Putting a Value on Sweat Equity in the Farm Business

Recorded August 23, 2016 | Michael Langemeier and Purdue Extension’s Denise Schroeder discuss how to divide business income between generations on a family farm and provide a simplified approach to valuing “sweat equity” in the family farming business.

Read MoreLand Values in Indiana (2016)

Recorded August 17, 2016 | Purdue agricultural economists present and discuss results from the 2016 Purdue Farmland Values Survey.

Read More2016 Crop Outlook

Recorded July 1, 2016 | The panelist discuss the corn, soybean, and wheat outlook following the release of USDA’s June 30th Grain Stocks and Acreage Reports.

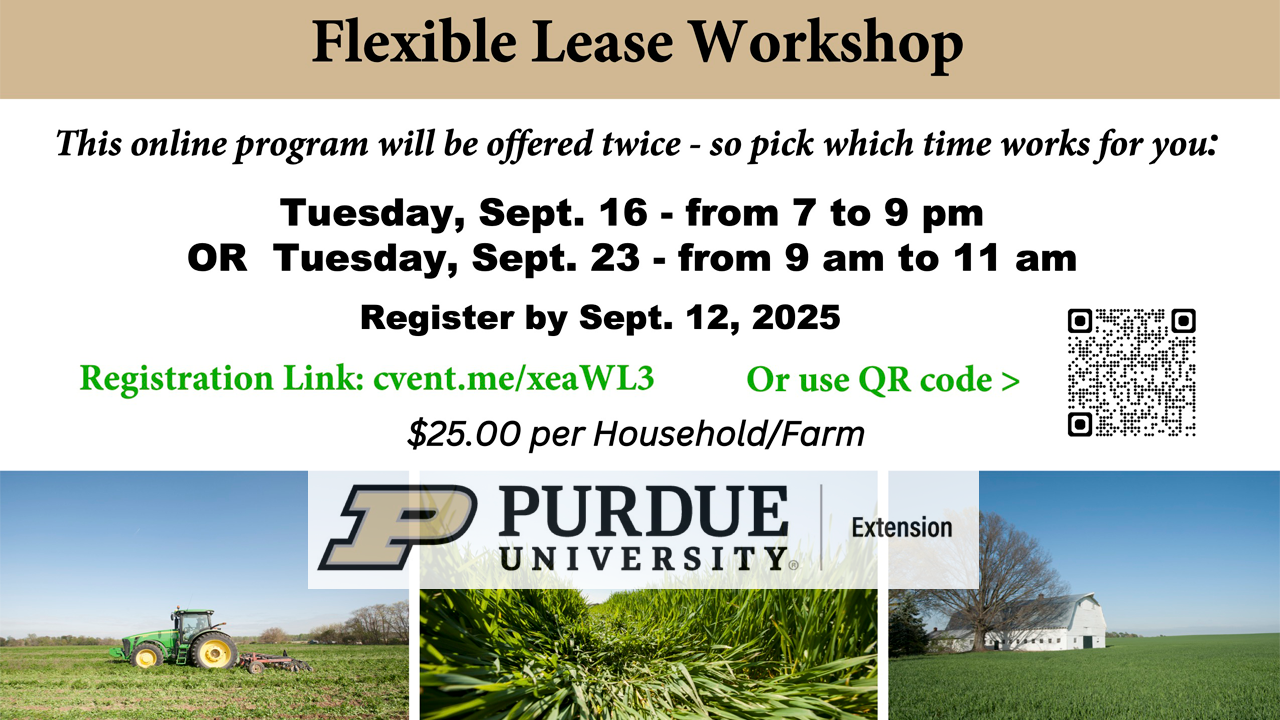

Read MoreSeptember 16 at 7 pm or September 23 at 9 am

The Flexible Lease virtual Workshop, presented by the Purdue Extension Land Lease Team, will include a presentation and discussion to help you decide if a flexible land lease arrangement is right for your farm.

Read MoreFind out where we will be presenting next as we collaborate with others.