June 28, 2021

Opportunities and Challenges Associated with “Carbon Farming” for U.S. Row-Crop Producers

By Nathanael M. Thompson, Megan N. Hughes, Eugene K.M. Nuworsu, Carson J. Reeling, Shalamar D. Armstrong, James R. Mintert, Michael R. Langemeier, Nathan D. DeLay, and Kenneth. A. Foster

*Find the companion webinar recording on Carbon Markets at https://purdue.ag/webinar062421.

Introduction

Alternatives for addressing climate change are varied (McKinsey and Company, 2009). Here we specifically discuss one such alternative that is receiving increasing attention: sequestering carbon in agricultural soils.1 The soil carbon pool plays an important role in the global carbon cycle. However, the expansion of agriculture and modern agricultural practices have contributed to the release of soil carbon into the atmosphere. While it is estimated that much of these losses can be re-sequestered, carbon soil dynamics are complex and the amount of carbon that can actually be sequestered depends on the practices implemented, crop rotation, soil type, soil drainage, topography, and climate. Nonetheless, the potential to sequester carbon in agricultural soils has spurred a precipitous increase in public and private interest in markets that pay farmers to sequester carbon in their soils as a means for mitigating climate change. Proponents of these programs posit agricultural soil carbon sequestration as a win-win, serving as a climate solution and a supplemental source of revenue for farmers. However, this view is naïve to the significant challenges associated with successful implementation of a voluntary soil carbon market.

Soil scientists unanimously agree there are agronomic and environmental benefits associated with rebuilding soil organic carbon in agricultural soils (Bradford et al., 2019). Further, it has been well demonstrated through scientific study that the impact of no-till and cover crops on soil organic carbon change can be detected after long-term management changes (> 10 years) (Poeplau and Don, 2015). However, there remains significant uncertainty regarding the ability to measure year-to-year changes in soil organic carbon—a necessity of a soil carbon market that makes annual payments (Amundson and Biardeau, 2019; Bradford et al., 2019; Ogle et al., 2019). This has caused many in the soil science community to raise concerns regarding expectations of measurement of soil organic carbon in agricultural soils. Some go as far as to say that focusing on soils as a climate change solution could undermine broader efforts to restore agricultural soils (Bradford et al., 2019; Ogle et al., 2019; Ritter and Treakle, 2020). In addition to challenges associated with the physical science, social science challenges, including cultural, economic, and political constraints, are just as problematic and often overlooked (Lewandrowski et al., 2004; Smith et al., 2005; Amundson and Biardeau, 2019; Bradford et al., 2019; Pannell et al., 2020; Thamo and Pannell, 2016, Thamo et al. 2020).

Therefore, the objective of our discussion is to (i) provide much needed information about emerging opportunities for U.S. row-crop producers to receive payments for sequestering carbon in their soils, (ii) examine the carbon sequestration potential of common carbon sequestering practices on U.S. cropland acres, and (iii) add transparency to current discussions by outlining some of the important challenges and questions that remain. In addressing these issues our goal is to equip farmers and policy makers with information necessary to make important decisions regarding the rapidly evolving agricultural soil carbon marketplace.

Soil Carbon Sequestration Opportunities for Farmers

A number of opportunities currently exist for farmers to receive payments for sequestering carbon in their soils. The crediting mechanism underlying these programs generally takes on one of two broad structures: offset or inset markets.

1. Offset markets

In offset markets, carbon offsets are generated by those who can reduce emissions or sequester carbon. These offsets are then verified and sold to emitters as a means of offsetting their carbon emissions. Offsets can be sold through voluntary offset programs (e.g., The Climate Trust or the United Nations Framework on Climate Change’s clean development mechanism markets) or to polluters regulated under carbon cap-and-trade programs. Briefly, these programs (i) cap the amount of emissions a regulated industry is allowed to generate; (ii) issue permits in accordance with this cap, where each permit allows the permit holder to emit one unit of pollution; then (iii) provides a forum for regulated polluters to trade permits according to their own costs and benefits such that they meet their abatement obligations in a cost-effective way. In addition to purchasing permits, most permit markets also allow regulated firms to meet emissions caps through the purchase of offsets from unregulated sources outside the market. Indeed, all major cap-and-trade markets in the U.S.—including the Chicago Climate Exchange (which ceased trading in 2010 due to inactivity), the Regional Greenhouse Gas Initiative, and California’s cap- and-trade program—all allow regulated polluters to purchase offsets from outside sources. However, none of these programs allow row crop agriculture as a source of carbon offsets.

A number of emerging programs seek to enhance agriculture’s role in climate mitigation by supporting offset production from agricultural soil carbon sequestration, with the goal of selling these offsets in voluntary offset markets. Examples include Indigo Carbon (2021), Nori (2021), Truterra’s TruCarbon program (2021), Soil and Water Outcomes Fund (2021), and Ecosystem Services Market Consortium (2021). Although each program is unique, they generally work with farmers to implement practices that sequester carbon, provide measurement and verification of carbon offsets, and sell those offsets to buyers interested in offsetting carbon emissions.

2. Inset markets

Insetting represents an initiative taken by a company to combat emissions within its own supply chain. Internalizing these efforts ensures the entity seeking to reduce its emissions is actively engaged in collaboratively providing education, technical assistance, and in many cases financial assistance. There are currently several examples of carbon insetting where companies have directly targeted the agricultural segments of their supply chains for opportunities to sequester carbon through implementation of regenerative practices. Examples of inset markets include initiatives by Nestlé (2021) and Bayer (2021) as well as the efforts of the Field to Market Alliance (2021).

Practices that Sequester Carbon

Eligibility for soil carbon programs requires the farmer to implement practices that sequester carbon. While there many practices available which can sequester carbon into soils (Thamo et al., 2020), here we provide a brief overview of the carbon sequestration potential of the two most frequently discussed practices for U.S. row-crop producers: no-till/conservation tillage and cover crops.

1. No-till and conservation tillage

Transitioning from conventional tillage to no-till reduces the loss of soil carbon by multiple mechanisms. Tillage enhances microbial activity due to aeration and mixes fresh residue from the surface into more favorable decomposition conditions, but also disrupts soil aggregates which protect soil organic carbon from decomposition. A meta-analysis on the efficacy of no-till farming for increasing soil carbon confirms that most corn-growing regions would be predicted to have an increase in soil organic carbon when switching from conventional tillage to no-till (Ogle et al., 2012).

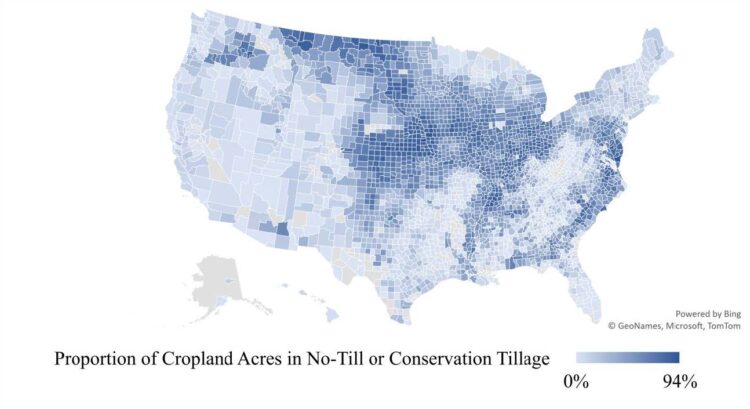

Of the approximately 396 million cropland acres in the United States, the 2017 U.S. Census of Agriculture reported that over half are in no-till (104 million acres, 26%) or other conservation tillage practices (98 million acres, 25%) (USDA National Agricultural Statistics Service [NASS], 2021). Adoption varies geographically with the highest rates of adoption in the corn belt (Figure 1). Previous research has reported carbon sequestration potential associated with no-till ranging from less than 0 to more than 0.4 MT/acre/year depending on climate and soil type (Ogle et al., 2019). The USDA Natural Resource Conservation Service (NRCS) COMET-Planner tool reports expected carbon sequestration of 0.31 MT/acre/year for no-till and 0.20 MT/acre/year for reduced tillage for most regions in the United States (USDA NRCS, 2021). Assuming this sequestration rate, current no-till and conservation tillage on U.S. cropland sequesters 52 million MT of carbon per year. This is equivalent to taking 11 million passenger vehicles (or 10% of all registered passenger vehicles in the United States) off the road each year. Putting all U.S. cropland acres into no-till would sequester a total of 123 million MT of carbon per year, or about 2% of all U.S. CO2 emissions in 2019 (Environmental Protection Agency, 2021).

Figure 1. Proportion of Cropland Acres in No-Till or Conservation Tillage. Source: USDA National Agricultural Statistics Service, 2017 U.S. Census of Agriculture.

2. Cover crops

Cover crops increase soil organic carbon by adding biomass carbon input, improving protection for soil organic carbon in the form of soil aggregation, and decreasing carbon loss through soil erosion (Ruiz and Blanco-Canqui, 2017). Numerous studies have demonstrated cover crops’ carbon sequestration effectiveness (e.g., Blanco-Canqui et al., 2015; Lal and Bruce, 1999).

Unlike conservation tillage practices, the 2017 U.S. Census of Agriculture reported that cover crops have only been adopted on about 4% (15 million acres) of U.S. cropland acres (USDA NASS, 2021), with the Chesapeake Bay area having the highest concentration of cover crop adoption (Figure 2).2 Previous research has shown cover crops to have carbon sequestration potential ranging from 0.04 to 0.4 MT/acre/year depending on biomass amount, years in cover crops, and initial soil carbon levels (Blanco-Canqui et al., 2015). The USDA NRCS COMET- Planner tool reports expected carbon sequestration of 0.37 MT/acre/year for cover crops for most regions in the United States (USDA NRCS, 2021). Assuming this sequestration rate, current cover crop adoption sequesters 5.5 million MT of carbon per year. This is equivalent to taking 1.2 million passenger vehicles (or 1% of all registered passenger vehicles in the United States) off the road each year. Planting all U.S. cropland acres with cover crops would sequester a total of 147 million MT of carbon, or the equivalent of 3% of 2019 CO2 emissions in the United States (Environmental Protection Agency, 2021).

Figure 2. Proportion of Cropland Acres in Cover Crops. Source: USDA National Agricultural Statistics Service, 2017 U.S. Census of Agriculture.

Soil Carbon Sequestration Questions and Challenges

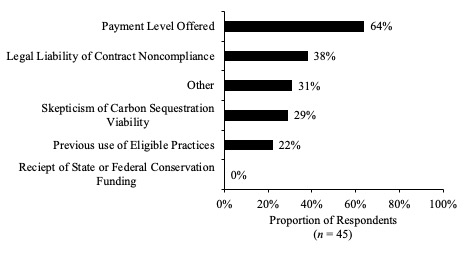

Despite increasing opportunities for agricultural producers to receive payments for sequestering carbon in their soils, a number of questions and challenges remain. We seek to address some common questions raised by farmers about soil carbon markets. To inform this discussion a random sample of 1,201 U.S. commercial scale agricultural producers were asked about their awareness of and participation in soil carbon markets as part of the Purdue University-CME Group Ag Economy Barometer’s February, March, and April 2021 surveys (Figure 3). In the March and April 2021 surveys an additional question was posed to survey respondents, asking them about the factors inhibiting their participation in soil carbon markets (Figure 4). For details on the survey methodology, see Purdue University-CME Group Ag Economy Barometer (2021).

Figure 3. Farmer Awareness, Engagement, and Participation in Carbon Contracts (n = 1,201). Source: Purdue University-CME Group Ag Economy Barometer February, March, and April 2021.

1. How much will I get paid?

As with any market, the price of offsets from carbon sequestration will ultimately be determined by supply and demand. In general, supply is lagging demand in these markets. While thirty-nine percent of producers in our survey were aware of opportunities to receive payments for storing carbon on their farms, only 7% have actively engaged in discussions about storing carbon and just 1% have actually entered into a contract to store carbon (Figure 3).

Demand for carbon offsets is more developed, with companies lining up to make carbon- neutrality pledges (e.g., Amazon, Uber, Microsoft, and IBM [The Climate Pledge, 2021]). However, it is important to note that these pledges are voluntary, leaving firms with wide latitude in deciding how to meet them and uncertainty as to their longevity. As a result, demand is uncertain and may vary with the quality of carbon offsets generated by a given program. Factors that affect offset quality include the degree of additionality (i.e., whether offsets represent carbon reductions that would not have occurred in the absence of payment) and permanence (i.e., the risk that sequestered carbon will be released when offset projects end).

Without these features, buyers are likely limited in what they will pay for soil carbon offsets, potentially stagnating supply.

So, what does that mean for the price of carbon sequestered? Much of the current discussion seems to indicate prices available to producers are currently $10-$20/MT of carbon sequestered, although this price seems to be quite arbitrary given (i) there is no actual scarcity of carbon offsets (these are 100% voluntary markets) and (ii) different offsets represent different commodities (e.g., different programs pay for carbon sequestered at different depths and some programs pay directly for practices implemented).

Current prices are likely too low to provide incentives for widespread participation. Indeed, producers most frequently identified the payment level offered as the reason they are not participating in soil carbon markets (Figure 4). For perspective, a study by Gramig and Widmar (2018) found that Indiana farmers would have to receive an additional $40/acre in net revenues to switch from conventional tillage to no-till. At an assumed carbon storage rate of 0.31 MT/acre (USDA NRCS, 2021), that would require a carbon price of $129/MT of carbon, plus the amount that compensates for increased production costs and potential yield drag in a no-till system. Further, estimates of the social cost of carbon—or the present value of avoided marginal damages from carbon abatement—are currently around $50/MT (IGW, 2021). Therefore, the price farmers are currently being offered to sequester carbon is well below both the minimum needed to induce widespread adoption as well as the benefit that the carbon sequestration provides to society.

Figure 4. Reasons Preventing Producers from Enrolling in a Program to Capture Carbon on Their Farm (n = 45). Source: Purdue University-CME Group Ag Economy Barometer March and April 2021.

Further complicating the discussion of price is the fact that there is currently very little price transparency in these markets. That is, how does a farmer know he or she is getting the best price for their carbon sequestration? How easy is it for a farmer to back out of a contract to take advantage of higher prices in other programs? These are important questions that need to be addressed.

2. What are my contractual obligations as a producer to continue the practice?

The second most frequently identified impediment to participation in carbon markets among the farmers in our survey was the legal liability associated with contract noncompliance (Figure 4). One of the uniquely challenging aspects of soil carbon sequestration is that it is extremely impermanent (Thamo and Pannell, 2016; Ritter and Treakle, 2020). Carbon may be released from soils if the practice used to sequester carbon is discontinued (e.g., a return to conventional tillage following no-till). This impermanence poses risks to producers who are contractually obligated to sequester carbon.

Take, for example, an Eastern Corn Belt producer who faced wet field conditions during planting and harvest of 2019. For some, the optimal decision was to get into the field under less than ideal conditions resulting in field ruts given the cost associated with waiting and not making the ruts (i.e., yield losses). In the absence of a carbon contract, a producer who chose to create the ruts would get into the field in the spring to do some tillage. However, under the conditions of a soil carbon contract, this may violate a carbon sequestration agreement by re- releasing soil carbon back into the atmosphere. The question is, what is the legal liability in this case? It seems that most programs would deal with this by “pausing” future payments until the farm can re-sequester the carbon released due to the one-time event (Bruner and Brokish, 2021). If the farm is unwilling to continue the practices to re-sequester released carbon in the absence of payments, it is unclear what the legal liability would be. At the very least it would likely require the producer to repurchase carbon offsets it had previously sold at the prevailing market price. Bound by contract, the producer may also choose not to make the rust in the first place, but this also comes at a cost.

The discussion of permanence raises another important question: what is the duration of currently available soil carbon sequestration contracts? In the United States, the major programs enrolling farmers in soil carbon sequestration programs are currently using 1- to 20- year contracts (Bayer, 2021; Bruner and Brokish, 2021; Truterra, 2021). What happens after the contract ends? Is the farmer obligated to maintain the practice or are they free to revert to previous practices without legal liability for re-releasing stored carbon? The answer to this question is not clear, but it is important—both for the producer and the offset purchaser. If there is no legal liability to maintain sequestered carbon beyond the contract term, it is hard to see how these programs could possibly be helping mitigate the effects of climate change—and helping offset purchasers meet their sustainability goals—given the lack of permanence.

For perspective, consider that programs abroad, such as Australia’s Emissions Reduction Fund initiative, started out with requirements to maintain sequestered carbon for 100 years (Thamo and Pannell, 2016). A 25-year contract was later added at a discounted payment level (Thamo and Pannell, 2016). While a 100-year contract still does not ensure permanence, it is a commendable attempt at ensuring stored carbon is maintained relative to currently popular programs in the United States. So, how do we reconcile permanence with current short-run contracts? First, additional clarity on the farmers legal liability beyond the contract is needed. Second, if there is truly no legal liability to maintain carbon after the contract period, this raises serious concerns over the quality of the offsets and, hence, whether demand for these offsets will be sustainable.

3. Do I qualify if I am already using eligible practices or if I already receive state or federal conservation funding for those practices?

An important aspect of emerging markets for carbon sequestration in agricultural soils is the focus on additionality. At present, nearly all of these programs seek to enroll producers who were not previously using eligible practices in an effort to sequester “new” carbon. This generally means that producers who have been previously implementing practices such as no-till and cover crops are ineligible to receive payments for carbon sequestration on land where those practices have been in place. Only adoption of new practices or implementing practices on new acres qualify for carbon sequestration programs. While some currently available programs have short lookback periods that allow producers to receive back payments on previously implemented practices, these only go back five years or less (Bruner and Brokish, 2021; Truterra, 2021).

The focus on additionality is intended to incentivize sequestration of carbon that would not be captured sans the incentive. However, for farms that have been implementing these practices for years, this can be a major point of contention. Among the farmers in our survey who said they engaged in discussions regarding sequestration program participation, twenty-two percent of them indicated that their previous use of eligible practices disqualified them from participating in a carbon market (Figure 4). While many are looking for ways to reward producers who have long made investments in regenerative practices, to our knowledge no clear solutions currently exist. Ultimately, the demand for “vintage” offsets—offsets for carbon stored in the past—is low.

When combined with the physical aspects of soil carbon sequestration—soil carbon sequestration increases at a decreasing rate and carbon storage potential is finite and can only be exploited once (Thamo and Pannell, 2016)—additionality requirements also raise concerns about adverse selection and moral hazard (Varian, 2006). In addition, the rhetoric of an ever- impending increase in the price of carbon may be adversely impacting farmers’ incentive to participate given the option value of waiting (Dixit and Pindyck, 1994). In other words, why would a farmer start selling his or her finite ability to sequester carbon today for $15/MT when they could wait and possibly sell that same sequestration for $30/MT or more three to five years from now?

Finally, there are also questions about whether producers who receive federal or state funding for conservation practice adoption (e.g., Natural Resource Conservation Service Environmental Quality Incentives Program [EQIP] payments) are eligible to also receive payments for carbon sequestration, or vice versa. Ultimately, the answer is that it depends. There are some programs that allow and encourage this sort of program “stacking” and there are others that strictly prohibit it (Bruner and Brokish, 2021). It is not our goal to speak to the efficiency of program stacking here; prior work finds stacking can be consistent with efficiency in some cases (Horan et al., 2004; Woodward, 2011; Reeling et al.; 2018) but not others (Lentz et al. 2014). Note that none of the farmers in our survey identified restrictions on program stacking as an impediment to their participation in soil carbon markets (Figure 4). However, producers seeking a contract to sequester carbon should clearly ask about opportunities or limitations on receiving additional funding for the practices implemented.

4. Who pays for verification and am I actually paid for carbon stored on my farm?

The technical challenges associated with measuring and verifying soil carbon are well documented (Amundson and Biardeau, 2019; Bradford et al., 2019). The purpose of this article is not to rehash these issues, but instead to examine the pragmatic questions that these difficulties create for implementing a soil carbon market. First, it is important to understand who bears measurement or verification costs. Currently available soil carbon programs almost unanimously bear the costs of testing, meaning the farmer does not have to worry about paying for soil carbon verification (Bruner and Brokish, 2021).

Still, most farmers will likely want to understand the process for how carbon will be measured on their farms. After all, unlike yield, which farmers can easily measure, carbon stored in the soil is intangible. Current soil carbon programs all rely on a combination of in-field soil sampling and modeling to measure carbon sequestration (Bruner and Brokish, 2021). That is, given high transactions cost, it is infeasible to sample every field in the program for actual soil carbon sequestration. For this reason, verifiers rely heavily on biogeochemical modeling to predict soil carbon sequestration. Although the science behind these models is continuously improving, it is important for farmers to understand they are not necessarily getting paid for actual carbon sequestration measured on their farm. Instead, they are likely being paid for predicted carbon sequestration from a model. Companies should be transparent about this and should work on messaging to earn the trust of the farms they work with. Furthermore, both parties should contemplate how future improvements in biogeochemical prediction and soil carbon measurement will be factored into contract payments.

There have also been questions about the government’s role in legitimizing and bringing oversight to soil carbon markets—most notably, recent U.S. Senate Bill S.1251, “Growing Climate Solutions Act of 2021” (Braun et al., 2021). This bill seeks to provide a framework that assists farmers participating in carbon markets by providing reliable information and establishing a series of standards for certification for carbon offsets. The USDA would be the major driving force behind this program by setting necessary guidelines for carbon offset certification by third party verifiers. While this could certainly help to bring standardization to the soil carbon marketplace, the parameters of this bill, or government involvement more generally, do not unilaterally resolve the other challenges associated soil carbon markets.

Conclusions

Increasing opportunities for farmers to receive payments for sequestering carbon in their soils are receiving much attention. While implementing practices that sequester carbon can help in the fight against climate change and serve as a source of supplemental revenue for farmers, it is not a panacea. Examining the carbon sequestration potential of common carbon sequestering practices (no-till and cover crops) indicates that even if these practices were purely additive and implemented on 100% of U.S. cropland acres, they would only sequester about 5% of total 2019 U.S. emissions. Therefore, while discussions of agriculture as part of the climate solution are a positive development, it is important to be realistic about the potential of U.S. cropland to sequester carbon. We also attempt to address several of the most common questions/challenges associated with soil carbon markets. Our goal is not to solve these issues, but instead to provide transparency to current discussions regarding these aspects of soil carbon markets. For soil carbon markets to be successful in attracting widespread participation by U.S. row-crop producers, the challenges we have identified here will need to be addressed.

1 It is important to point out that this is distinctly different from reducing carbon emissions. Emissions reductions strategies are critical to addressing climate change, and many promising strategies for reducing carbon emissions, even in the agricultural sector, are being investigated. However, these are not the focus here.

2 See Boerman and Lynch (2019) for a description of the programs supporting cover crop use in Maryland.

REFERENCES

Amundson, R., and L. Biardeau. 2019. “Soil Carbon Sequestration is and Elusive Climate Mitigation Tool.” Proceeding of the National Academy of Sciences 115:11652-11656. https://www.pnas.org/cgi/doi/10.1073/pnas.1815901115.

Bayer. 2021. “Bayer Carbon Program.” Available online at https://www.cropscience.bayer.com/who-we-are/farmer-partner-resources/carbon-program/united-states (accessed 04/06/2021).

Blanco-Canqui, H., T.M. Shaver, J.L. Lindquist, C.A. Shapiro, R.W. Elmore, C.A. Francis, and G.W. Hergert. 2015. “Cover Crops and Ecosystem Services: Insights from Studies in Temperate Soils.” Agronomy Journal 107:2449-2474.

Boerman, M., and L. Lynch. 2019. “Government Programs that Support Farmer Adoption of Soil Health Practices: A Focus on Maryland’s Agricultural Water Quality Cost-Share Program.” Choices 34:1-8.

Bradford, M.A., C.J. Carey, L. Atwood, D. Bossio, E.P. Fenichel, S. Gennet, J. Fargoine, J.R.B. Fisher, E. Fuller, D.A. Kane, J. Lehmann, E.E. Oldfield, E.M. Ordway, J. Rudek, J. Sanderman, and S.A. Wood. 2019. “Soil Carbon Science for Policy and Practice.” Nature Sustainability 2:1070-1072. https://doi.org/10.1038/s41893-019-0431-y.

Braun, M., D. Stabenow, L. Graham, and S. Whitehouse. 2021. “Growing Climate Solutions Act of 2021.” Senate Bill S.1251. Available online at https://www.congress.gov/bill/117th-congress/senate-bill/1251 (accessed 06/24/2021).

Bruner, E., and J. Brokish. 2021. “Ecosystems Market Information: Background and Comparison Table [Fact Sheet].” Illinois Sustainable Ag Partnership. Available online at https://ilsustainableag.org/wp-content/uploads/2021/02/EcosystemMarketInformation.pdf (accessed 03/22/2021).

Dixit, R.K., and R.S. Pindyck. 1994. Investment Under Uncertainty. Princeton University Press. Princeton, NJ.

Ecosystem Services Market Consortium (ESMC). 2021. Available online at https://ecosystemservicesmarket.org/ (accessed 04/06/2021).

Environmental Protection Agency (EPA). 2021. “Greenhouse Gas Inventory Data Explorer.” Available online at https://cfpub.epa.gov/ghgdata/inventoryexplorer/#allsectors/allgas/gas/current (accessed 04/06/2021).

Field to Market Alliance. 2021. Available online at https://fieldtomarket.org/ (accessed 04/15/2021).

Gramig, B.M., and N.J.O. Widmar. 2018. “Farmer Preferences for Agricultural Soil Carbon Sequestration Schemes.” Applied Economic Perspectives and Policy 40:502-521. https://doi.org/10.1093/aepp/ppx041.

Horan, R.D., J.S. Shortle, and D.G. Abler. 2004. “The Coordination and Design of Point-Nonpoint Trading Programs and Agri-Environmental Policies.” Agricultural and Resource Economics Review 33:61-78.

Indigo Carbon. 2021. Available online at https://www.indigoag.com/for-growers/indigo-carbon (accessed 04/06/2021).

Interagency Working Group on Social Cost of Greenhouse Gases (IWG). 2021. “Technical Support Document: Social Cost of Carbon, Methane, and Nitrous Oxide Interim Estimates under Executive Order 13990.” Available: https://www.whitehouse.gov/wp-content/uploads/2021/02/TechnicalSupportDocument_SocialCostofCarbonMethaneNitrousOxide.pdf (accessed 04/02/2021).

Lal, R., and J.P. Bruce. 1999. “The Potential of World Cropland Soils to Sequester Carbon and Mitigate the Greenhouse Gas Effect.” Environmental Science and Policy 2:177-185.

Lentz, A.H., A.W. Ando, and N. Brozović. 2014. “Water Quality Trading with Lumpy Investments, Credit Stacking, and Ancillary Benefits.” Journal of the American Water Resources Association 50:83-100.

Lewandrowski, J., M. Peters, C. Jones, R. House, M. Sperow, M. Eve, and K. Paustian. 2004. “Economics of Sequestering Carbon in the U.S. Agricultural Sector.” Technical Bulletin Number 1909, USDA Economic Research Service. Available online at https://www.ers.usda.gov/webdocs/publications/47467/17126_tb1909_1_.pdf?v=7496. 5 (accessed 01/22/2021).

McKinsey and Company. 2009. “Pathways to a Low-Carbon Economy.” Available online at https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/sustainability/cost%20curve%20pdfs/pathways_lowcarbon_economy_version2.ashx (accessed 03/26/2021).

Nestlé. 2021. “Supporting Regenerative Agriculture.” Available online at https://www.nestle.com/csv/global-initiatives/zero-environmental-impact/climate- change-net-zero-roadmap/regenerative-agriculture (accessed 04/06/2021).

Nori. 2021. Available online at https://nori.com/ (accessed 04/06/2021).

Ogle, S.M., A. Swan, and K. Paustian. 2012. “No-Till Management Impacts on Crop Productivity, Carbon Input and Soil Carbon Sequestration.” Agriculture, Ecosystems, and Environment 149:37-49.

Ogle, S.M., C. Alsaker, J. Baldock, M. Bernoux, F.J. Breidt, B. McConkey, K. Regina, and G.G. Vazquez-Amabile. 2019. “Climate and Soil Characteristics Determine where No-Till Management can Store Carbon in Soils and Mitigate Greenhouse Gas Emissions.” Scientific Reports 9:11665.

Pannell, D.J., P.G. Pardey, and T.M. Hurley. 2020. “Private Incentives for Sustainable Agriculture: Principals and Evidence for Sustainable Agriculture Change.” Working Paper 2002, UWA Agricultural and Resource Economics.

Poeplau, C., and A. Don. 2015. “Carbon Sequestration in Agricultural Soils via Cultivation of Cover Crops—A Meta-Analysis.” Agriculture, Ecosystems and Environment 200:33-41. https://doi.org/10.1016/j.agee.2014.10.024.

Purdue University-CME Group Ag Economy Barometer. 2021. “Survey Methodology.” Available online at https://ag.purdue.edu/commercialag/ageconomybarometer/survey-methodology/ (accessed 04/05/2021).

Reeling, C., C. Garnache, and R. Horan. 2018. “Efficiency gains from integrated multipollutant trading.” Resource and Energy Economics 52:124-136.

Ritter, T., and J. Treakle. 2020. “Why Carbon Markets Won’t Work for Agriculture.” Institute for Agriculture and Trade Policy. Available online at https://www.iatp.org/documents/why-carbon-markets-wont-work-agriculture (accessed 01/22/2021).

Ruiz, S.J., and H. Blanco-Canqui. 2017. “Cover Crops Could Offset Crop Residue Removal Effects on Soil Carbon and Other Properties: A Review.” Agronomy Journal 109:1-21.

Smith, P., O. Andren, T. Karlsson, P. Perala, K. Regina, M. Rounsevell, and B. Van Wesemael. 2005. “Carbon Sequestration Potential in European Croplands had been Overestimated.” Global Change Biology 11:2153-2163. https://doi.org/10.1111/j.1365-2486.2005.01052.x.

Soil and Water Outcomes Fund. 2021. Available online at https://www.theoutcomesfund.com/ (accessed 04/06/2021).

Thamo, T, and D.J. Pannell. 2016. “Challenges in Developing Effective Policy for Soil Carbon Sequestration: Perspectives on Additionality, Leakage, and Permanence.” Climate Policy 16:973-992. https://doi.org/10.1080/14693062.2015.1075372.

Thamo, T, D.J. Pannell, P.G. Pardey, and T.M. Hurley. 2020. “Private Incentives for Sustainable Agriculture: Soil Carbon Sequestration.” Working Paper 2004, UWA Agricultural and Resource Economics.

The Climate Pledge. 2021. “Signatories.” Available online at https://www.theclimatepledge.com/us/en/Signatories.html (accessed 04/05/2021).

USDA National Agricultural Statistics Service (NASS). 2021. “2017 U.S. Census of Agriculture.” Available online at https://www.nass.usda.gov/Publications/AgCensus/2017/index.php (accessed 04/06/2021).

USDA Natural Resource Conservation Service (NRCS). 2021. “COMMET-Planner Tool.” Available online at http://comet-planner.nrel.colostate.edu/ (accessed 04/16/2021).

Varian, H.R. 2006. Intermediate Micro Economics. W.W. Norton and Company, New York, NY.

Woodward, R.T. 2011. “Double-Dipping in Environmental Markets.” Journal of Environmental Economics and Management 61:153-169.

TAGS:

TEAM LINKS:

RELATED RESOURCES

UPCOMING EVENTS

We are taking a short break, but please plan to join us at one of our future programs that is a little farther in the future.