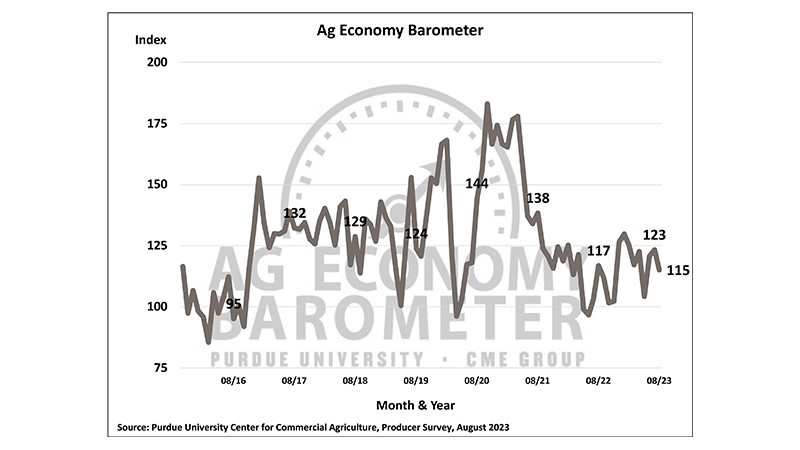

Farmer sentiment dips amid weaker view of current conditions

Producer sentiment was notably lower in August, as the Purdue University/CME Group Ag Economy Barometer index dipped 8 points to a reading of 115. This month’s decline was fueled by producers’ weaker perception of current conditions both on their farms and in U.S. agriculture. The Index of Current Conditions fell 13 points to a reading of 108. The Index of Future Expectations also declined 5 points in August to a reading of 119. This month’s Ag Economy Barometer survey was conducted from August 14-18.

“Rising interest rates and concerns about high input prices continue to put downward pressure on producer sentiment,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “This month over half (60%) of the producers we surveyed said they expect interest rates to rise in the upcoming year.”

When asked about their top concerns for their farming operations in the next 12 months, producers continue to point to higher input prices (34% of respondents) and rising interest rates (24% of respondents). Even though crop prices weakened significantly this summer, only one in five producers (20% of respondents) chose declining commodity prices as one of their top concerns.

The Farm Capital Investment Index was lower this month, falling 8 points to a reading of 37. Increasing prices for farm machinery and new construction along with rising interest rates continue to be the two most commonly cited reasons for their negative view. Meanwhile, producers’ rating of farm financial conditions changed little in August, as the Farm Financial Conditions Index declined just one point to a reading of 86.

Despite increasing concerns about rising interest rates, producers remain cautiously optimistic about farmland values. The Short-Term Farmland Value Expectations Index rose one point to 126, while the long-term index was unchanged at a reading of 151. About 4 out of 10 (39%) respondents said they expect farmland values to rise over the next year, while 13% said they look for values to decline in the next year. When asked about their longer-term view of farmland values, more than 6 out of 10 (63%) respondents said they expect values to rise over the next five years, while 12% said they expect values to fall.

To better understand the usage of carbon contracts in row-crop agriculture, corn and soybean growers were asked about the types of conversations they have had with those companies. In the August survey, 6% of corn and soybean growers said they have engaged in discussions with companies about receiving payments to capture carbon on their farms, while just 2% said they had signed a carbon contract. Nearly half (47%) of the farms who discussed contract terms with a company said they were offered a payment rate of $10 to $20 per metric ton of carbon captured. Among the farms who engaged in discussions but chose not to sign a carbon contract, half said it was because the payment level was too low.

Read the full Ag Economy Barometer report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available at https://purdue.ag/barometervideo. For more information, check out the Purdue Commercial AgCast podcast available at https://purdue.ag/agcast, which includes a detailed breakdown of each month’s barometer and a discussion of recent agricultural news that affects farmers.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world's leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec and EBS are trademarks of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.