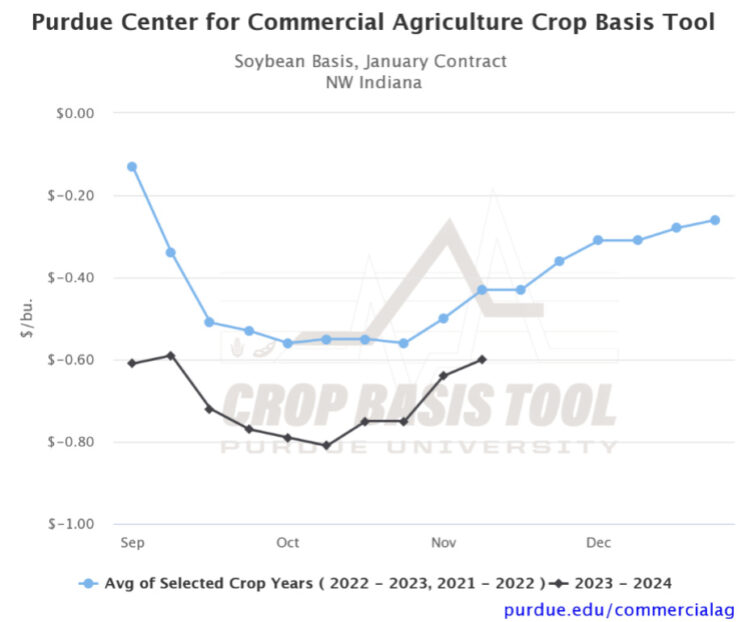

Turning our attention to soybeans, harvest has been much more even, ranging from 87% to 97% complete in Indiana, Illinois, and Iowa as of November 5th. Soybean basis has also been strengthening across the region, especially in the past two weeks. For example, soybean basis in north west Indiana is $0.60/bu. under Jan. ’24 soybean futures. While this $0.17/bu. weaker than the 2-year historical average for the region, this gap has been narrowing in recent weeks. As always, be sure to visit the Purdue Center for Commercial Agriculture Crop Basis Tool to check current corn and soybean basis levels and historical basis trends for your local area.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Corn and soybean basis levels have improved across much of the Eastern Corn Belt in early 2026, though large regional differences remain. Learn what’s driving basis strength—and how to track your local opportunities using Purdue’s Crop Basis Tool.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.