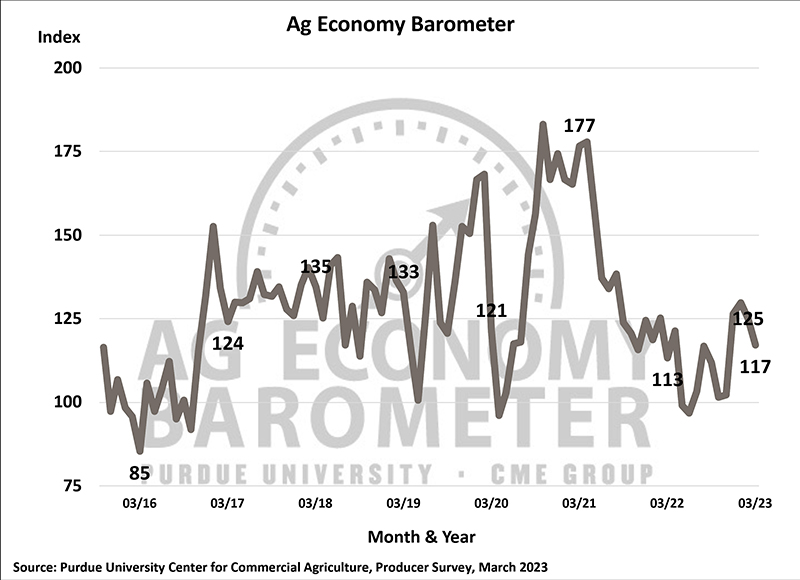

Commodity price outlook and interest rate concerns cloud farmer sentiment

Farmer sentiment weakened again in March as the Purdue University/CME Group Ag Economy Barometer fell 8 points to a reading of 117. Both of the barometer’s sub-indices declined 8 points in March, leaving the Current Conditions Index at 126 and the Future Expectations Index at 113. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted between March 13-17, which coincided with the demise of Silicon Valley Bank and Signature Bank.

“Rising interest rates and weaker prices for key commodities including wheat, corn and soybeans from mid-February through mid-March were key factors behind this month’s lower sentiment reading,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Although the March survey did not include any questions directly related to the bank closures, during an open-ended comment question posed at the end of each survey, multiple respondents voiced concerns about the banking sector’s problems and its potential to hurt the economy. These problems also likely weighed on producer sentiment.”

The Farm Financial Performance Index remained unchanged from February at a reading of 86. Producers point to higher input costs (34% of respondents) and rising interest rates (25% of respondents) as their number one concern for the year ahead. Notably, concern about higher input cost has been falling since last summer’s peak when 53% of respondents cited it as their number one concern for the year ahead. At the same time, the percentage of producers pointing to interest rates as a top concern has been increasing, up 11 points from last summer.

While there was little change in the Farm Capital Investment Index, down one point to a reading of 42 in March, there was a change in how respondents perceived whether now was a good or bad time for large investments. Since last July, respondents who felt now is a bad time to make large investments have consistently chosen “increased prices for farm machinery and new construction” as the key reason. That changed in March as more felt that rising interest rates (34% of respondents, up from 27% in February) over high prices (32% of respondents, down from 45% in February) was the key reason that now is a bad time for such investments.

Producers’ outlook for farmland values in the short-term and long-term were mixed in March. The Short-Term Farmland Value Index declined 6 points to 113, while the Long-Term Farmland Value Index rose 5 points to 142. This month’s short-term index value provided the weakest reading since September 2020 and left the index 32 points lower than a year earlier. One out of five producers in this month’s survey said they expect farmland values to weaken in the next 12 months. Long-term, 17% of respondents said they expect weaker values in the next five years, up from 13% a year ago and 7% two years ago.

This month’s survey included several renewable energy questions focused on the ethanol and renewable diesel sectors. When asked to look ahead five years, nearly half (46%) of respondents said they expected the renewable diesel industry to be larger than it is today, while just a quarter (25%) expect the ethanol industry to grow over the same time period. In a follow-up question, respondents were asked what impact they expect the renewable diesel industry to have on soybean prices over the upcoming five years, with 39% expecting a price increase of up to .50 cents per bushel, 28% expecting a boost in price between 50 cents up to $1 per bushel, and 21% expecting soybean prices to rise by $1 or more per bushel.

Read the full Ag Economy Barometer report. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results. For more information, check out the Purdue Commercial AgCast podcast, which includes a detailed breakdown of each month’s barometer and a discussion of recent agricultural news that affects farmersThe Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec, EBS, TriOptima, and Traiana are trademarks of BrokerTec Europe LTD, EBS Group LTD, TriOptima AB, and Traiana, Inc., respectively. Dow Jones, Dow Jones Industrial Average, S&P 500, and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.