December 1, 2011

Pasture Rental Arrangements

Why Seek Equitable Lease Arrangements?

Determining rental rates is not an exact science. Local demand and supply conditions, anticipated market conditions and even long standing working relationships can have some bearing on rental rate negotiations. It is in the best interests of both land owners and renters to establish and record rental agreements that are equitable.

The success of the lease depends on meeting the needs of all parties. Both the land owner and livestock owner legitimately seek to recover their direct and opportunity costs. The “Contributions Approach” is a method to estimate the annual costs to own and operate a pasture enterprise. Once the ownership and operating expenses are budgeted, these values can be used to estimate an equitable division of receipts.

This document illustrates the contributions approach using a Missouri beef stocker example. The principles and worksheets outlined apply to grazing dairy cattle, sheep, goats, horses, and other roughage-consuming livestock. Examples using other species or geographic regions can be obtained from the NCFMC Lease website at: http://AgLease101.org/. The site also contains additional leasing resources and Extension contact information.

A sample lease form is included at the end of this publication.

Stocking Rates

Other than the lease rate, perhaps the most important aspect of any pasture lease is the stocking rate. Clearly specifying the stocking rate in the lease agreement helps avoid disagreements between both parties and maintains the quality of the grass stand.

Stocking rates can be stated in number of animals or as “animal units.” When establishing stocking rate by number of head, it is important to designate the type (e.g. bull, cow, yearling, etc.) of livestock and weight of livestock to be grazed. Stocking by animal units is useful for stocking animals that are not necessarily for weight gain such as dairy heifers, beef cow/calf, and horses. Animal units are described in the footnote.1 Because the definition of animal unit has changed over time, it is recommended that any pasture lease agreements specify the definition being used.

Setting pasture rent on a per-acre basis or a share of gain basis gives an incentive to the livestock owner to stock heavily. The landowner, on the other hand, may desire light stocking rates in order to preserve pasture quality. It is in the interest of both parties to develop a lease agreement that achieves maximum economic returns to all resources while maintaining the grass stand and quality.

Several ways of expressing stocking rates exists. Stocking rates can be expressed as the average during the lease period since numbers may vary as animals are born or die and weight will vary with time. Alternatively, the rent can be established on the basis of animal-days or animal unit-days to account for the changing number and size of animals grazing at different times during the grazing season. Stocking rates can have a maximum set so that it never exceeds a particular rate at any one time.

Establishing Landowner and Livestock Owner Contributions

The landowner’s cost and livestock owner’s net return are two financial estimates used to establish pasture leases. By completing Worksheets 1 and 2 of this publication, information necessary to compute various lease rates can be computed.

Landowners’ Cost Estimate

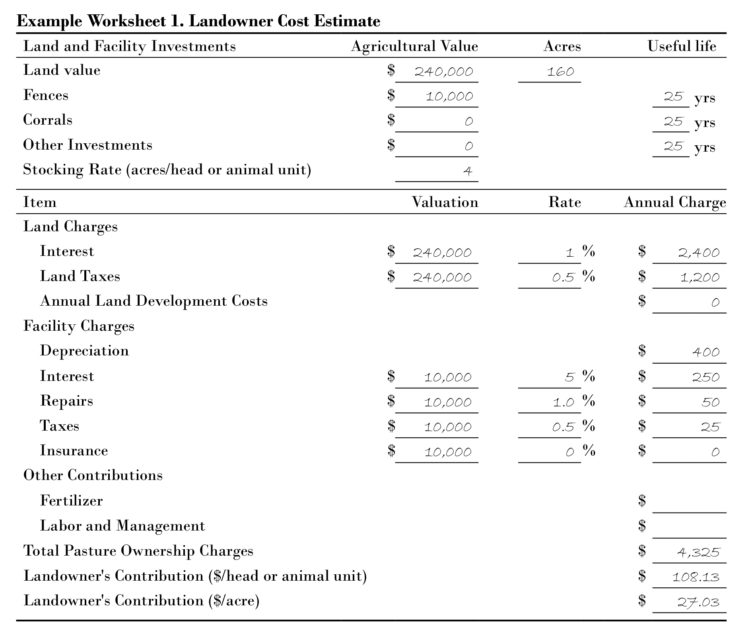

The major task in estimating the landowner’s cost is to establish reasonable values for the resources provided to the livestock owner and to clearly estimate annual costs. The valuation process is outlined in the following discussion and in Worksheet 1.

Land: Land is valued at its current fair-market value for agricultural purposes. The influence of location near cities and other nonagricultural influences on value is disregarded.

Interest on land: The land value multiplied by an opportunity interest rate is a method of estimating the annual land charge. A practical starting point for negotiating the return to land is the rent-to-value ratio in the region (cash rent divided by market value), as this reflects the “opportunity cost” of not renting the land on a cash basis. The USDA NASS reports the rent-to-value ratios for average cropland in the various regions in the U.S. The rent-to-value ratios vary considerably from region to region. Additionally, the ratios have been trending down in some regions (Northern Plains, Delta, and Southern Plains regions) and thus using a longer term historical average value may not be appropriate.

Real estate taxes: Actual real estate taxes paid on the land and improvements are a contribution of the landowner.

Land development: The average dollars spent annually by the landowner for land improvements, including conservation practices, are a contribution of the landowner.

Building or facility investment: A fair-market value should be placed on the fences, buildings, ponds, wells, and handling facilities used by the livestock owner. Those facilities that provide no benefit to the livestock owner should not be considered a contribution of the landowner. Ownership costs on these provided resources include depreciation, interest, repairs, taxes, and insurance (the “DIRTI five”).

- Depreciation: Depreciation is calculated from the estimated useful life of the asset. Since a fair-market value (not the purchase price) of the buildings and facilities are used, estimate the remaining useful life to calculate depreciation. Do not use depreciation allowance in tax law since this does not always conform to useful life.

- Interest: Interest on facilities is included to reflect the capital tied up in facilities as opposed to actual interest paid on facility loans. It can be calculated as the current interest rate on operating loans multiplied by the average facility value. Average facility value is usually assumed to be ½ the total investment value because the investments are expected to have zero salvage value.

- Repairs, taxes, and insurance: Facility repairs usually vary from 1 to 3 percent of the average investment value. The charge for both taxes and insurance usually are about 0.25 to 1 percent of the average investment value.

Other costs: Other costs that landowners may incur include annual fertilizer expense, tree removal, and weed control.

Labor and Management: Any labor or management that the landowner contributes to the livestock owner is a cost that the landowner can claim in determining rent.

Worksheet 1 illustrates ownership costs for 160 acres of pasture. As outlined by the example, the per-acre ownership cost of $27.03 establishes an asking lease price for one acre of pasture land. Rent per head or per animal unit is determined by dividing the total ownership costs by the stocking rate of the pasture.

Livestock Owner’s Net Returns Estimate

Livestock production budgets that estimate net returns can be obtained from local and state Extension offices or websites. These budgets are helpful in insuring that all the costs of production are considered when entering into a lease. When using budgets prepared by others to estimate net returns, be careful to include only the income and costs associated with the livestock owner for this estimate.

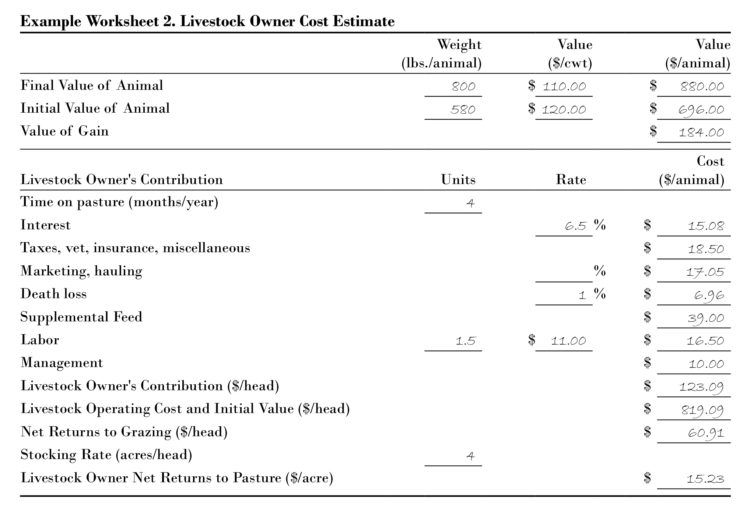

Worksheet 2 provides a simplified budget format that can be used to determine the livestock owner’s net returns. The livestock owner’s net return is calculated on a per head basis since that is the unit used for marketing livestock. The final estimate of dollars per head will be used to gauge the relative contributions of the pasture owner and the livestock owner.

Net returns to grazing ($/head) is the final value of the animal, less the initial value (purchase cost) of the animal and the operating costs incurred during the lease term. The livestock owner has an investment in the animal put on the land. This investment incurs the ownership costs of interest, taxes, and insurance. If the animals are stockers intended for weight gain, 4depreciation is not a cost but the value of the animals themselves is a cost. Interest is the opportunity cost of owning the animals and is charged even if no loans were used to purchase the animals. Interest is only for the length of the time the animals are grazing. For example, if the animals on are the pasture 6 months, interest would be charged for ½ year. Taxes and insurance are the amount actually paid while the animals are on pasture. Other costs such as veterinary and medicine, labor, marketing, transportation and supplemental feed should be listed. Accounting for death loss is important to accurately calculate the cost of raising livestock. Cost due to death loss is the estimated percentage of animals that die times their purchase price.

The calculation of net return is more complex for breeding animals and milk cows and recreational livestock such as horses. It is recommended that you start with a complete budget from your Extension economist and modify it to determine the net income. The revenue will be calculated as the value of the calf or milk produced during the lease period. In addition to the other expenses mentioned for feeder livestock, pastured breeding animals will incur a depreciation expense or cow replacement costs. Bull cost or artificial insemination charges are also common.

The Worksheet 2 example where a 580-pound calf is pastured, the livestock owner can afford to pay $60.91 per head or a per-acre rent of $15.23 if 4 acres of pasture are needed per head.

Establishing Lease Rates

A final lease rate value acceptable to both the tenant and landowner can be arrived at via several methods presented in this publication. Negotiation provides a means of arriving at a rate that is acceptable to both, and it is an opportunity for both parties to understand the other’s point of view. As negotiations progress, the landowner and livestock owner can identify areas of agreement and differences based on the values each party has independently developed in the above worksheets.

Cash Lease

Using Worksheets 1 and 2 as examples of the landowner and livestock owner contributions, the landowner would like to receive $21.54 per acre (or $86.18 per head) based on his contribution of pasture and other productive resources. In turn, Worksheet 2 shows that the tenant would like to only pay $19.68 per acre (or $78.74 per head) in order to have a positive net return. Our example shows the landowner wanting more for pasture rent than the livestock owner wants to pay. The eventual pasture lease rate will be negotiated as each party makes the case for his or her position. Eventually one or both parties will need to reduce their return on investment desired in order to come to an agreeable lease rate, or walk away from the lease.

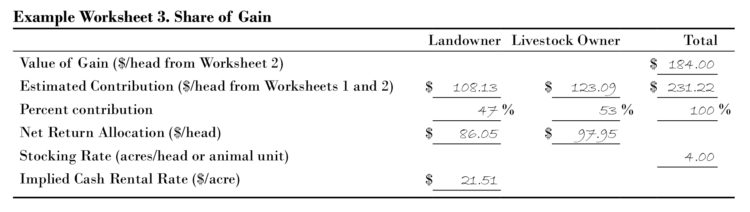

Share of Gain

One way of negotiating a pasture lease is to divide the value of the livestock gain between the landowner and livestock owner based on their relative contributions. Worksheet 3 uses estimates from Worksheets 1 and 2 to illustrate how to divide the value of livestock gain. The landowner’s dollar contribution per head or animal unit pastured is recorded along with the livestock owner’s contribution per head or animal unit. Care needs to be taken to insure that both the landowner’s and livestock owner’s contributions are in the same unit (number of head or number of animal units). These contributions are used to calculate the percentage of the total contribution of each party. Room for negotiation still exists as the parties seek to assert the value of their contributions.

At the end of the lease the value of gain is calculated by subtracting the beginning value of the animal from the ending value of the animal (see Worksheet 2). This value of gain is divided between the landowner and livestock owner in the percentages computed earlier looking at their contributions.

The actual rental rate that will be paid to the landowner is unknown until the end of the lease. Provisions might be made for a portion of the rent to be paid earlier in the lease period with the final amount paid at the end when the value of gain is known.

Variable Rates

A lease arrangement also can be developed that would shift some of the risk, and the probability of additional profit (or loss), to the landowner. The two most common sources or uncertainty in livestock production are the actual livestock prices received and the actual weight gain. Weight gain is influenced by the quality of the pasture which is influenced by weather conditions during the growing season.

The risk due to productivity could be effectively shifted by charging a fixed amount per pound of gain. To illustrate this type of lease arrangement, the pasture rent for a yearling steer could be set at $25.00 per month. The total lease charge would be $100.00 for a 4 month grazing season ($25.00/month × 4 months). During the days on pasture, a 220-pound gain per animal would be a reasonable expectation. The cost of gain is $0.45 per pound ($100.00 ÷ 220 pounds) under these circumstances.

Instead of charging $25.00 per head per month, the landowner could set a lease rate of $0.45 per pound of gain. If the total gain turned out to be excellent, say 300 pounds, the landowner would receive $135.00 (300 pounds of gain × $0.45/pound of gain) for the season instead of $100.00. Yet, if the amount of grass was short and the gain per animal was only 175 pounds, the landowner would receive only $78.75 (175 pounds of gain × $0.45/pound of gain). Pasture owners may be unwilling to assume this kind of risk unless, on the average, a higher base rent ($/pound gained) is charged.

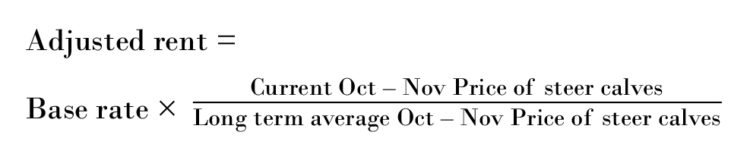

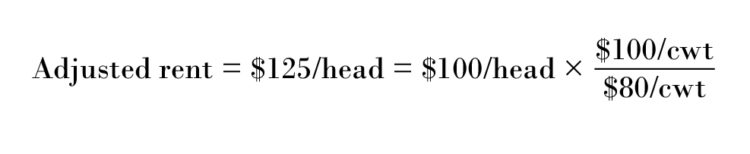

The risk due to market price changes can be shifted to the landowner by utilizing a flexible rent formula. One way to accomplish this is to tie the base rental rate (dollars per head) to the long term average price for good-choice steer calves during the months of October and November at a terminal market. Each year, the rental rate would increase or decrease as the price of calves varied in relation to the long-run average price. The formula for such a method would be as follows:

For example, a base rental rate of $100 per head would be multiplied by 1.25 to arrive at a rental rate of $125 per head. The 1.25 adjustment reflects that the sales price received for steer calves was 1.25 times the average price received for steer calves.

Other Factors Affecting Lease Rates

Pasture rental rates should reflect productivity. Poor pastures rent for less per acre than highly productive pastures. But other characteristics of a pasture affect its value to a livestock producer. Lease negotiations may be influenced by market rates, the value of location, water and landowner services. While the value of these factors may be difficult to quantify, they do enter into the amount a livestock producer is willing and able to pay for leasing pasture.

While each of the previously discussed methods may be used to establish pasture rental rates, the market rate cannot be ignored. The market rate is the going price for pasture rental resulting from negotiations between multiple landowners and livestock owners within the region. Previous years’ rates are published by state crop and livestock reporting services or university Extension economists. Estimated livestock inventories, price, and weather conditions for the current year are needed to estimate and negotiate the current year’s rates from previous year’s rental rates. Market rates should be carefully scrutinized because they report dollars per head or per acre without specifying other factors that influence pasture value to a livestock owner.

Location: The pasture location is important if the livestock owner is caring for the livestock. Nearby pastures are more valuable than distant pastures. The value of location can be estimated by multiplying 7the number of trips to the pasture per season by the number of miles and the cost per mile. The number of trips should consider checking the cattle for count, health, minerals, and water supply as well as hauling or driving the cattle to and from the pasture.

Water: Good quality water in proper locations improves gain. If the water supplies go dry in mid-season, provisions must be made for hauling water or removing the animals. The lease agreement should establish the party responsible for these costs.

Landowner services: Landowner services vary from mere rent collection to taking complete care of the livestock during the growing season. In most cases, the value of such services is included in the rental rate.

Whole-tract rentals are when land rentals contain both crop and pasture land. The parcel is rented as a whole with the landowner charging a flat fee and not distinguishing between crop and pasture land. Oftentimes the cropland is the primary concern of the tenant and less attention is paid to the pasture. However, whole-tract rentals should still specify key pasture rental provisions, such as stocking rate and limitations on subleasing, so that the pasture quality is maintained.

Improved Pastures

Improved pastures refer to grass planted on land that has been previously tilled, or pasture that is fertilized or irrigated. Generally, management of improved pastures includes the application of annual fertilizer and possibly mowing or spraying for weed control. Some improved pastures may be hayed rather than grazed.

In addition to the stocking rate decision discussed above, leasing improved pastures introduces the question of fertilization. If the landowner is responsible for purchasing and applying fertilizer, the livestock owner will likely want relatively heavy rates of fertilizer applied in order to obtain the maximum production per acre. The landowner, in turn, will want to apply only enough fertilizer to maintain the stand of grass. The lease agreement should specify the fertilizer plan so that the livestock owner understands how the landowner plans on managing the land. Alternatively, the livestock owner can be responsible for the costs and amount of fertilizer applied. In this case, it might be wise to again specify in the lease agreement any minimum that the landowner considers necessary for maintaining the pasture. Whichever party pays for the fertilizer, it should be recognized as their contribution on Worksheets 1 and 2.

Putting the Agreement in Writing

A copy of the pasture lease form is included in this publication. Some of the advantages of a written lease agreement are:

- It encourages a detailed statement of the agreement, which assures a better understanding by both parties.

- It serves as a reminder of the terms originally agreed upon.

- It provides a valuable guide for the heirs if either the tenant or landowner dies.

The agreement should be carefully reviewed annually to ensure the terms are still applicable and desirable.

Every lease should include certain items. These are the names of the parties involved, an accurate description of the property being rented, the beginning and ending dates of the agreement, the amount of rent to be paid, a statement of how and when the rent is to be paid, and the signatures of the parties involved.

These minimal provisions alone, however, do not meet all the requirements of a good lease. Additional provisions should provide guidance on how the land is to be used and outline possible problem areas and solutions.

A good lease should clearly identify the property being rented. If the landowner wishes to reserve the use of certain improvements on the land, these reservations should be clearly stated in the lease.

Absent a statutory or constitutional limitation, the duration of the lease can be any length of time agreed upon by the parties. Many leases are for at least one full year but pasture leases may specify portions of the year that livestock are allowed to graze. Operators sometimes request leases for more than one year, particularly if they must invest additional capital in equipment or make improvements on the farm being rented. Either party should communicate a desire to end or modify a lease agreement far enough in advance for the other party to make needed adjustments, seek other rented land, or seek a new operator. When a lease is terminated, provisions should be made to reimburse the operator for unrecovered investments to the land. Because state laws and customs vary so much on lease termination, it is suggested that competent legal advice be obtained.

In general, most transactions involving real estate require a contract in writing to be enforceable. In most states, though, oral leases for not more than a year are valid.

Landowners, as well as operators, should enter into long-term leases only after very careful consideration. Remember that the lease is a contract – a contract that “marries” the parties to favorable and unfavorable terms alike. Long-term leases commit both parties to each other for the length of the lease. Often it is better to include an automatic renewal clause and a provision for compensation for unexhausted improvements made by the operator.

Long-term leases specifying a fixed cash rent are particularly risky because of unpredictable commodity prices and uncertain costs of operation. Landowners and operators should agree to adjust rental rates from time to time when economic conditions change, either in advance or after the fact.

Generally, it is desirable to set the dates for paying the cash rent to coincide with sales of livestock. Paying more than one installment also may be desirable. For example, one-half the lease payment may be due at the time the lease agreement is signed and the other one-half payment at the time livestock are sold. Several smaller payments can help the operator from a cash-flow standpoint while better meeting the needs of the landowner who may be dependent on the farm rental income for family living expenses.

The sample lease provides for most concerns of both the tenant and landowner. The parties can cross out or omit unwanted provisions. Both parties must initial these lease changes. Before provisions are eliminated, the landowner and tenant should remember that one of the functions of a written lease is to anticipate possible developments and to state how to handle such problems if they actually do develop. Sections of a lease that deserve special attention are mentioned below.

Stocking rate: This section is perhaps the most important section of the lease form if disagreements are to be avoided between the parties and the grass stand and quality is to be maintained.

Operation and maintenance: The lease form specifies which party performs the most common operation and maintenance practices. Additional provisions should specify what happens in the event of water or grass failure. Will the landowner provide feed and water? Will the livestock owner remove the cattle? What adjustments in rent are needed if these events should occur? What happens if the responsible party fails to meet their responsibility? Each situation is different; however, one of the purposes of a written lease is to consider these possible situations and include them in the lease.

Payment schedule: The lease form provides space for three different methods of payment. Method 1 specifies that pasture rent is on a per-acre basis. Method 2 specifies that pasture rent is on a per animal basis with comprehensive descriptions of the animals to be pastured included. Provisions for share of gain or variable rates can be described in Method 3. Complete the section for the method to be used.

Worksheets

1 An animal unit (au), historically been described as a 1,000-pound beef cow with or without a calf less than three months of age. It is assumed that a cow of this size consumes 26 pounds of dry matter per day, or 780 pounds per month. How-ever, since 1991 the official definition by the “Terminology for Grazing Lands and Grazing Animals” defines an animal unit as the consumption of 17.6 pounds of dry matter per day, or 528 pounds of dry matter in 30 day month. Either method is appropriate to calculate stocking rates, since they are based on available pounds of dry matter per acre and the expected rate of removal by the livestock pastured.

For additional references, see the North Central Farm Management Extension Committee Website at: http://AgLease101.org/

*Originally published on Ag Lease 101 by North Central Farm Management Extension Committee. https://aglease101.org

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.