February 6, 2024

Producer Sentiment & Resilience at the Purdue Top Farmer Conference

by Margaret Lippsmeyer, Michael Langemeier, James Mintert, & Nathan Thompson

Introduction

Each year in early January, Purdue University hosts the Purdue Top Farmer Conference, where academic speakers, agribusiness affiliates, and farmers convene to discuss current issues and trends in agricultural markets. At this year’s conference, participants were invited to complete a brief survey assessing farm resilience and producer sentiment. A total of 83 survey responses were collected, with 53 coming from farmers. This article compares the producer sentiment of attendees at the Purdue Top Farmer Conference with survey responses from the Purdue/CME Group Ag Economy Barometer survey conducted in December 2023. It then contrasts the farm resilience levels of conference attendees with those from a national survey on farm resilience to strategic risk conducted by the Purdue Center for Commercial Agriculture in April 2023. The survey respondents at the Top Farmer Conference, though not a random sample, offer unique insights into how some of Indiana’s leading farmers compare to respondents of national surveys.

Producer Sentiment

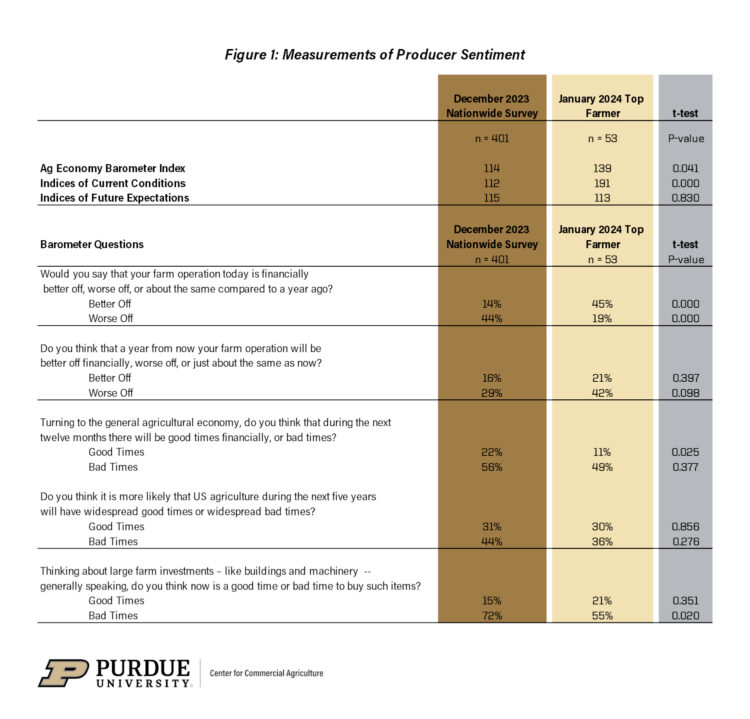

In December of 2023, the Ag Economy Barometer recorded a reading of 114, with the Index of Current Conditions slightly lower at 112 and the Index of Future Expectations slightly higher at 115 (Mintert & Langemeier, 2024). The Farm Capital Investment Index for December 2023 stood at 43, changing only by one point compared to the previous month. This index gauges respondents’ perceptions of the suitability of the current time for making large farm investments. The average value of the Farm Capital Investment Index over the past five years has been 52, suggesting that producers currently view it as a relatively unfavorable time for large farm investments.

However, a comparison with the producer sentiment from participants at the 2024 Purdue Top Farmer Conference reveals a more optimistic outlook regarding the state of the agricultural economy (Figure 1). Survey results show that their Ag Economy Barometer Index has a combined reading of 139, with a notably high Index of Current Conditions at 191. At 113, the Index of Future Expectations aligns with the national level. Additionally, the Farm Capital Investment Index for Top Farmer Conference attendees was at 66, indicating that, although the current period might not be ideal for large farm investments, these producers are significantly more optimistic compared to their counterparts in the nationwide survey.

A possible explanation for this disparity in producer sentiment, particularly for the Index of Current Conditions, could be the higher-than-expected corn and soybean yields across the Midwest, particularly in Indiana and Ohio, despite early-season drought conditions. Since the conference attendees are predominantly from the Midwest, their sentiment following a comparatively successful season is much more positive than that of producers who experienced less favorable growing conditions in 2023.

Resilience to Strategic Risk

Resilience to strategic risk has been a major focus for the Purdue Center for Commercial Agriculture (CCA) in recent months, driven by the impact of exogenous shocks in agricultural markets. At the Purdue Top Farmer Conference, this topic was confirmed to be of significant interest, with 98% of attendees expressing either moderate or high interest in learning more about strategic risk, its impact on their operations, and strategies for building resilience.

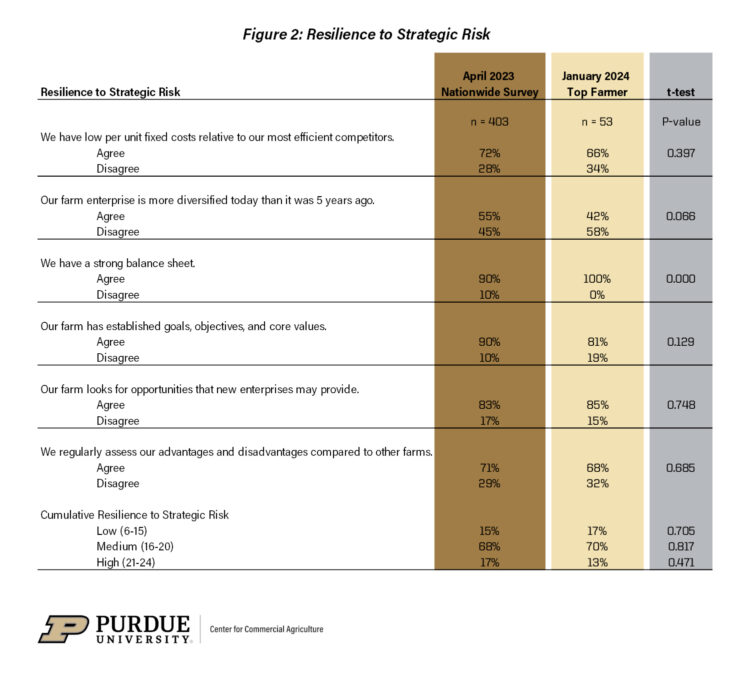

In April 2023, the Purdue CCA conducted a nationwide survey to better understand the average commercial producer’s resilience to exogenous market shocks. The same survey questions were posed at the Purdue Top Farmer Conference to assess the resilience levels of attendees, yielding largely similar results. Statistical tests comparing the resilience of the two groups found the aggregate measures to be virtually identical. However, more nuanced differences emerged when breaking down the survey results by individual question. The most notable variances were observed in responses regarding farm diversification and balance sheet strength.

From the April 2023 survey, 55% of respondents reported that their farm enterprises were more diversified than five years ago. In contrast, only 42% of Top Farmer participants indicated increased diversification in their enterprises (Figure 2). Farm diversification is considered a key metric for resilience, as it reduces reliance on any single enterprise. However, the lower diversification rate among Top Farmer Conference participants is less surprising when considering that they are primarily Midwestern farmers, with a focus on corn and soybean production.

Given that resilience scores are cumulative, and diversification was lower for Top Farmer participants, yet overall resilience levels were consistent across groups, suggests these producers excel in another resilience metric. This metric is financial performance, measured by balance sheet strength. Notably, 100% of respondents at the Purdue Top Farmer Conference self-assessed as having a strong balance sheet.

Farm Growth Expectations

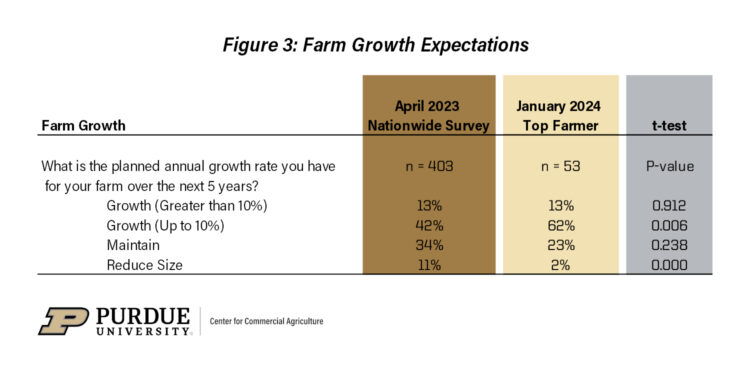

In addition to questions on resilience and producer sentiment, participants were asked about their annual farm growth expectations. Responses to this question were compared between attendees at the Top Farmer Conference and respondents from the Purdue CCA resilience survey conducted in April 2023 (Figure 3). In the nationwide survey, 11% of respondents indicated plans to reduce farm size, 34% intended to maintain their farm size, and 55% aimed to grow their operations in the next five years. In contrast, at the Top Farmer Conference, a mere 2% of participants planned to reduce the size of their farms, 23% intended to maintain their current size, and 75% planned to expand their operations in the coming five years.

Conclusions

The trends observed in the survey responses from this year’s Top Farmer Conference align with expectations. As previously mentioned, many of these producers experienced above-average yields in the last harvest, benefiting from generally favorable growing conditions in the Midwest, despite earlier drought conditions. Such a successful year inevitably fosters greater optimism about the general agricultural economy, as reflected in the Ag Economy Barometer, and positions farms more favorably for growth and capital investments.

The consistency in resilience levels across producer groups can be largely attributed to the lower diversification levels observed among conference attendees. While diversification can mitigate risk, specialization can also be a strategic business approach. Specialization may lower operational fixed costs, enhance production efficiencies, and improve profitability. Therefore, a slight decrease in resilience might be a trade-off that producers are willing to accept, adopting a business strategy that entails higher risk for the possibility of higher returns. More detailed information on farm resilience to strategic risks can be found in (Lippsmeyer et al., 2023).

References

Lippsmeyer, M., M. Langemeier, J. Mintert and N. Thompson. “Resilience to Strategic Risk.” Center for Commercial Agricultural, Purdue University, June 23, 2023.

Mintert, J. and M. Langemeier. (2024). U.S. Farmer Sentiment Stable as Inflation Expectations Subside. Purdue Center for Commercial Agriculture. Retrieved from https://ag.purdue.edu/commercialag/ageconomybarometer.

TAGS:

TEAM LINKS:

RELATED RESOURCES

Margaret Lippsmeyer presented during agri benchmark’s 2024 annual conference in mid June, which was hosted by the Spanish Ministry of Agriculture in Valladolid, Spain. An increase in soybean acreage may come from either (a) shifting away from continuous corn rotations to corn-soy and (b) shifting corn-soy rotations toward corn-soy-soy. Based on agri benchmark data, Margaret showed that option (a) would require an increase in soybean prices of 6% and option (b) of 8% to make these rotations preferable over existing ones.

READ MOREUPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.