January 28, 2013

Structural Change in Agriculture: Implications for the Farming Sector

Introduction

The global food and agribusiness industry is in the midst of major changes – changes in product characteristics, in worldwide distribution and consumption, in technology, in size and structure of firms in the industry, and in geographic location of production and processing. And the pace of change seems to be increasing. Responding to these changes is difficult because of three fundamental characteristics of the agricultural industry. First, it is highly volatile, both in production and market conditions. A combination of biological production processes that are subjected to unpredictable biological predators (disease, insects, pathogens, etc.), combined with variable climatic/weather/heat/rainfall patterns, results in significant variability in production and processing conditions and thus efficiency and output. This fluctuation in output or supply combined with the inelastic or non-responsive demand for food products results in dramatic price fluctuations, particularly at the crop and livestock raw materials stages of the supply chain.

The biological production processes for raw materials are also characterized by long production cycles and batch rather than continuous flow of production/processing, which means that in general production adjustments to changing conditions are lethargic. And the time delays between a new idea and a commercially viable product are much longer than in industries characterized by continuous flow processing and short production cycles.

The food and agribusiness industry is also characterized by very complex supply chains that are not well coordinated, particularly among the up-stream stages in that chain. The production sector in general is very fragmented which provides challenges for those firms further downstream that desire traceability or guaranteed and consistent quality attributes. Changes and innovations that require adoption/adjustment across the entire value chain (e.g., systemic innovations) is much more difficult to adopt and implement if that value chain is not only complex but also fragmented and not well coordinated (Brӧring 2008).

Drivers of Structural Change in Agriculture

The drivers or determinants of structural change are numerous and diverse. This discussion focuses on forces driving structural change in the production sector of the value chain because that is the sector in which the most dramatic changes are occurring. But most of these forces are directly as well as indirectly impacting the input supply (manufacturing and retailing) and product transformation (origination, processing/manufacturing, distribution, and retailing) stages of the chain as well.

Technology

Technology drives structural change through the form or type of technology that will be used in agricultural production as well as the rate and characteristics of the adopters of the technology. The types of technology that have the potential to be part of the future of the production industry include bio/nutritional technology, monitoring/measuring/communication technology and process control technology. The end result is the prospect of an industry characterized by biological manufacturing of differentiated products for various food and nonfood uses.

New technology has dramatically changed the timeliness constraint that has been a significant limit on the growth potential for many grain operations. The ability to plant and harvest crops during the limited number of suitable field days in the spring and fall without encountering yield penalties is critical to overall efficiency and profitability. The development of guidance and auto-steer technology combined with larger planting and harvesting equipment (36 row planters and 12 row combines) has dramatically altered the timeliness constraint. For example, planting 2000 acres in Illinois, with a 24-4ow planter, starting April 1, and working 24 hours, there is a 70 percent chance of finishing planting by May 1. If auto-guidance allows 16 hours per day and improves efficiency 5 percent, chances of completing planting my May 1 improve to 85%. With a 36 row planter and auto-guidance, the chances of completing planting by May 1st improve to 90% (Boehlje and Erickson, 2007).

More sophisticated monitoring and measuring technology that is part of precision farming also enables growth of crop operations. If crop production processes can only be monitored by people with unique skills and those resources are costly or expensive to train, the monitoring process limits the span of control to what one individual (or at least a few) can oversee personally. But, if electronic systems can monitor the processes of plant growth (whether it be machinery operations, or the growth process of the crop, or the level of infestation of insects or weeds), fewer human resources are needed for this task and generally larger scale is possible. Crop production can and will move more and more towards improved electronic monitoring and control systems which expand the span of control of a farmer/manager.

Financial/Economic Forces

Economic/financial forces shape the size and other structural characteristics of the firm. These include economies of size/scope and learning, risk and risk mitigation strategies, rental and outsourcing opportunities and costs, financial and capital structure decisions and costs and ownership and operation of the land resource. In addition to new technology and new operating procedures to relax the timeliness constraints, farmers are also using management strategies and new business models to more fully utilize their machinery and equipment. One of those strategies is multi-site production. Growers are increasingly producing in more than one locale, and in many cases are choosing those locales based on weather patterns, access to water, and transportation/logistics capacity and systems. They then move equipment from site to site, in essence allowing them to not just increase the utilization and lower the cost of machinery operations, but to again relax the timeliness constraint on size of operation without investing in additional machinery or equipment.

One new business model is the use of operating leases or machinery sharing to cost effectively acquires additional machinery services. Such arrangements have typically been individual agreements between growers and machinery owners (sometimes dealers, sometimes other growers), but increasingly these arrangements are developing through more formalized custom farming agreements or with such entities as Machinery Link that provides operating leases for combines, cotton strippers and power units similar to rental arrangements for automobiles, trucks and other equipment.

Precision farming combined with creative ways to schedule and sequence machinery use including 24 hour-per-day operations, moving equipment among sites and deployment based on weather patterns has the potential to increase machinery utilization and lower per acre machinery and equipment costs as well.

Finally, more and more of today’s expanding crop farmers are adopting the common business strategy of mergers and acquisitions compared to buying assets as in the past. Thus, farmers are buying businesses or the package of assets (including leased land) rather than purchasing individual partials of land or pieces of equipment. And in fact, an increasingly common growth strategy for some growers is to approach a current operator with say 1000 to 1500 acres of farmland, who is near retirement, offer to buy the “farm business,” and retain the current operator and his/her machinery to complete the machine operations on that acreage. In essence, the acquiring farmer obtains control of not only the owned but also the rented acreage of the current operator, and also increases his capacity to farm this additional acreage by outsourcing some of the machinery and other operations to a skilled farmer who likely is uniquely qualified to farm that particular acreage. This strategy of acquiring businesses rather than acquiring assets usually involves obtaining control over a larger asset base, and thus accelerates the rate of growth and consolidation of large scale operations.

Human Capital

The skill sets and capabilities of the managers/entrepreneurs in the industry drive many of the growth, technology choice and financing decisions that will have a significant impact on many dimensions of the future structure of the industry. Additional human capital dimensions that will be important include the adapting general business management skills to farming, the allocation of time to work and community activities, and career path opportunities of new entrants and current industry participants. Larger farm businesses with specialize managerial expertise are likely to have more time and talent to seek efficiencies not only in economies of input purchases but also in areas of learning, risk mitigation, and resource acquisition/control.

Business Family Life Cycle

The production sector is currently dominated by proprietorship business structures where the life of the business is profoundly impacted by the life of the individuals who manage and contribute labor and capital resources to that business. Consequently the typical proprietorship business lifecycle stages of entry/establishment, growth and expansion, maturation, and exit characterize the industry, and combined with the demographics of the resource owners and operators, have a significant impact on the current and future structural characteristics of the industry. Furthermore, potential changes in the proprietorship model to a more “corporate” structure where the life of the firm is not as dependent on the life of the entrepreneur or his/her heirs have important structural implications. As the industry transitions from the current life cycle to the next life cycle it can be expected that the proportion of businesses using something other than the proprietorship model is likely to increase.

Much discussion of structural change in agriculture has focused on the increasing age of farmers and the expectation that significantly larger amounts of farm property will be transferred to other owners as these farmers retire or exit the industry. But the transfer of ownership of farmland may not be nearly as important and immediate as the transfer of control/operation of that farmland. USDA (2006) estimates almost 50 percent of U.S. cropland is rented; and in some parts of the Midwest the percentage rented is as high as 85 percent; thus, changes in control and operation of farmland may not mimic changes in ownership.

In contrast to the past, it is not unusual today for a farm operator at retirement to control a substantially larger acreage than he or she owns. So in reality a larger proportion of the total land becomes available to new or current prospective operators than just that acreage owned by the retiring farmer. Even though only two to three percent of farmland is transferred from the current to a new owner each year, the amount available for new operators each year is substantially more than that – maybe as much as 4-5% per year.

Value Chain Forces

A number of forces are now impacting the farming industry that have the potential to challenge the traditional open market based coordination system with buyers and suppliers and replace it with a more tightly aligned vertical coordination system. These forces include the demand for more unique and differentiated products from the production sector, concerns about traceability and identity preservation through the production and distribution channel, strategies to capture efficiencies of improved flow scheduling, benefits of better and more accurate information flows form users to producers, concerns about quality and quantity availability by processors and others downstream in the distribution channel, etc. As production agriculture becomes less commodity oriented and has to be more precise in the attributes it produces as well as the documentation of what and how products are produced, structural changes in the form of different coordination mechanisms between suppliers, producers and buyers are likely to occur. These business arrangements are frequently less costly to implement by larger scale firms that have the scale and perhaps scope to attract attention of potential partners in downstream activities.

The Modern Global Farmer

The forces just described create significant challenges and opportunities for the farming sector. An illustrative case study is presented to obtain a better understanding of these challenges and opportunities.

Tom Farms

Tom Farms LLC is a 20,000 acre value-adding crop farm composed of 16,000 acres in Indiana and 4,000 acres in Argentina. Crops include seed corn production, commercial corn, soybeans, tomatoes, and a business unit that provides customized agricultural services to an additional 28,000 acres, particularly in seed production. In addition, they operate a large commercial trucking business that provides transportation and brokerage services.

Tom Farms is the largest provider of seed services in the U.S. and a major player in world seed markets. They have 4,200 acres of their own seed production in Indiana and an additional 2,000 acres of seed production in Argentina. They harvest 10,000 acres of seed in the U.S. plus their 2,000 acres in Argentina. They provide transportation for over 30,000 acres of seed production from the field to the processing plant and then move $95 million of processed seed to retail locations throughout the U.S. They are in an alliance with Monsanto for the production and distribution of DeKalb and Asgrow seed brands. Their 250 acres of tomatoes in Indiana are destined for Indiana’s own Red Gold tomato products.

The current family members have been involved in the business since 1948 when Kip’s parents, Everett and Marie Tom began farming with a 240-acre crop and livestock operation. Since that time the business has broadened and expanded to include six families. Everett and Marie remain active in the business. Kip is the President of the Tom Farms LLC, and his sister Melissa Gerber is the office manager and controller. In addition, three of Kip’s five children are active in running the company. They are sons Kyle and Kris, and Daughter Kassi Rowland and her husband Greg Rowland. Kyle and Greg share crop production management supervision, and Kassi works with Melissa in managing office and financial matters.

Kip summarizes their business philosophy as follows: “Tom Farms puts people first. We treat all employees, customers, and suppliers honestly and fairly. We strive to build a business with a sustainable business structure for the future that improves the industry, the community and solves problems. We do this by quickly adapting superior technologies that deliver value, by fully utilizing resources to their maximum value, by providing our customers with products and services that add value and solve problems for them, and by operating on an industrial platform. The resources to do this include a highly qualified staff, efficient machinery, a large and high quality land vase, and utilization of the latest technology.”

Implementing this philosophy involves the following:

- Adapt quickly to new technologies that are either cost lowering or value increasing

- Find the best technology through information collection and analysis, and then develop that intoa standardized system of management.

- Develop a standardized system of command and control or standard operating procedures.

- Utilize alliances with “partners” both to learn from them, but also to extend the scope of thebusiness.

- Are supply-chain oriented, seeking ways to maximize the value in the food supply chain fromfarm inputs to the dinner table through differentiation, quality, and consistency.

- Are solution oriented as they seek ways to reduce costs or increase vale with their partners in thesupply chain.

- Continually seek to gain economies of size.

- Once they “perfect” their technology-management-scale model, seek to replicate it in otherlocations or in other businesses.

The Challenges

Price/Cost/Margin Volatility

Farming has always been a risky business with the returns to reward that risk available for only brief periods of time. When measured by daily price movements in the futures markets, the range in monthly cash bid prices, or any other metric one would choose, output prices have become quite variable in agriculture. Some would argue that price fluctuations are more than double what they were 5-10 years ago. Erratic and intense rain-fall patterns in the spring and fall in recent years have resulted in significant variability and yields across counties and even within the same field for many farmers compared to the past. And in addition to output price variability, input prices have also been quite variable. The fluctuations in fertilizer, chemical and energy costs have been the most dramatic. The resulting volatility in operating margins (price minus cost) has been even more dramatic than that of prices, costs or yields. By some estimates volatility in operating margins has more than doubled, and some have argued that they have increased by as much as 3 to 4 times compared to the past. Tom Farms’ fundamental risk management strategy has been selling in the top one-third of the market, to purchase crop insurance and be a low cost producer. What else should they consider – is there some form of index tool that might be considered? Kip felt that the risk in agriculture today, particularly in crop production, is greater than it has been in the past, but there is opportunity to be rewarded for taking that risk.

Strategic Risks

Kip was comfortable with his ability and the position of his business to manage/mitigate the traditional operating and financial risks. What kept him awake at night were the strategic risks – “unanticipated surprises” resulting from changes in government policy and regulation; mergers and acquisitions that change the competitive landscape and disease and food safety crises such as H1N1, BSE and salmonella contamination, for example. These new uncertainties were more complex and difficult to analyze and manage than traditional business risks—they were not as predictable in frequency and consequence, and they often create opportunities for gain as well as exposures to financial losses. He knew that these potential “Black Swans” could be critical to the future of Tom Farms, but was unsure how to strategically position to capture the upside and mitigate the downside of these uncertainties.

Selecting New Ventures

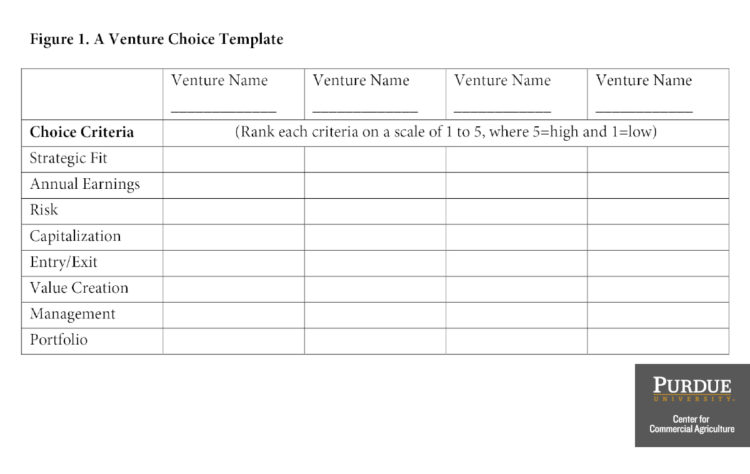

The number of new venture opportunities that Tom Farms could pursue has increased dramatically and Kip has decided he needs to be more systematic in his venture assessment than he might have been in the past. At a recent seminar he was introduced to a new project/venture “scorecard” that provides a structure for assessing new ventures. (Figure 1) Kip wanted to use the scorecard in his next venture assessment, but wanted to review it with colleagues in other industries to see what might have been “left off the list” as well as to see if they had an alternative framework or template for such assessments.

Becoming a “Breakthrough Company”

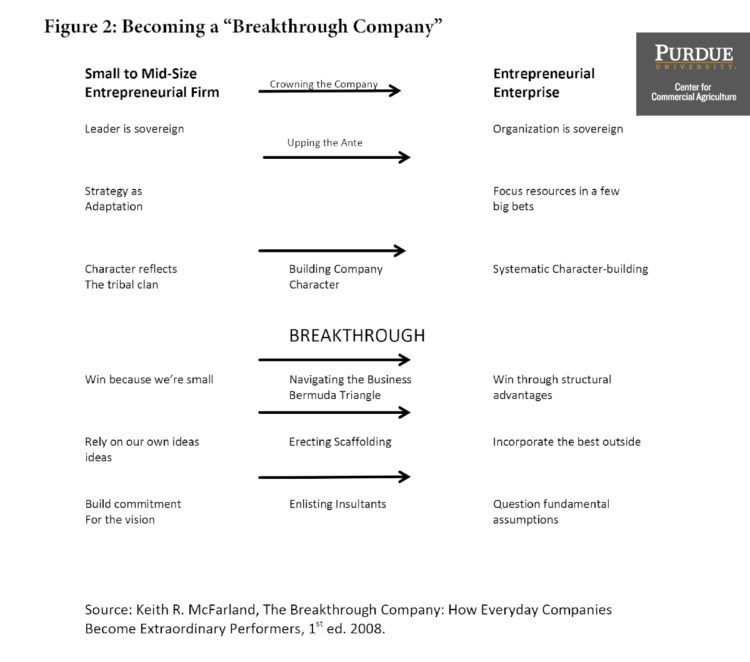

Kip had attended a recent seminar where he was challenged to think about how to reposition Tom Farms from an owner centric business to an entrepreneurial enterprise – a “breakthrough company” that transcends the family of origin, embraces family participation (even if not full control) and is positioned to regularly and permanently capture new opportunities and grow the business. The framework for making this transition (Figure 2) was useful in helping kip think about his longer term goals for the business, the management team he would need to put in place to accomplish those goals and the succession plan he needed to develop to transfer management responsibilities to the next generation and beyond. First steps in succession planning and staffing have been initiated, but more needs to be done.

Expanding the Management Team

Kip and his family currently comprise the key management team, but additional management resources will be needed to be a “breakthrough” production company. His management structure is typical for businesses of his size – himself as CEO/CFO/COO and others in operations and support managerial positions. The management structure and team 3-5 years down the road are expected to be as follows:

- CEO

- CFO (interviewing currently)

- CIO (plans to hire in next 2 years)

- Risk Management Office (currently delegated to CEO)

- Operations Manager(s) (company has three operations managers, one for grain and fertilizerbusiness, one for field production operations, and one for logistics.

- Mergers and acquisitions lead

- Internal CPA (2 days a week now but plans to go full time)

- Process Engineer(s) (training of staff currently)

- Council/advisory Board

Filling these positions with the right people will be essential to the long-term success of Tom Farms, and growing to a size of support this level of overhead will also be critical.

Market access and resource control

Preferred access to input markets will increasingly be determined by the ability to implement standard operating procedures, deliver value and have sustainability plans in place for the operations of the business for business partners such as Monsanto. Currently Tom Farms is often selected to “beta” test many new forms of technology such as equipment, remote sensing and controls, information tools, to genetics and traits. It is highly important for the business to be an early adopter of new technologies in an attempt to leverage operating efficiencies. Tom Farms has brought an awareness to many technology providers, helping them understand the needs of the industry, and has had a number of specific technologies accepted and patented by the companies with no value coming back to Tom Farms. “Maybe we need to be more creative in capturing some of this intellectual property or brand value we are creating”, Kim wonders where the current owner/operator has in terms of commodities products market access and premiums attained seem to be more driven by volume as end users appear unwilling to place any values on brand, SOP’s, and channel coordination offerings. Growing more important is the need for proof of our environmental sustainability and as well our corporate social responsibility to maintain or build market access, but again understanding of this value in a commodity market is not yet recognized.

As to capital, the current business is at a size and growth rate that all capital is sourced by leverage internal equity, but if rapid sustained growth would occur, outside capital will be required. What is that size of operation, today estimates would be a $75MM annual business? And what about the capital demands of Tom Farms supply chain partners – will they be able to access adequate capital to maintain their market position.

Probably the most critical resource access/control issue is that of control of land. Kip and his family continue to expand their land holdings but he wants to expand the business more rapidly (and with less further concentration of their investment) than family capital availability will support. Strategies being pursued to increase access/control of land include: a) Acquisition of mid-size farms, b) private placement of outside capital in land, c) acquisition of other farm operations where the current owner/operator has no succession plan prior to dispersal of assets. As to this later strategy, key issues include valuing these operations and gaining control before they are dispersed for hard asset value only. If this is a model for growth how do you approach these mid-sized operations and sell them on the rewards of this merger/acquisition strategy?

Creating Brand Value

Tom Farms has historically been an earlier adopter of new technology – the first user of irrigation in the locale (Tom Farms currently has more than 80 center pivot irrigation units operating), production of value-added crops such as seed corn and vegetable crops, the least high-productivity equipment, the newest tillage and other cultural practices. But the early adopter, first mover advantages of these technologies is rapidly dissipating. Neighbors can easily observe the success that Kip has experienced from using these physical technologies, acquire them from the appropriate supplier and quickly mimic his success. Kip has concluded that to create additional value that is not dissipated as rapidly in the future, the technologies, activities and ideas need to be less visible and, thus, more difficult to mimic. The “intangible” resources of relationships with buyers and suppliers; the information systems that link climatic/soil/cultural and production practices to product attributes (yields and quality characteristics); and the process control systems that enable prescription-based biological manufacturing of specific attributes in agricultural raw materials have more potential to create IP and brand value. These solutions should result not only in higher profit margins, but also a more sustainable competitive advantage and a business that has more value than the sum of its physical assets’ market prices.

The “New” Agriculture

Agriculture is destined to face dramatic changes in the future based on both the globalization of the economic climate and changes in the consumer or end-user of agricultural products. The new agriculture will be characterized by:

- Global competition

- Industrialization

- Differentiated products

- Precision (information intensive) production

- Supply chains

More Global Competition

Globalization and internationalization are not new to agriculture – since the 1970’s farmers’ incomes have been heavily dependent on their success in selling products in international markets. Expanded market access is not an unimportant dimension of the future of global markets and international trade, but the most important dimension of more open trade is the international transfer of and global access to technology and research and development.

Most of the private sector technology transfer and R&D activity has focused on U.S. and Western Europe in the past. Today these are relatively mature markets in terms of acreage growth and expansion of livestock production capacity. Growth opportunities are likely greater outside these regions (i.e. Canada, Mexico, South America, Eastern Europe, Asia, etc.), and with the opportunities for global-oriented companies to expand their markets in these areas, one would expect substantial expansion in the technology transfer and R&D activity of these companies specifically focused on geographic regions outside the U.S. and Western Europe. The longer-run consequences are a narrowing of the gap between the productivity in these parts of the world and that of the traditional dominant production regions, as well as an increase in world-wide production capacity. This increased efficiency, productivity and capacity in other production areas along with the world-wide sourcing and selling strategies of global food companies means that the U.S. and Europe will not be as dominant players and will face increased competition in world markets in the future.

Expansion of Industrialized Agriculture

The current movement toward industrialized production units in the U.S. is nearly complete for some livestock species, but lagging for others. The poultry industry moved to an industrialized model from the 1940s through the 1960s. Cattle feeding moved to the industrialized model in the 1960s and 1970s. The dairy and pork industries are in the midst of a dramatic movement to the industrial model, with the current transition largely to be completed by 2010. The brood cow industry continues to be much less affected by industrialization, as technologies have yet to be found that can greatly increase the productivity of the brood cow through confinement and intensive management. Specialty crops have or are rapidly adopting industrialized production systems. The grain industry is moving more slowly to this type of agriculture, but even segments of the commodity markets are increasingly adopting a biological manufacturing approach.

Industrialization of production means the movement to large scale production units, that use standardized technology and management and are linked to the processor by either formal or informal arrangements. Size and standardization are important characteristics in lowering production costs and in producing more uniform crop products and animals that fit processor specifications and meet consumers’ needs for specific product attributes, as well as food safety concerns. Smaller operations not associated with an industrialized system will have increasing difficult gaining the economies of size and the access to technology required to be competitive, except perhaps in niche markets. Smaller operations can however remain in production for a number of years since they may have facilities that have low debt and are able to utilize family labor. Technological advances combined with continued pressures to control costs and improve quality are expected to provide incentives for further industrialization of agriculture.

Precision (Information Intensive) Production

The management of production is expected to trend toward more micro management of each specific production site, specific room, and possibly even specific acres or animals. The shift will be driven by the influx of information about the environmental and biological factors that affect production. The motivation will be to minimize costs and enhance product quality.

Increased use of monitoring technology will greatly expand the amount of information available regarding what affects plan and animal growth and well-being. This will be made possible by innovations in sensors to use in individual monitoring and control systems. In addition, greater understanding of how various growth and environmental factors interact to affect biological performance will be forthcoming. This understanding will then be designed into management systems which incorporate the optimum combinations and apply them at a micro or localized level.

Precision farming in crop production includes the use of global positioning systems (GPS), yield monitors and variable rate application technology to more precisely apply crop inputs to enhance growth, lower cost and reduce environmental degradation. Examples in animal production include medication treatment by animal rather than by the entire group or the herd; nutritional feeding to the specific genetics, sex, age, health, and consumer market for the individual animal; and continuous adjustment of the ambient environment, including such factors as temperature, humidity, air movement, and dust and gas levels within buildings, to maximize economic returns.

Nutrition management is expected to more closely match the nutrient supply with the needs of individual animals. This will include the matching of specific grains with individual species and perhaps specific genetics, body conformation, gender, phase of life cycle, or even the end-use for the animal. Greater emphasis also will be placed on nutrition to minimize odor and nutrient levels in manure rather than on traditional economic factors such as feed efficiency and rate of gain.

Buildings and equipment will continue to move toward larger scale to fit the industrialized model. Inside the buildings, expect enhancement of monitoring and control systems to help detect gases, temperature, humidity, and disease organisms that could adversely impact the economic performance of animals, and correct problems when they reach critical thresholds. Further advancements can be expected in cleaning systems to maintain higher sanitation, improve conditions for workers and in animal handling systems to reduce injury to animals in movement and marketing.

Development of Differentiated Products

The transformation of crop and livestock production from commodity to differentiated product industries will be driven by consumers’ desire for highly differentiated food products; their demands for food safety and trace-back ability; from continued advances in technology; and from the need to minimize total costs of production, processing, and distribution. Food systems will attempt to differentiate themselves and their products by science and/or through marketing. Ways to differentiate through science include gaining exclusive rights to genetics through patentable biotechnology discoveries; by exclusive technology in processing systems; and by superior food safety integrity. Marketing may include: branding, advertising, packaging, food safety, product quality, product attributes, bundling with other food products for holistic nutritional packages, and presentation of products in non-traditional formats.

Formation of Food Supply Chains

Much of U.S. plant and animal agriculture will be a part of industrialized food systems by the year 2020. Industrialized food systems are those which are holistic in production-processing-marketing, and organized to deliver specific-attribute consumer products by development of optimized delivery systems or through differentiation by science or branding.

An increasing emphasis will be placed on managing and optimizing supply chains from genetics to end- user/consumer. This supply chain approach will improve efficiency through better flow scheduling and resource utilization, increase the ability to manage and control quality throughout the chain, reduce the risk associated with food safety and contamination, and increase the ability of the crop and livestock industries to quickly respond to changes in consumer demand for food attributes.

Food safety is a major driver in the formation of chains. One way to manage food safety risk is to monitor the production/distribution process all the way from final product back through the chain to genetics. A trace-back system combined with HACCP (Hazard Analysis Critical Control Points) quality assurance procedures facilitates control of the system to minimize the chances of a food contaminant, or to quickly and easily identify the sources of contamination.

A supply chain approach will increase the interdependence between the various stages in the food chain; it will encourage strategic alliances, networks, and other linkages to improve logistics, product flow, and information flow. Some have argued that in the not-too-distant future, competition will not occur in the form of individual firms competing with each other for market share, but in the form of supply chains competing for their share of the consumers’ food expenditures.

Future Market Environment of the Global Food System

Describing the future market environment is a formidable challenge, but six key features seem important. First, the market will be even more volatile over the next decade. Commodity price swings have been extreme; farmland prices, input costs and cash rents are at unprecedented levels. Climate change is a poorly understood uncertainty contributing to extreme weather and temperatures. Farmers have lost money from bankrupt counterparties from VeraSun to MF Global. In the midst of this sea of uncertainty, a new farm bill is being considered with radical potential changes proposed.

Globalization, changing government policy, rapid technological change, and input firms in transition will all combine to make for a business environment that will be more uncertain. A second key feature is raising standards on the part of every player in the food system. Every entity will demand higher quality and lower prices, better service, more information, greater flexibility, and quicker response. Innovation and continuous improvement will be critical to success, but that innovation will be beyond new technology and new product offerings. Innovation in marketing strategy, customer intelligence to obtain customer insight, and new distribution strategies and business models may be as important as product innovation.

A third feature is continued consolidation. The need for scale/size – will continue to drive consolidation across input industries at both the manufacturing and distribution levels. The sheer cost of developing, obtaining approval for, and introducing new products drives manufacturing firms to seek global market opportunities. In distribution, the economics of procurement and information management will lead to fewer, larger organizations; there will be an even more aggressive move to multiple location facilities, spreading the cost of accounting, inventory, regulatory compliance, equipment, administration, etc. across a number of sites. Consolidation in the players in each stage of the value chain will continue, resulting in increasing competition, in some cases from new players who have never been part of the industry. Continued or increased merger/acquisition activity suggests that firms must position themselves to be either an acquirer or acquire – the current ownership status is highly unlikely to be maintained in the future.

The fourth key feature will be the drive for efficiency. Suppliers will work to add value and differentiate offerings, but in the current and expected competitive environment, even this is a challenge as any innovation is quickly copied and “commoditized”. There is enormous pressure on margins with the resulting emphasis on internal operating efficiency. This will lead to a search for linkages and a more coordinated system as finding cost economies increasingly requires system optimization.

Fifth, global ownership/operation combined with global sourcing and selling strategies of agribusiness companies will result in increased competition, but also a more diverse focus of these companies. Traditional customers (modest size farmers) and geographies (North America and Europe) may receive less focus in marketing and in new technology development and delivery as firms attempt to grow their business in new markets rather than increase market share in mature markets.

Finally the fundamental issue of control of the system will result in significant new linkages between food firms, farmer/producer, and input suppliers with the full range of acquisitions, joint ventures, and contractual and partnering arrangements being used. A premium will be placed on alliance and partnering skills as organizations work to obtain the advantages of size without ownership, or seek access to resources unavailable within their own organization. The push for efficiency will drive more consolidation at every level. It will drive more linkages across inputs as input bundles which cut across traditional input industry boundaries are assembled to maximize productivity. And it will lead to stronger linkages across the food production/distribution stages to form vertically linked food chains. The ability to cultivate and manage alliance and partnering relationships will be fundamental to a successful strategic position.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.