November 14, 2023

Trend in Breakeven Prices for Cattle Finishing

by Michael Langemeier

Average fed cattle prices increased from an average price of $161 in the first quarter of 2023 to $180 in the third quarter, or 12 percent. Moreover, feeding cost of gain had declined from its peak earlier this year. These two phenomena represent the good news. Now for the not so good news. Feeder steer prices have increased substantially from their levels earlier this year. Obviously, net returns to cattle finishing depend on fed cattle prices, feeder cattle prices, and feeding cost of gain. An earlier article examined trends in feeding cost of gain (Langemeier, 2023). This article will focus on recent trends in feeder prices and breakeven prices, and provide projections for the next few months.

Historical Breakeven Prices

Breakeven prices are sensitive to changes in feeding cost of gain, feeder prices, and interest rates. Monthly issues of the Focus on Feedlots newsletter were used to obtain information on feeding cost of gain. Historical and projected feeder prices were obtained from the Livestock Marketing Information (LMIC) web site. Interest rates were obtained from the Federal Reserve Bank of Kansas City.

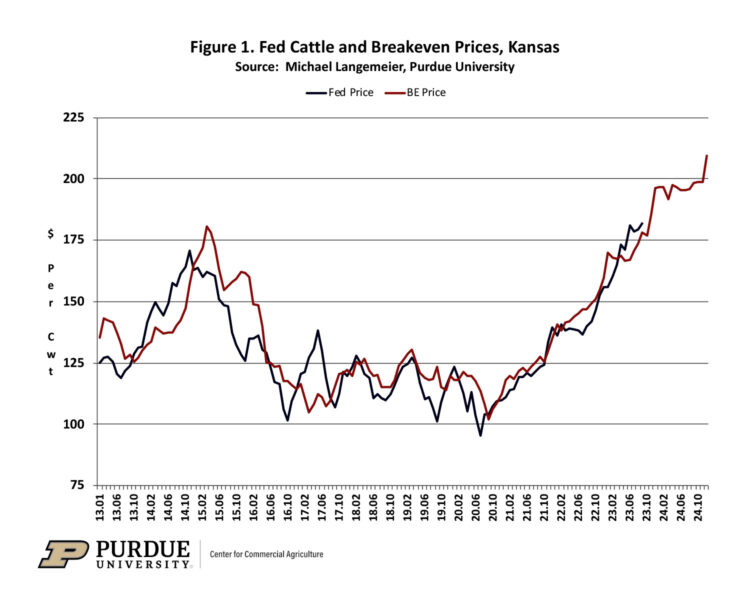

Figure 1 illustrates breakeven prices from January 2013 to September 2023 as well as projections for 2024. In this section we will focus on historical breakeven prices. In the next section will discuss our projections. As evident from figure 1, breakeven prices have been increasing rapidly since the fourth quarter of 2022. After averaging approximately $155 per cwt. in the fourth quarter of 2022, breakeven prices averaged approximately $168.40 per cwt. in the first quarter of 2023 and $167.40 per cwt. in the second quarter. Average breakeven price for the third quarter of this year was approximately $174.20.

Though not a focus of this article, net return can be determined using the difference between fed cattle price and breakeven price in figure 1. Since April of this year fed cattle price has been higher than breakeven price with the widest gaps (i.e., largest net returns) occurring in June and July. Whether this relationship between fed cattle price and breakeven price continues will be discussed below.

Projected Breakeven Prices

Breakeven prices are expected to average approximately $186 per cwt. in the fourth quarter of 2023, with the highest breakeven price, $196 per cwt., occurring in December. What about the gap between fed cattle and breakeven prices? The gap is projected to be positive in October and November, and then become negative as we move into December.

For the first one-half of 2024, breakeven prices are expected to range from $193 to $197 per cwt. Will these breakeven prices lead to cattle finishing losses? They very well could. However, given the relatively tight beef supplies, the potential monthly gaps between fed cattle and breakeven prices, or net returns, are very difficult to project.

Summary and Conclusions

Fed cattle prices have strengthened the last few months. At the same time, due to lower corn prices, feeding cost of gain has also declined. Partially in response to these two phenomena, feeder prices and breakeven prices have increased substantially. Breakeven prices for the fourth quarter of this year are expected to be $10 per cwt. higher than those for the third quarter. Moreover, breakeven prices in early 2024 are expected to be $10 per cwt. higher than the projected breakeven prices for the fourth quarter of this year. These large increases in breakeven prices increase the uncertainty related to net return prospects for the next few months.

References

Focus on Feedlots, Animal Sciences and Industry, Kansas State University, www.asi.k-state.edu/about/newsletters/focus-on-feedlots , accessed October 11, 2023.

Langemeier, M. “Impact of Lower Corn Prices on Feeding Cost of Gain for Cattle Finishing.” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, October 12, 2023.

Livestock Marketing Information Center, www.lmic.info/, accessed November 3, 2023.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.